Startup Series Funding: Pre-Seed to IPO Explained

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

The stark reality of startup finance reveals a sobering truth: insufficient capital kills more promising ventures than poor products or weak markets. When nearly half of all startup failures stem directly from funding shortfalls, understanding the mechanics of series funding transitions from academic curiosity to survival imperative.

Series funding represents the structured pathway through which startups systematically raise capital, trading equity stakes for the resources needed to scale operations, penetrate markets, and ultimately achieve sustainable profitability. This multi-stage process demands strategic timing, compelling narratives, and increasingly sophisticated operational metrics at each successive round.

The funding landscape operates on a progression of risk and reward calculations that fundamentally shift as companies mature from concept to market leader. Each funding stage serves specific operational needs while establishing valuation benchmarks that influence all subsequent capital raises.

What Defines Series A Funding in Startup Ecosystems?

Series A funding marks the first institutional investment milestone where startups transition from friends-and-family capital to professional venture capital. This stage typically occurs when companies demonstrate product-market fit through measurable traction metrics rather than theoretical projections.

The Series A round addresses a specific operational challenge: scaling proven business models beyond their initial market validation phase. Companies entering this stage possess established customer acquisition channels, repeatable revenue models, and management teams capable of executing growth strategies.

Venture capitalists dominate Series A investments because they possess the capital reserves and risk tolerance necessary for companies still proving long-term viability. These investors evaluate startups based on total addressable market size, competitive differentiation, and the management team's execution track record.

Series A funding enables strategic investments in customer retention systems, market expansion initiatives, and product development capabilities that transform promising startups into scalable businesses. The capital raised during this phase typically supports 18-24 months of operational runway while companies pursue aggressive growth targets.

Understanding the Series Funding Architecture

Series funding operates as a sequential capital-raising framework where startups exchange ownership percentages for progressively larger investment amounts. Each funding round corresponds to specific business development stages, from initial concept validation through market leadership establishment.

External investors participate in series funding rounds because early-stage companies offer disproportionate return potential compared to established businesses. Angel investors, venture capitalists, and institutional funds contribute capital in exchange for equity stakes that could generate significant returns if startups achieve successful exits.

Startup founders pursue series funding when internal cash flow cannot support their growth objectives or operational requirements. This financing model provides entrepreneurs with necessary capital while preserving personal financial resources and enabling rapid business expansion.

The series funding process creates value for both parties: investors gain access to high-growth potential companies before they reach public markets, while founders secure capital without traditional debt obligations or restrictive lending requirements.

The Critical Role of Funding Valuations

Pre-funding valuations determine the equity percentage investors receive for their capital contributions, making accurate company assessments essential for fair deal structuring. Valuation methodologies incorporate multiple variables including market size analysis, competitive positioning, management team strength, financial projections, and risk factors.

Market conditions significantly influence valuation calculations, as investor appetite and available capital affect pricing across all funding stages. During favorable market periods, startups command higher valuations, while economic uncertainty typically depresses company values and increases investor selectivity.

Growth trajectory analysis forms the foundation of most valuation models, with investors projecting future revenue potential based on current traction metrics and market expansion opportunities. Companies demonstrating consistent month-over-month growth rates typically achieve premium valuations compared to businesses with stagnant or declining performance indicators.

Risk assessment directly impacts valuation outcomes, as investors discount company values based on execution risks, market risks, competitive threats, and regulatory uncertainties. Startups operating in proven markets with experienced management teams generally receive higher valuations than ventures pursuing unvalidated opportunities.

Series Funding Operational Mechanics

The series funding process begins with comprehensive business performance documentation that demonstrates growth potential and capital efficiency. Startups must present detailed financial models, market analysis, competitive assessments, and strategic roadmaps that justify their funding requirements and valuation expectations.

Investor due diligence investigations examine every aspect of startup operations, from financial records and legal compliance to product development capabilities and market positioning. This evaluation process typically requires 8-12 weeks of intensive documentation review and management presentations.

