What Does It Mean Going Through Customs? [English]

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

![What Does It Mean Going Through Customs? [English]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F147z5m2d%2Fproduction%2F71f31c69718bba81e8598a7d754d2bdaf247d4cd-2240x1260.png&w=3840&q=75)

The moment your aircraft touches down in a foreign country, you enter a critical phase of international travel that can determine whether your journey continues smoothly or encounters significant delays. Going through customs represents far more than a bureaucratic checkpoint—it serves as a nation's primary defense mechanism against illegal imports, security threats, and economic violations.

Understanding customs procedures has become increasingly vital as global travel rebounds to pre-pandemic levels. The World Trade Organization reports that international trade volumes have grown by 12% annually since 2023, directly correlating with stricter enforcement protocols at border crossings. This reality makes customs literacy not just helpful, but essential for modern travelers.

Understanding Customs: The Foundation of Border Control

Customs represents the government agency responsible for regulating the flow of goods and people across national borders. This system operates on three fundamental principles: revenue collection through duties and taxes, security enforcement through contraband detection, and economic protection through trade regulation.

The customs process begins before you even leave your departure country. Airlines share passenger manifests with destination countries through Advance Passenger Information Systems, allowing customs authorities to pre-screen travelers. This technological integration means customs officials already possess detailed information about your journey, luggage weight, and travel patterns before you arrive.

Modern customs operations leverage sophisticated risk assessment algorithms that analyze travel patterns, purchase histories, and behavioral indicators. These systems flag approximately 3-5% of travelers for detailed inspection, a percentage that has remained consistent across major international airports since 2020.

The Customs Declaration Process: Your Legal Obligation

Filing a customs declaration constitutes a legal requirement in virtually every country worldwide. This document serves as your sworn statement regarding items you're bringing across the border, including purchases, gifts, business samples, and personal belongings acquired abroad.

The declaration process varies significantly between destinations, but universal principles apply. You must declare items exceeding duty-free allowances, which typically include alcohol quantities above 1-2 liters, tobacco products beyond 200 cigarettes, and merchandise valued over $200-800 depending on the country. These thresholds exist not as arbitrary limits, but as carefully calculated economic policies designed to protect domestic industries while facilitating reasonable personal imports.

Currency declaration requirements trigger at specific monetary thresholds, typically $10,000 USD or equivalent. This requirement stems from anti-money laundering legislation rather than taxation purposes. Countries track large cash movements to prevent financial crimes, making accurate declaration critical for legal compliance.

Navigating Duty-Free Allowances: Economic Policies in Practice

Duty-free allowances represent negotiated trade agreements designed to balance tourist spending with domestic economic protection. These limits reflect complex calculations involving local tax rates, industry protection needs, and reciprocal international agreements.

Alcohol allowances demonstrate this complexity clearly. Countries with domestic wine industries typically impose lower duty-free limits on wine imports compared to spirits, protecting local vintners while accommodating tourist preferences. France allows 4 liters of wine but only 1 liter of spirits for EU residents, reflecting this strategic approach.

Tobacco regulations follow public health considerations alongside economic factors. The European Union's standardized allowances of 200 cigarettes or 50 cigars represent compromises between tax revenue protection and health policy objectives. Countries with stronger anti-smoking campaigns often impose stricter limits regardless of economic considerations.

Gift exemptions operate under separate calculations, typically allowing higher values for items intended as presents rather than personal use. This distinction acknowledges cultural practices around international gift-giving while preventing commercial importation disguised as personal items.

Prohibited and Restricted Items: Security Meets Economics

Customs prohibited item lists reflect national security priorities, public health concerns, and economic protection policies. These restrictions operate on multiple levels, from absolute prohibitions to regulated importation requiring special permits.

Agricultural products face the strictest controls due to biosecurity risks. The United States Department of Agriculture reports that agricultural inspections prevent approximately 50,000 potential pest introductions annually. Fresh fruits, vegetables, meat products, and dairy items carry diseases and pests that could devastate domestic agriculture, making these restrictions non-negotiable from both economic and environmental perspectives.

Pharmaceutical restrictions protect public health while supporting domestic medical industries. Prescription medications require documentation proving personal medical necessity, preventing both drug trafficking and parallel importation that undermines regulated pharmaceutical markets. Countries typically allow 90-day personal supplies with proper documentation.

Cultural heritage items face export restrictions from source countries and import scrutiny from destinations. These dual controls prevent cultural property trafficking while respecting international heritage protection agreements. Items requiring authenticity documentation include artwork, antiques, and indigenous cultural artifacts.