Throughout fundraising cycles, startups maintain regular investor communications that highlight operational progress, key performance indicators, and strategic milestone achievements. These updates build investor confidence while establishing relationships that facilitate future funding rounds.

Successful series funding execution requires startups to balance multiple investor relationships simultaneously, as diversified investor bases provide strategic advantages through varied expertise, network access, and risk distribution across funding sources.

Pre-Seed Funding: Foundation Capital

Pre-seed funding represents the initial capital injection that transforms business concepts into operational entities. Funding sources during this phase typically include personal savings, family contributions, close friend investments, and occasionally early-stage incubators or accelerator programs.

Capital requirements for pre-seed funding generally range from $10,000 to $250,000, depending on business model complexity and initial operational needs. Technology startups often require minimal pre-seed capital for software development and market validation, while hardware or manufacturing ventures may need substantially higher initial investments.

Pre-seed funding enables critical foundational activities including prototype development, initial team assembly, market research execution, and business model validation. Entrepreneurs use this capital to test core assumptions, refine product offerings, and establish initial customer relationships.

The pre-seed stage focuses on proving concept viability rather than achieving significant revenue generation. Success metrics include product development milestones, customer feedback validation, and market demand indicators that support future funding round preparations.

Seed Funding: Market Validation Capital

Seed funding constitutes the first formal external investment round where startups engage professional angel investors, seed-stage venture capital firms, and sophisticated individual investors. This funding stage occurs when companies possess validated business concepts and initial market traction indicators.

Typical seed funding rounds raise between $500,000 and $3 million, providing startups with sufficient capital to develop minimum viable products, establish initial customer bases, and build core operational teams. The funding amount varies significantly based on industry requirements, geographic location, and business model scalability.

Seed investors evaluate startups based on founding team capabilities, market opportunity size, product differentiation potential, and early customer validation signals. These investors often provide strategic guidance and industry connections that prove as valuable as their financial contributions.

Seed funding supports critical business development activities including product development completion, initial marketing campaigns, early customer acquisition efforts, and foundational team building. Companies typically use seed capital to achieve key milestones that demonstrate scalability potential to Series A investors.

Series A Funding: Scaling Infrastructure

Series A funding rounds typically raise between $3 million and $20 million from institutional venture capital firms that specialize in early-stage growth companies. This funding stage requires startups to demonstrate established product-market fit, repeatable customer acquisition processes, and clear paths to profitability.

Investors evaluate Series A opportunities based on revenue growth rates, customer acquisition costs, lifetime value metrics, and market expansion potential. Companies must present comprehensive business plans that outline specific growth strategies, competitive advantages, and capital allocation priorities.

Series A funding enables strategic investments in sales team expansion, marketing campaign scaling, product development acceleration, and operational infrastructure development. This capital typically supports 18-30 months of aggressive growth initiatives designed to establish market leadership positions.

Only approximately 30% of startups successfully raise Series A funding, making this stage a critical filter that separates scalable businesses from unsustainable ventures. Success requires demonstrating consistent execution capabilities and significant market opportunity capture potential.

Series B Funding: Market Expansion Capital

Series B funding rounds generally raise between $10 million and $60 million from venture capital firms that focus on proven growth companies ready for market expansion. This stage occurs when startups have established sustainable revenue models and seek capital for accelerated scaling initiatives.

Companies pursuing Series B funding must demonstrate substantial revenue growth, efficient customer acquisition systems, and clear competitive advantages within their target markets. Investors evaluate opportunities based on market share capture potential, operational efficiency metrics, and management team scaling capabilities.

Series B capital supports major expansion initiatives including geographic market entry, product line diversification, strategic team building, and operational infrastructure enhancement. Companies typically use this funding to establish dominant market positions before pursuing later-stage financing options.

The Series B stage often occurs 24-36 months after Series A completion, allowing sufficient time for companies to demonstrate scalability and establish sustainable competitive advantages. Success metrics include revenue growth rates, market share expansion, and operational efficiency improvements.

Series C Funding: Market Leadership Investment

Series C funding rounds typically raise between $25 million and $150 million from established venture capital firms, private equity investors, and strategic corporate partners. This stage targets companies that have achieved significant market positions and seek capital for market dominance initiatives.

Investors evaluate Series C opportunities based on market leadership potential, international expansion capabilities, acquisition integration possibilities, and preparation for eventual exit events. Companies must demonstrate sustainable competitive advantages and clear paths to substantial return generation.

Series C funding enables transformative business initiatives including international market entry, strategic acquisitions, major product development projects, and pre-IPO preparation activities. This capital often represents the final private funding round before companies pursue public market opportunities.

For many successful startups, Series C funding serves as the bridge between private growth phases and public market readiness. Companies use this capital to establish the operational scale, financial performance, and market positioning necessary for successful initial public offerings.

Series D and Beyond: Strategic Capital Deployment

Less than 5% of startups progress to Series D funding rounds, which typically raise between $50 million and $500 million from specialized late-stage investors. These rounds occur when companies require additional capital for major strategic initiatives or face specific operational challenges.

Series D funding serves multiple strategic purposes including international expansion acceleration, major acquisition financing, competitive response initiatives, or IPO preparation support. Some companies pursue these rounds to extend their private market phase while building additional scale before going public.

"Down rounds" occasionally occur during Series D or later stages when companies raise capital at lower valuations than previous rounds. These situations typically result from missed performance targets, market condition changes, or increased competitive pressures that affect investor confidence.

Late-stage funding rounds require sophisticated investor management and strategic capital deployment to justify continued private market participation rather than pursuing exit opportunities through acquisitions or public offerings.

Alternative Funding Strategies Beyond Series Funding

Bootstrapping Advantages and Limitations

Self-financing through bootstrapping enables founders to maintain complete ownership control while building sustainable businesses through organic growth. This approach works effectively for service-based businesses, software companies with low infrastructure requirements, and ventures targeting niche markets with limited capital needs.

Bootstrapping limitations include slower growth rates, limited scaling capabilities, and vulnerability to competitive threats from well-funded rivals. Companies choosing this path must prioritize profitability over growth speed and often face resource constraints that limit market opportunity capture.

Crowdfunding Platform Utilization

Crowdfunding platforms enable startups to raise capital from large numbers of small investors while simultaneously validating market demand for their products or services. Successful crowdfunding campaigns require compelling storytelling, strong marketing execution, and products that resonate with broad consumer audiences.

Equity crowdfunding platforms now allow startups to raise significant capital from accredited investors while maintaining many advantages of traditional venture capital relationships. These platforms provide access to diverse investor networks and simplified fundraising processes.

Government Grants and Innovation Programs

Government grants provide non-dilutive funding for startups developing technologies that address societal challenges or economic development priorities. These programs often target specific industries, geographic regions, or demographic groups while supporting innovation and entrepreneurship development.

Grant funding requires extensive application processes and compliance requirements but offers capital without equity dilution or repayment obligations. Many successful technology companies have utilized government grants during early development phases to supplement private investment.

Preparing for Initial Public Offerings

Companies typically pursue IPOs when they achieve annual revenues exceeding $100 million, demonstrate consistent profitability, and operate in markets large enough to support public company valuations. The IPO process requires extensive regulatory compliance, financial auditing, and investor relations capabilities.

Public market readiness indicators include scalable business models, diversified revenue streams, experienced management teams, and operational systems capable of supporting public company requirements. Companies must also demonstrate sustainable competitive advantages and clear growth trajectories.

IPO preparation involves 12-18 months of intensive financial documentation, regulatory filing completion, and investor education activities. Investment banks guide this process while helping companies optimize their public market positioning and valuation potential.

Strategic Funding Decision Framework

Successful startup funding requires strategic timing decisions that balance growth capital needs with ownership dilution concerns. Entrepreneurs must evaluate their capital requirements, growth opportunities, and market conditions to optimize funding round timing and structure.