Technology and Modern Customs: The Digital Revolution

Customs operations have undergone dramatic technological transformation, fundamentally changing how border control functions. Advanced imaging systems can detect contraband hidden within luggage construction, while chemical sensors identify trace amounts of prohibited substances on clothing and personal items.

Biometric integration connects customs checkpoints with international security databases, allowing instant verification of traveler identities and risk assessments. This system processes over 1.2 billion border crossings annually, with algorithmic flagging achieving 94% accuracy rates according to International Civil Aviation Organization data.

Mobile customs applications now allow pre-declaration submission, reducing processing times by an average of 40% for participating travelers. These systems integrate with airline booking data, automatically populating travel information and purchase records from connected accounts.

Artificial intelligence analyzes behavioral patterns during customs interactions, identifying stress indicators that may suggest deception or concealment attempts. This technology supports customs officers rather than replacing human judgment, providing additional data points for risk assessment decisions.

Red and Green Channels: Strategic Traffic Management

The red and green channel system represents operational efficiency engineering designed to optimize customs throughput while maintaining security standards. This system relies on traveler honesty and statistical risk management to process large volumes effectively.

Green channel selection constitutes a legal declaration that you carry nothing requiring customs attention. Choosing this path while carrying declarable items constitutes customs violation regardless of intent, making channel selection a critical decision point. Random green channel inspections occur at rates varying from 2-15% depending on airport security assessments and seasonal factors.

Red channel processing involves detailed declaration review and potential physical inspection. This process takes significantly longer but provides legal protection for travelers carrying items near allowance limits or uncertain about declaration requirements. Customs officers in red channels typically demonstrate greater patience and provide clearer guidance compared to enforcement actions in green channels.

Nothing to declare channels in some countries create three-tier systems, specifically addressing travelers with items below duty-free thresholds but above absolute zero. This intermediate option reduces green channel violations while maintaining processing efficiency.

Customs Penalties: Understanding Consequences

Customs violations carry escalating penalty structures designed to deter intentional smuggling while providing reasonable consequences for honest mistakes. Understanding these penalty frameworks helps travelers make informed decisions during the customs process.

Minor violations typically result in duty payment plus administrative penalties ranging from 20-50% of item values. These penalties apply to situations involving inadvertent declaration errors or misunderstanding of duty-free limits. Payment resolves most minor violations without creating lasting legal consequences.

Significant violations involving high-value items or clear attempt to evade customs can result in item seizure, substantial monetary penalties, and potential legal prosecution. Countries define "significant" differently, but values exceeding $5,000 or quantities suggesting commercial intent typically trigger enhanced enforcement actions.

Repeat violations create elevated risk profiles in customs databases, leading to increased inspection probability on future travels. This system tracks violation patterns across multiple years, making consistent compliance essential for maintaining normal processing status.

International Customs Unions: Simplified Procedures

Customs unions eliminate internal border controls between member countries while maintaining external barriers, fundamentally altering travel experiences within these zones. The European Union represents the most comprehensive example, allowing free movement of goods between 27 member states while maintaining unified external customs policies.

These arrangements create significant advantages for travelers moving within union boundaries. EU residents can transport unlimited quantities of legally purchased goods between member countries without customs declaration, reflecting complete economic integration objectives. This freedom extends to high-value items like vehicles and luxury goods, provided they were legally acquired within the union.

External border controls for customs unions often involve enhanced procedures, as these entry points serve multiple countries simultaneously. Travelers entering the EU through any member country gain access to the entire union, making these checkpoints more thorough than typical bilateral border crossings.

Business Travelers: Commercial Customs Considerations

Business travelers face additional customs complexities involving temporary importation procedures, carnet documentation, and commercial sample regulations. These procedures acknowledge legitimate business needs while preventing disguised commercial importation.

Temporary importation allows business equipment, demonstration materials, and professional tools to enter countries without permanent importation procedures. This system requires detailed documentation proving items will be re-exported within specified timeframes, typically 6-12 months depending on item categories and country policies.

Commercial samples face value and quantity restrictions designed to distinguish legitimate business promotion from disguised sales activities. Most countries allow samples valued under $100 per item with total shipment values below $500, provided items bear permanent sample markings preventing retail sale.

Business gifts operate under separate allowance structures, typically permitting higher values than personal gifts while requiring detailed recipient information. These provisions facilitate international business relationships while preventing tax avoidance through gift designation.

Digital Customs: The Future of Border Control

Emerging technologies promise to revolutionize customs procedures through automation, predictive analytics, and seamless integration with travel systems. These developments aim to maintain security standards while dramatically reducing processing times and traveler inconvenience.