Due diligence preparation significantly impacts funding success rates and valuation outcomes. Companies that maintain organized financial records, clear performance metrics, and comprehensive strategic documentation typically achieve better funding terms and faster closing processes.

Investor selection extends beyond capital provision to include strategic value through industry expertise, network access, and operational guidance. The best funding partnerships combine financial resources with strategic support that accelerates business development and market success.

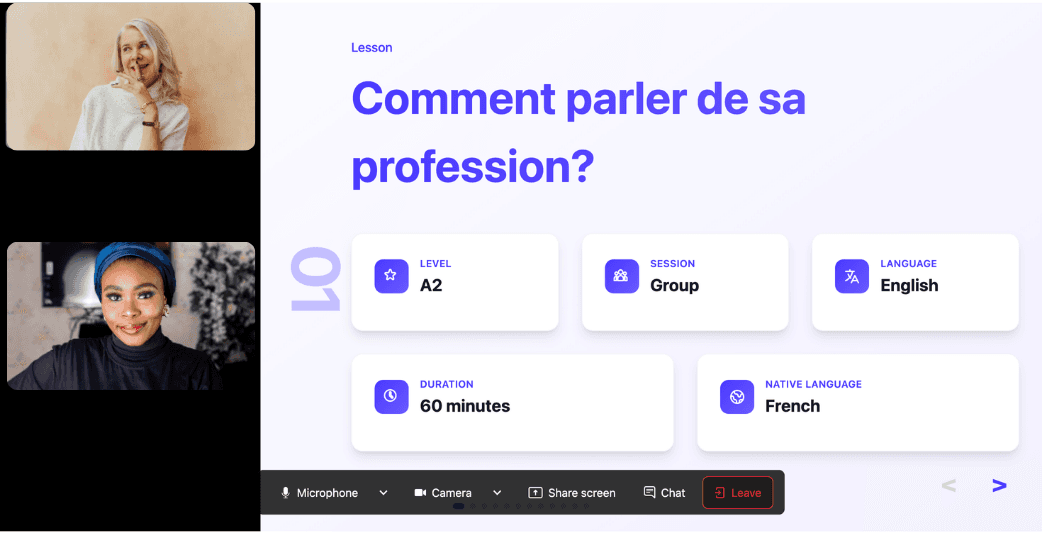

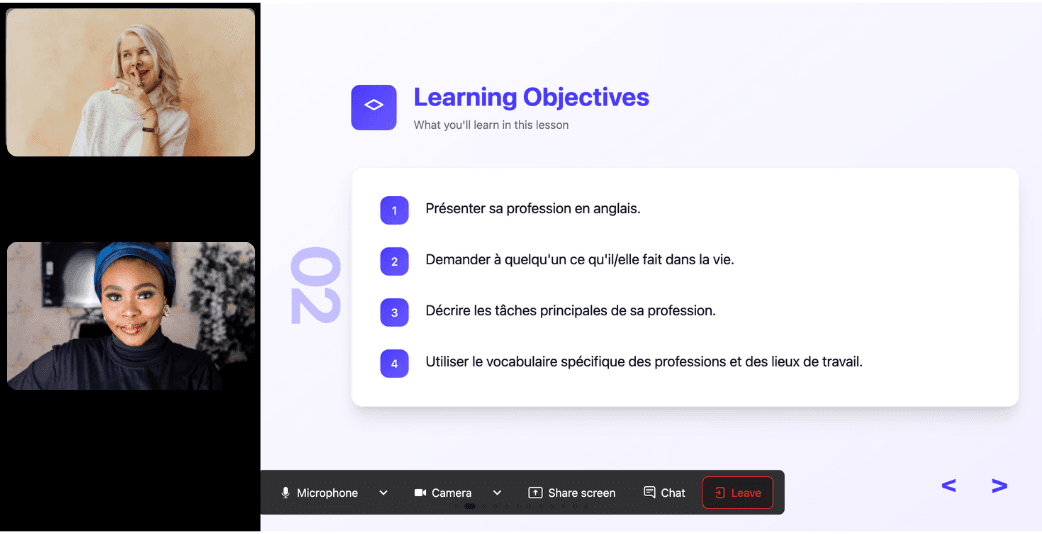

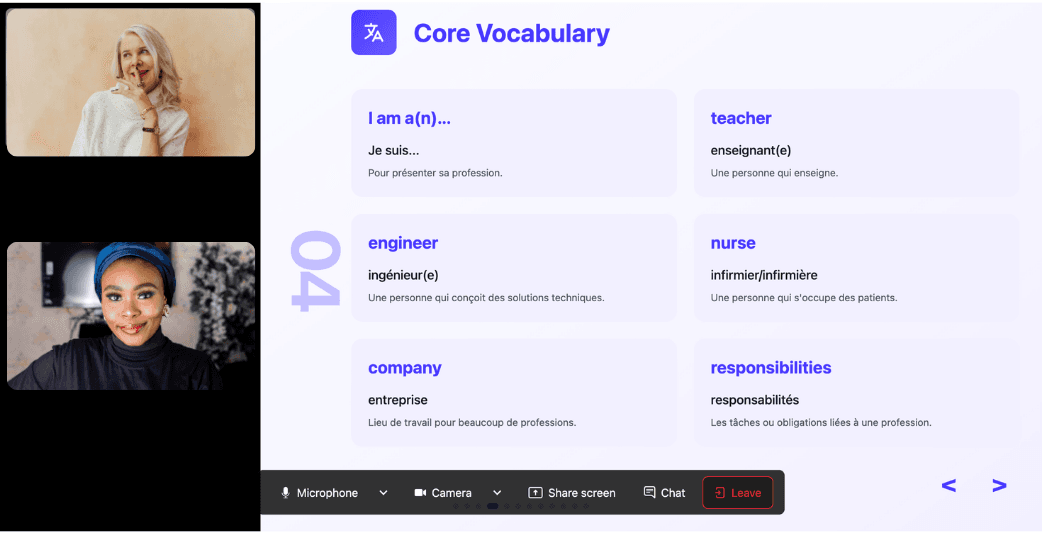

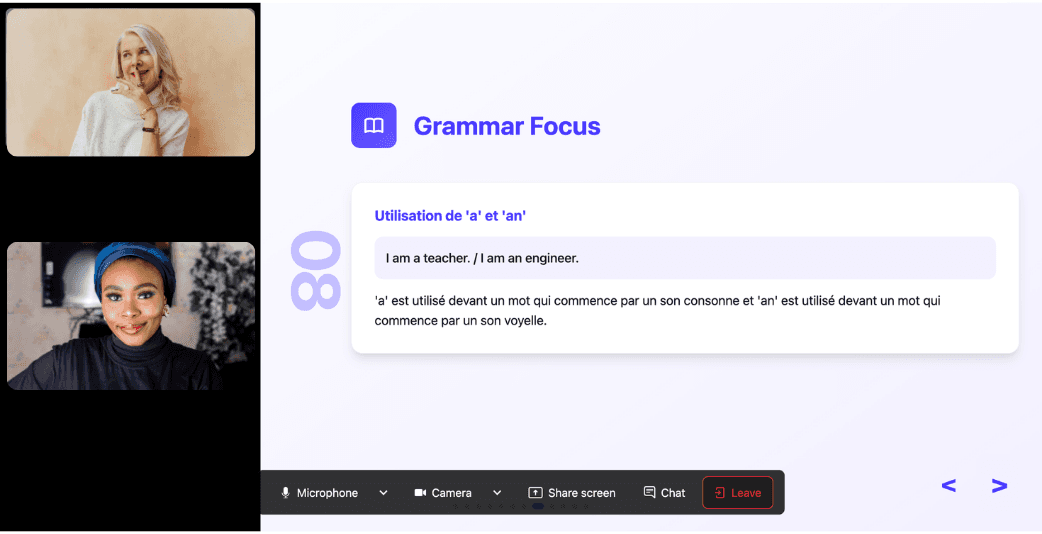

Learn Any Language with Kylian AI

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

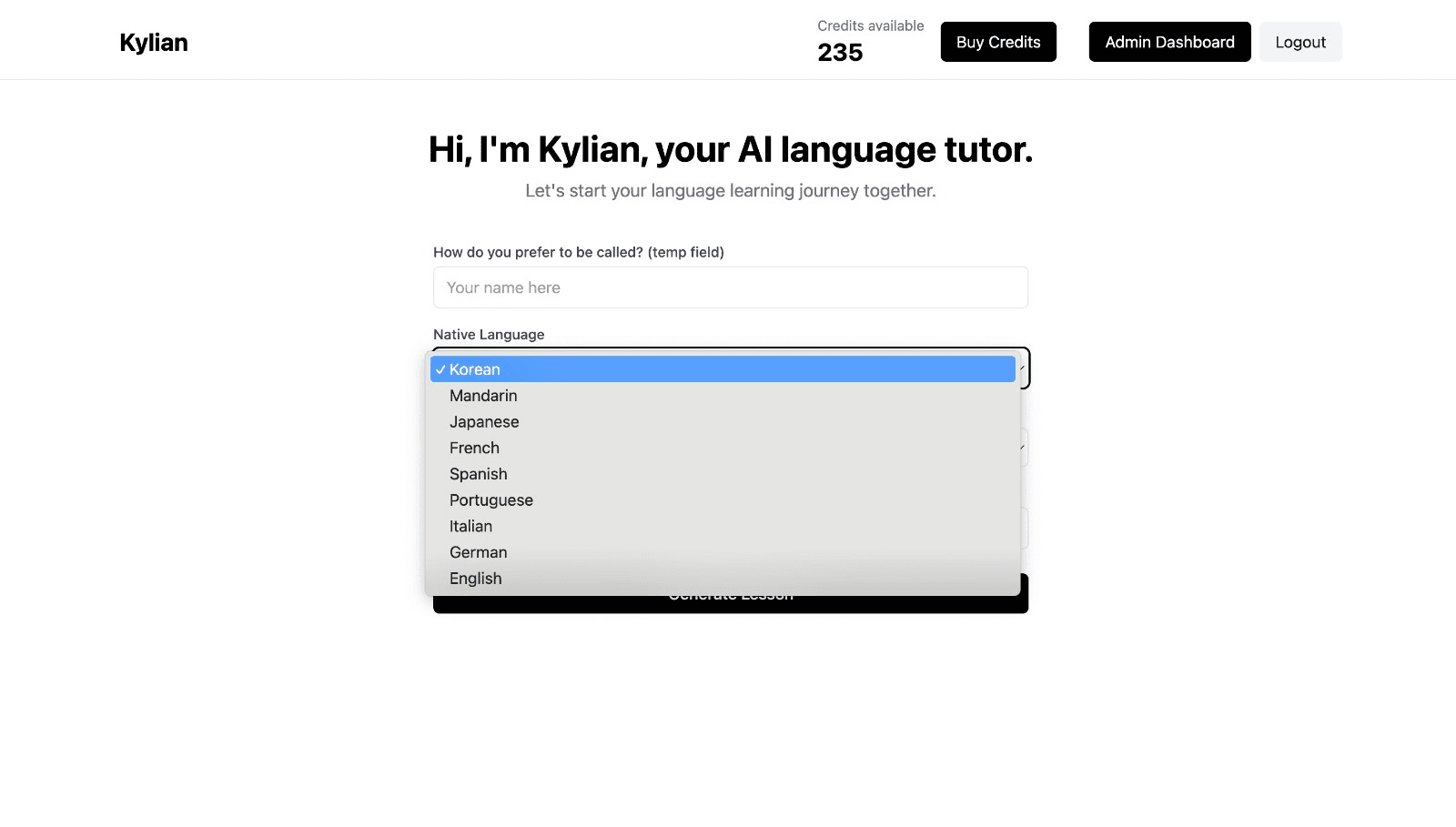

To get started, just tell Kylian which language you want to learn and what your native language is