Blockchain documentation systems could eliminate customs declaration paperwork by creating immutable purchase records accessible to customs authorities worldwide. This technology would automatically calculate duties, verify purchase authenticity, and flag suspicious transaction patterns without requiring traveler input.

Automated inspection systems using advanced imaging and chemical detection could process luggage without human intervention for low-risk travelers. These systems would integrate with pre-travel risk assessments, allowing eligible travelers to bypass traditional customs checkpoints entirely.

Real-time duty calculation and payment systems could enable instant resolution of customs obligations through mobile applications, eliminating the need for physical customs interaction except in high-risk situations. This approach would transform customs from a checkpoint model to a seamless digital process.

Practical Strategies for Smooth Customs Processing

Successful customs navigation requires preparation, documentation, and strategic decision-making based on risk assessment and travel circumstances. These practical approaches reduce delays while ensuring legal compliance.

Maintain detailed purchase records including receipts, gift documentation, and business justifications for items carried internationally. Digital receipt storage through cloud applications provides accessible documentation even if physical receipts are lost or damaged during travel.

Research destination country customs requirements before departure, focusing on specific restrictions affecting items you plan to transport. Customs websites provide detailed guidance, but calling customs information lines can clarify ambiguous situations before travel.

Pack strategically by placing declarable items in easily accessible luggage locations, reducing inspection time and demonstrating cooperation with customs procedures. This approach particularly benefits business travelers carrying samples or demonstration materials requiring detailed examination.

Consider duty pre-payment options where available, eliminating customs processing delays by resolving obligations before arrival. Several countries offer online duty calculation and payment systems for travelers who prefer certainty over potential inspection outcomes.