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

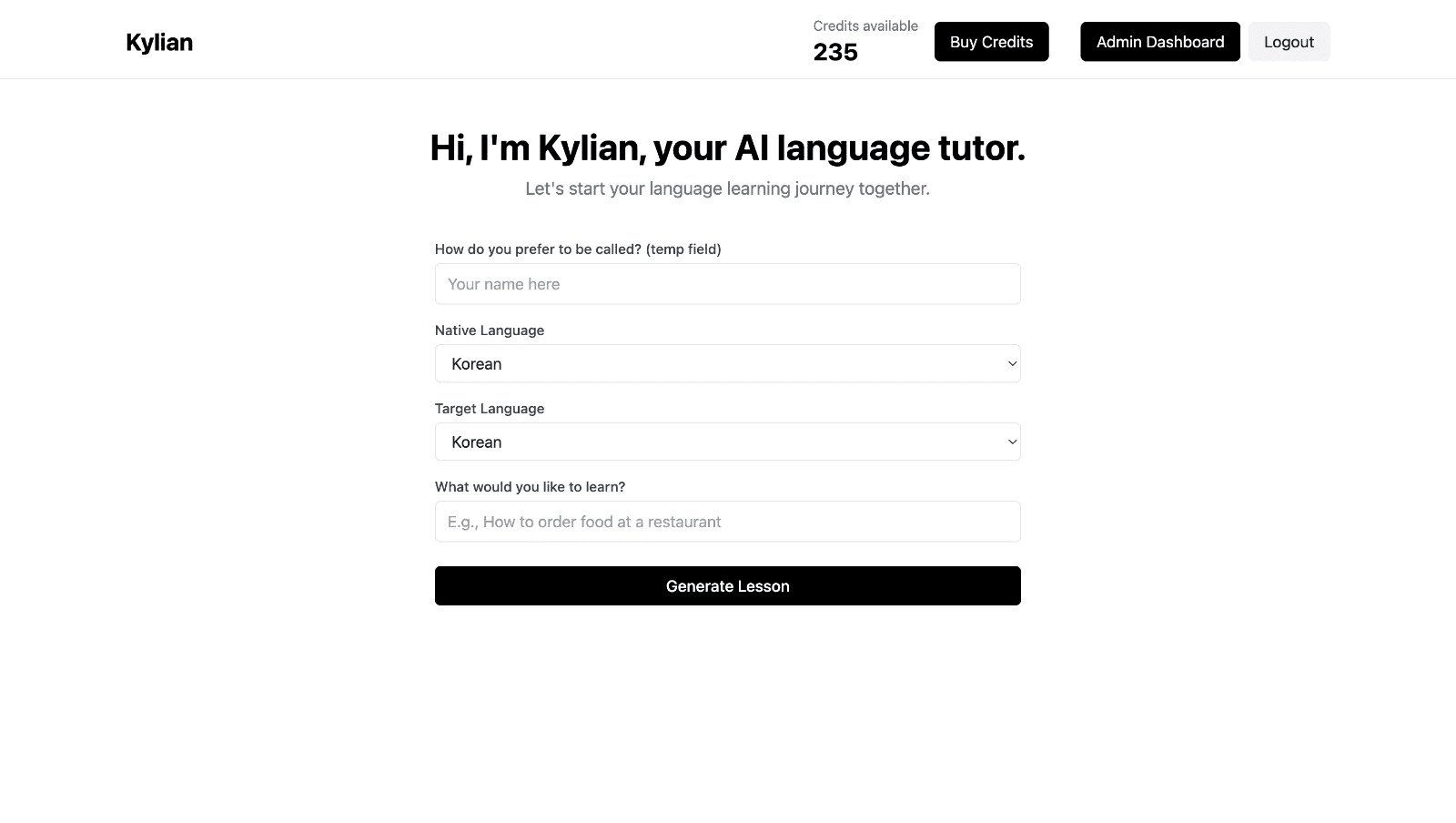

Choose a specific topic you want to learn

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

Join the room to begin your lesson

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

Your Complete Guide to Days of the Week in French

Learning how to say and use the days of the week in French is a fundamental step toward language fluency. Whether you're scheduling business meetings, making weekend plans with friends, or simply trying to understand when a shop is open, mastering these seven essential words will dramatically improve your everyday communication skills. This comprehensive guide explores everything you need to know about the French days of the week—from pronunciation and etymology to grammatical rules and cultural contexts. We'll also examine common phrases and expressions that will help you sound more natural when discussing time and schedules in French.

The Essential Guide to Saying "Thank You" in French

In every culture worldwide, expressing gratitude represents a fundamental social cornerstone. Yet in France, the art of saying "thank you" transcends mere politeness—it embodies an essential cultural practice deeply woven into daily interactions. Understanding the nuances of French gratitude expressions doesn't just prevent social faux pas; it demonstrates cultural literacy and respect that French speakers deeply value. This comprehensive guide examines the various expressions of gratitude in French across formal, casual, and written contexts. We'll analyze when and how to deploy each phrase effectively, examine crucial cultural context, and highlight common mistakes to avoid.

Portuguese Numbers: The Complete Guide for Language Learners

Numbers form the foundation of practical communication in any language. Whether you're shopping at a market in Lisbon, scheduling a meeting in Rio de Janeiro, or simply discussing statistics with Portuguese-speaking colleagues, mastering numbers is essential. This comprehensive guide covers everything from basic counting to expressing complex numerical concepts in Portuguese.

80+ Common Catalan Phrases to Sound Like a Local