Learn Any Language with Kylian AI

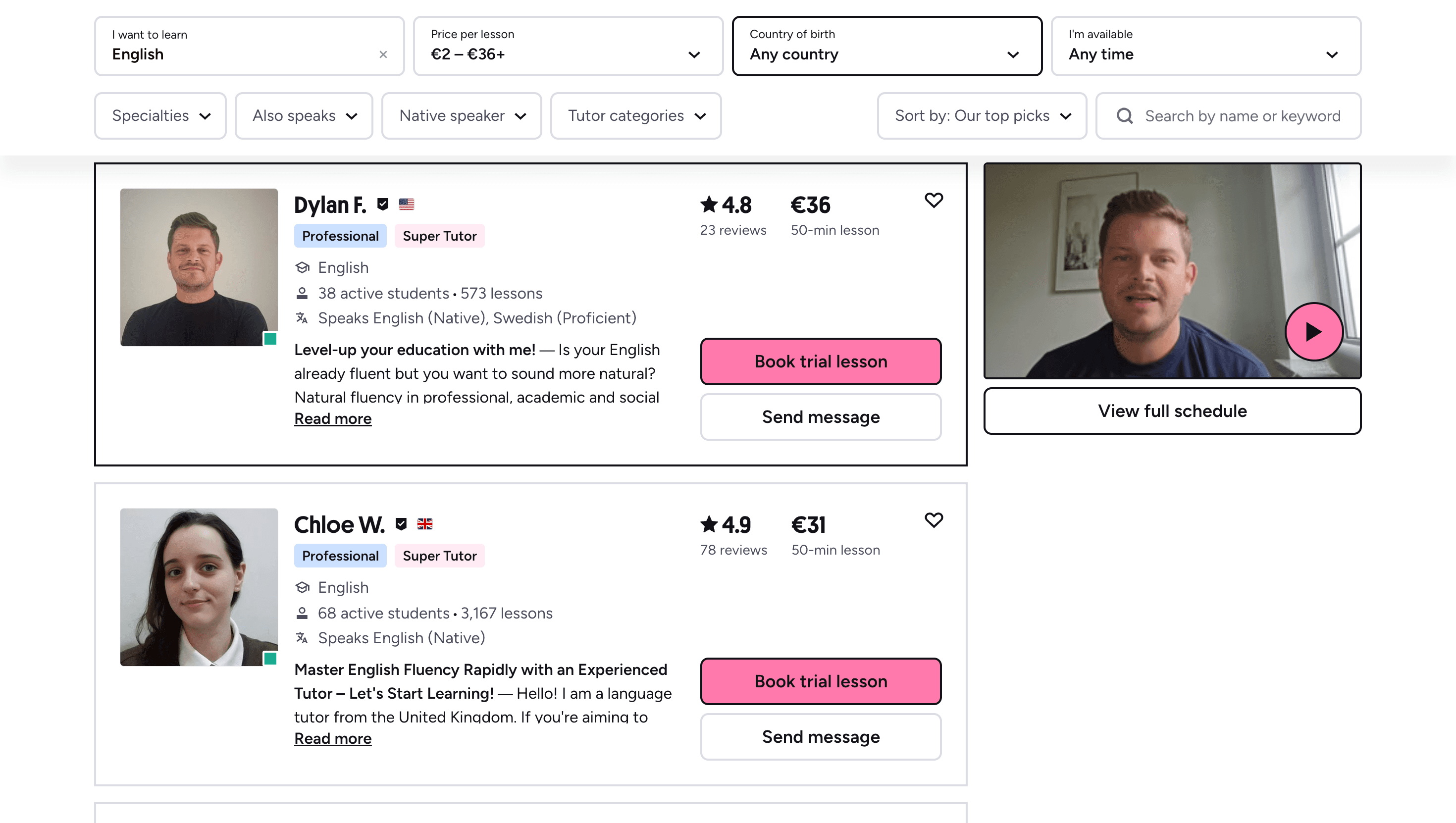

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

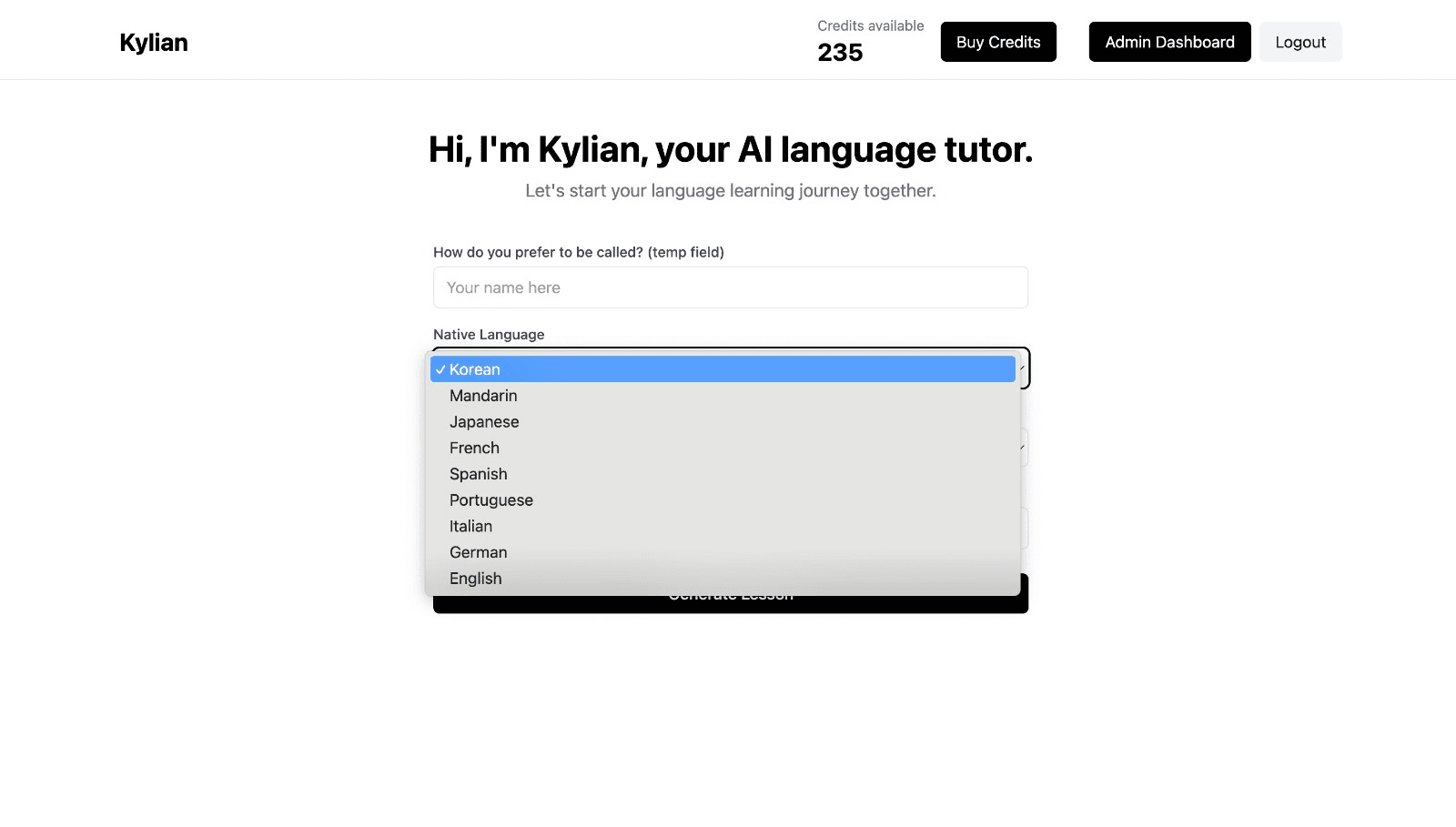

To get started, just tell Kylian which language you want to learn and what your native language is

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

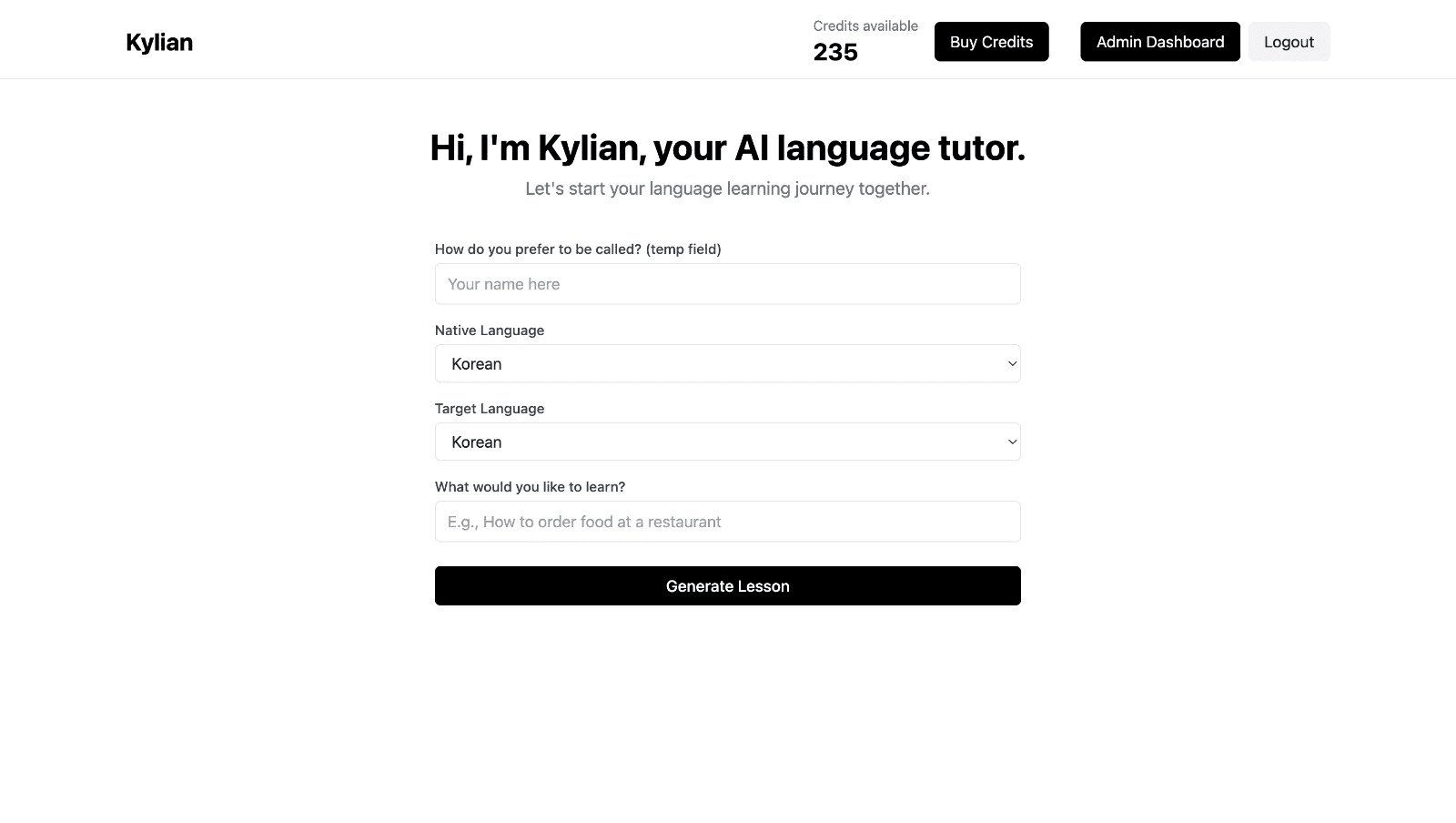

Choose a specific topic you want to learn

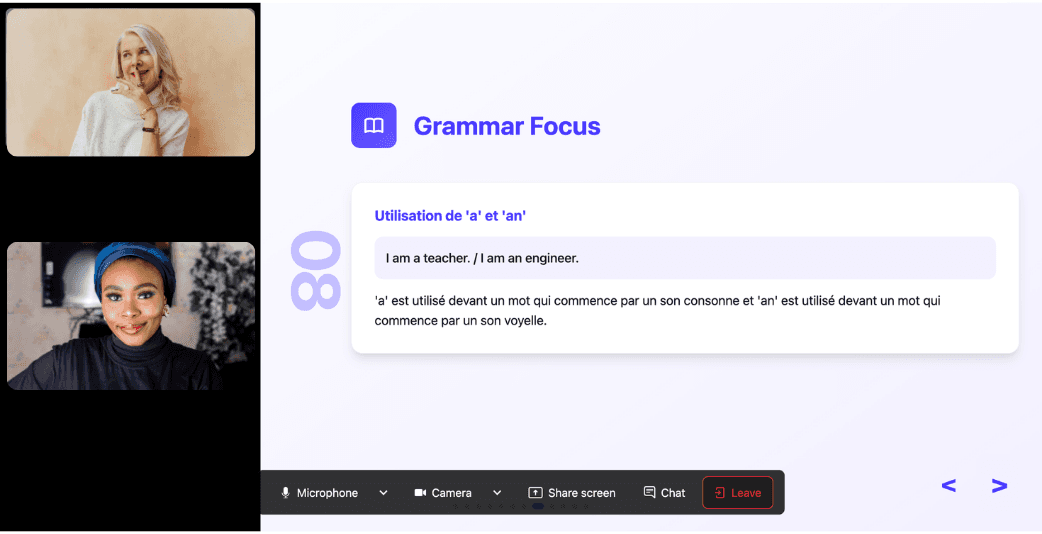

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

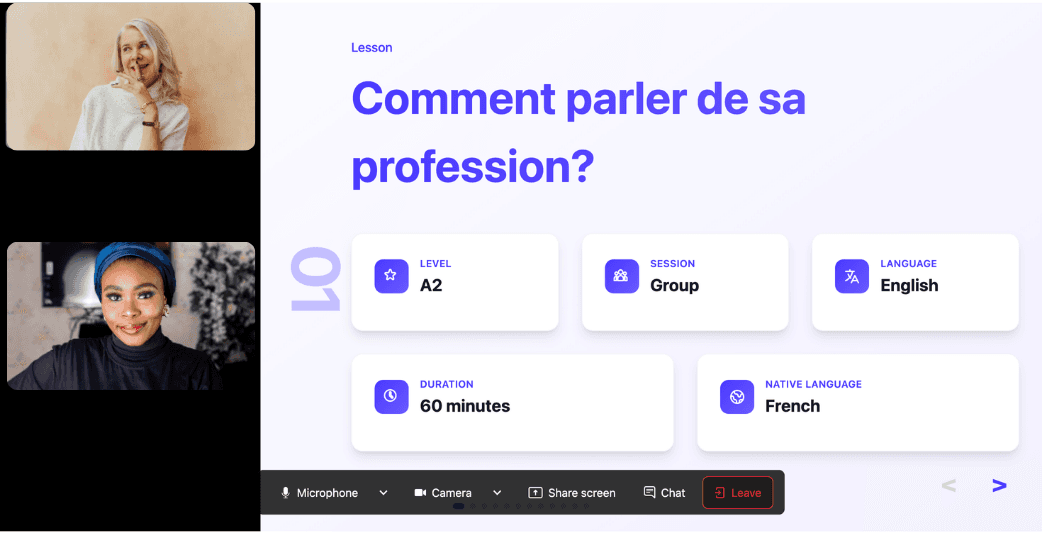

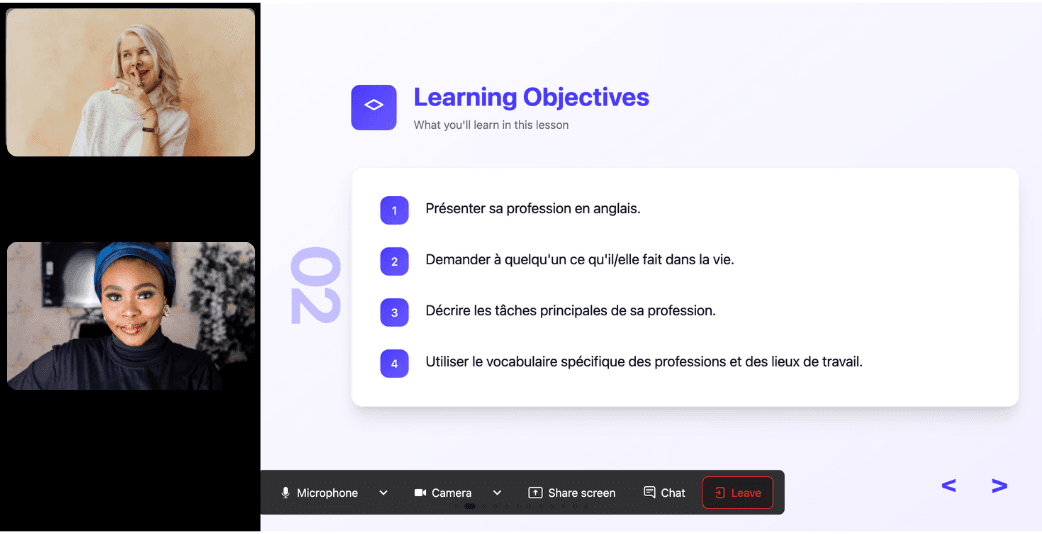

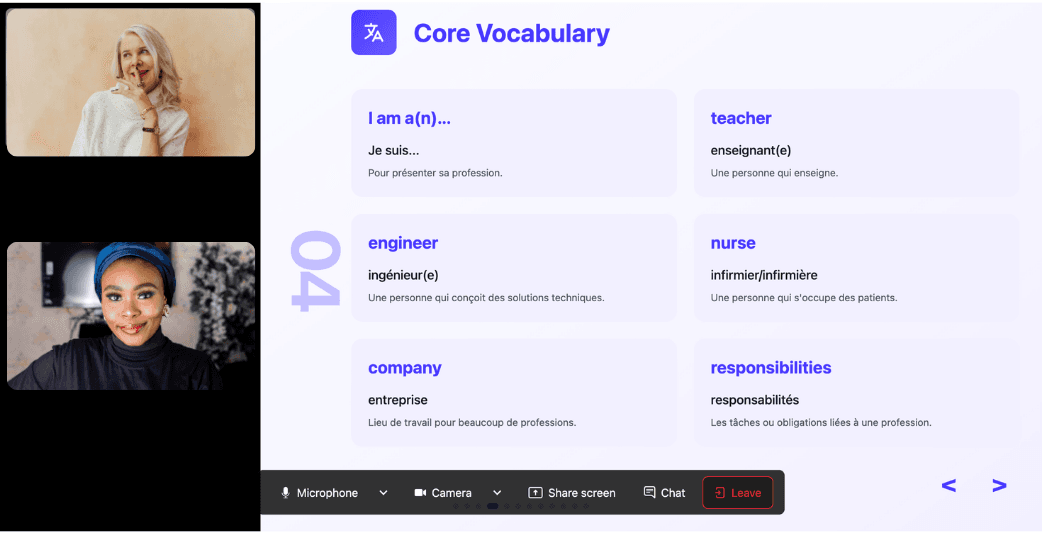

Join the room to begin your lesson

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

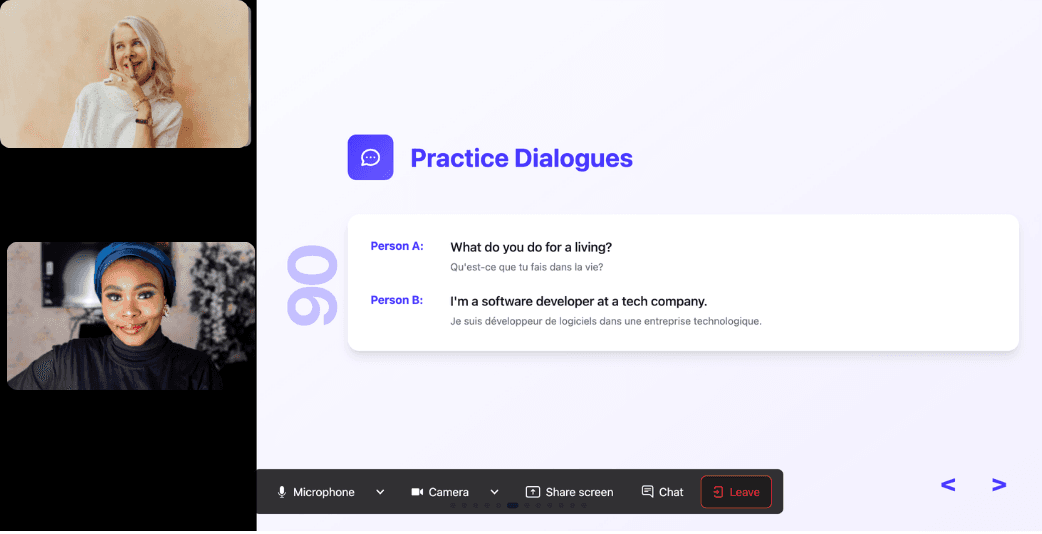

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

Past Tense of Check in English

Understanding verb tense transformations constitutes a fundamental aspect of English language mastery. The verb "check" represents one of those seemingly straightforward verbs that can actually prompt questions when writers and speakers need to express it in past contexts. This comprehensive analysis explores the past tense forms of "check," examining its regular conjugation patterns while addressing common misconceptions and usage variations. The significance of mastering the past tense of "check" extends beyond simple grammar exercises—it directly impacts effective communication in professional, academic, and everyday scenarios. By exploring this specific verb transformation, we gain insights into broader linguistic patterns that enhance overall English proficiency.

Gift-Giving Etiquette in English: The Complete Guide