Barcelona's streets echo with a language that predates Spanish colonization by centuries. While 10.2 million people worldwide speak Catalan—making it more widely spoken than Swedish or Greek—most travelers remain linguistic outsiders to this Romance language that serves as the cultural backbone of Catalonia, Valencia, the Balearic Islands, and Andorra. The misconception that Catalan is merely a Spanish dialect persists, yet this assumption costs travelers authentic connections with locals who switch to Spanish the moment they detect linguistic uncertainty. Learning essential Catalan phrases transforms surface-level tourist interactions into meaningful cultural exchanges, particularly in Barcelona where 95% of residents understand Catalan but only 75% actively use it in daily conversation. This comprehensive guide provides 80+ essential Catalan phrases that enable genuine communication with native speakers. Each phrase serves a strategic purpose in daily interactions, from navigating Gothic Quarter's narrow streets to ordering authentic bomba at neighborhood tapas bars where menus remain untranslated.

Canadian French Words: Daily Life, Slang & Idioms

French language mastery extends far beyond textbook vocabulary when you encounter the 7.2 million French speakers across Canada. The linguistic reality confronting learners reveals a fundamental gap: traditional French education fails to prepare speakers for authentic Canadian conversations, where chum replaces copain and char substitutes voiture. This disconnect matters because language acquisition without cultural context creates communication barriers that textbooks cannot bridge. Understanding Canadian French words becomes essential for anyone seeking genuine integration into francophone Canadian communities, whether for professional advancement, academic pursuits, or personal relationships.

The Useful Guide to Saying "Thank You" in Portuguese

In the realm of language acquisition, mastering expressions of gratitude stands as a fundamental milestone. When venturing into Portuguese-speaking territories—whether the bustling streets of Lisbon or the vibrant beaches of Rio de Janeiro—knowing how to properly express thanks transcends mere politeness; it establishes meaningful connection. The Portuguese language, like many Romance languages, incorporates nuanced ways to express gratitude that vary depending on context, relationship, and even the speaker's gender identity. This comprehensive guide delves into the multifaceted approaches to saying "thank you" in Portuguese, equipping you with practical knowledge for authentic interactions.