Exchanging gifts represents one of the most universal human customs across cultures, yet the linguistic nuances surrounding this practice vary significantly. For English language learners, mastering the vocabulary and expressions associated with gift-giving creates meaningful social connections and prevents potential misunderstandings in personal and professional settings. This guide addresses a practical challenge many English learners face: how to navigate gift exchanges with confidence and cultural awareness. Beyond just vocabulary, understanding the contextual differences between terms like "gift" and "present" and knowing appropriate phrases for offering and receiving items demonstrates cultural fluency that transcends basic language proficiency.

The 25 Most Common Italian Verbs: Master Italian Grammar

Mastering Italian verbs represents the single most critical breakthrough in achieving conversational fluency. While Italian vocabulary encompasses over 260,000 words, linguistic research demonstrates that just 25 core verbs appear in approximately 60% of everyday Italian conversations. This concentration principle fundamentally changes how we should approach Italian grammar acquisition. The challenge isn't complexity—it's prioritization. Most Italian learners scatter their attention across hundreds of verbs when they should laser-focus on these essential 25. Understanding why these specific verbs matter, how they function systematically, and their practical applications creates the foundation for genuine Italian communication competency.

How to Write the Date in Korean: A Practical Guide

Understanding how to express dates is a fundamental stepping stone when learning any language. For Korean language learners, mastering date formats provides immediate practical value—from scheduling appointments to celebrating important occasions. This guide breaks down the Korean date system logically and comprehensively, giving you both the structure and cultural context to navigate temporal expressions with confidence.

8 Amazing Online Spanish Classes for Kids That Will Delight

The cognitive advantages of bilingualism are no longer theoretical. Neuroscience research demonstrates that bilingual children show enhanced executive function, improved problem-solving abilities, and greater cognitive flexibility compared to monolingual peers. Spanish, as the world's second-most spoken language with over 500 million speakers globally, represents an strategic educational investment for parents seeking to maximize their children's future opportunities. Mexico's GDP is projected to surpass that of several European economies by 2050, according to PwC economic forecasts. This economic trajectory, combined with the growing Hispanic population in the United States—expected to reach 111 million by 2060—creates compelling reasons for early Spanish acquisition. Children who master Spanish before age 12 demonstrate near-native pronunciation and grammatical intuition that becomes increasingly difficult to achieve in adulthood. The challenge lies not in recognizing Spanish's value, but in identifying effective learning platforms that maintain engagement while delivering measurable progress. After analyzing curriculum structures, instructor qualifications, pricing models, and student outcomes across dozens of platforms, seven online Spanish programs demonstrate superior results for different learning profiles and family needs.

How to Say Hello in Norwegian: Your Complete Guide

Norwegian greetings matter more than most language learners realize. The way you open a conversation shapes every interaction that follows, whether you're navigating Oslo's business districts or connecting with locals in Bergen's fish markets. Understanding Norwegian greetings isn't just about memorizing phrases—it's about grasping the cultural framework that governs Norwegian social interaction. The stakes are higher than you might think. Norwegians value directness and authenticity, which means using the wrong greeting at the wrong time doesn't just sound awkward—it signals that you don't understand the social context. This matters because Norway's egalitarian culture treats proper greeting etiquette as a sign of respect and social awareness.