Opening a Bank Account in Portugal: Complete Guide

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

Banking access forms the cornerstone of financial integration for anyone relocating to Portugal. Without a local bank account, you're essentially operating in a financial vacuum—unable to receive salary payments efficiently, struggling with rental deposits, and facing bureaucratic roadblocks that can derail visa applications like the D7 or Golden Visa programs.

The Portuguese banking system processes over €180 billion in deposits annually, yet many expatriates encounter unnecessary friction during the account opening process. This comprehensive analysis breaks down the systematic approach to securing Portuguese banking services, examining the documentation requirements, institutional options, and strategic considerations that determine success or failure in this critical financial milestone.

Why Portuguese Bank Accounts Matter Beyond Basic Banking

Portuguese residency visas explicitly require local banking relationships. The SEF (Serviço de Estrangeiros e Fronteiras) mandates proof of financial means through Portuguese banking institutions for D7 visa holders, making this more than a convenience—it's a legal necessity.

The economic implications extend beyond visa compliance. Portugal's banking sector offers SEPA (Single Euro Payments Area) integration, providing seamless European transaction capabilities. This matters because cross-border payments through Portuguese banks cost significantly less than international wire transfers from foreign institutions—typically €2-5 versus €25-50 per transaction.

Furthermore, Portuguese banks provide access to the country's social security system integration, enabling automatic tax payments and simplified interaction with government services. This systemic integration becomes crucial when managing NIF obligations, property purchases, or business establishment.

Understanding Portuguese Banking Account Categories

Portuguese banking legislation defines three primary account structures, each serving distinct financial strategies and regulatory requirements.

Conta Corrente (Current Account) functions as the primary transactional vehicle. These accounts support card payments, direct debits, and ATM withdrawals across Portugal's extensive banking network. Most current accounts require minimum monthly activity or face maintenance fees ranging from €3-12 monthly.

Conta Poupança (Savings Account) offers immediate liquidity with modest interest returns. Current Portuguese savings rates hover around 0.1-0.3% annually—minimal returns reflecting the European Central Bank's monetary policy. These accounts suit emergency fund storage rather than wealth accumulation strategies.

Conta de Depósito a Prazo (Fixed-Term Deposit) requires capital commitment for predetermined periods—six months, one year, or longer. Interest rates improve with commitment duration, typically reaching 1-2% for longer terms. However, early withdrawal penalties often negate interest advantages, making these suitable only for committed capital allocation.

Portuguese banks also offer specialized junior accounts designed for minors, featuring reduced fees and educational savings programs. These accounts require parental guarantees and provide limited transaction capabilities until the account holder reaches majority age.

Essential Documentation: Beyond Basic Requirements

Portuguese banks operate under European Union anti-money laundering directives, creating stringent documentation standards that many expatriates underestimate. The basic requirements represent minimum compliance—successful applications often require additional verification.

Passport verification must include current validity extending at least six months beyond intended account opening. Portuguese banks may reject applications with passports nearing expiration, even if technically valid.

Portuguese address proof creates the most significant challenge for new arrivals. Rental agreements must include lessor identification and property registration details. Utility bills require account holder name matching exactly with passport documentation. Hotels receipts or temporary accommodation letters typically fail to satisfy address requirements.

Employment and income verification demands more than simple employment letters. Portuguese banks increasingly require tax returns from origin countries, bank statements showing regular income deposits, and sometimes employer contact verification. Self-employed applicants face additional scrutiny, requiring business registration documentation and revenue proof spanning 6-12 months.

NIF (Número de Identificação Fiscal) represents Portugal's tax identification system. This nine-digit number links to all Portuguese financial and legal activities. Without NIF registration, bank account opening becomes impossible across all Portuguese institutions.

Different banks implement varying documentation interpretations. Some require apostilled document translations, while others accept English-language originals. This inconsistency necessitates bank-specific research before document preparation.

Strategic Approach to Portuguese Banking Integration

Step 1: Expatriate Community Intelligence Gathering

Portugal's expatriate population exceeds 500,000 residents, creating extensive knowledge networks that provide invaluable practical insights often unavailable through official channels.

Facebook groups like "Portugal Expat Community" and "Digital Nomads Portugal" maintain active discussions about banking experiences. However, information quality varies significantly. Focus on recent posts (within 3-6 months) and cross-reference experiences across multiple sources.

LinkedIn professional networks offer higher-quality information, particularly for business-oriented banking needs. Professional expatriate groups often discuss banking relationships in context of tax optimization and business establishment.

Local expatriate meetups provide face-to-face verification of online information. Cities like Lisbon, Porto, and Faro host regular expatriate networking events where banking experiences form common discussion topics.

Step 2: Institutional Analysis and Selection Criteria

Portuguese banking landscape includes over 40 retail institutions, ranging from state-influenced entities to international subsidiaries. Selection requires analyzing multiple factors beyond basic fee structures.

Geographic accessibility matters more than many expatriates realize. Rural areas often lack branch networks for smaller banks, creating service limitations. Urban centers provide multiple options, but specific neighborhoods may have limited representation from certain institutions.

Digital banking capabilities vary dramatically across Portuguese banks. Traditional institutions like Caixa Geral de Depósitos offer comprehensive online services but with older interface designs. Digital-first banks like ActivoBank provide modern user experiences but may lack human support for complex issues.

Fee structures require careful analysis beyond monthly maintenance charges. Portuguese banks implement numerous fee categories: card issuance, transaction limits, international transfers, and overdraft facilities. Annual fee calculations often reveal significant cost differences between seemingly similar accounts.

Language support impacts long-term banking relationships. While most Portuguese banks employ English-speaking staff in major cities, rural branches or specialized services may require Portuguese communication capabilities.

Step 3: NIF Acquisition Strategy

The Portuguese tax identification number (NIF) acquisition process requires strategic planning, particularly for non-residents without immediate Portuguese tax obligations.

Fiscal representative requirements apply to most non-residents opening bank accounts. This Portuguese resident accepts legal responsibility for your tax obligations, typically charging €150-300 annually. Legal firms, accounting services, and specialized NIF services provide fiscal representation.

Direct application at local tax offices (Finanças) requires Portuguese language capabilities and often involves extensive waiting periods. Offices in major cities experience high demand, sometimes requiring appointments weeks in advance.

Online NIF services like Bordr or NIF Portugal expedite the process but charge premium fees (€200-400). These services include fiscal representation and handle document preparation, making them cost-effective for time-sensitive situations.

Document preparation for NIF applications requires specific formatting. Birth certificates, marriage certificates, and educational documents may require apostille certification and sworn translations, depending on origin country agreements with Portugal.

Step 4: Documentation Compilation and Verification

Successful bank account opening depends on meticulous document preparation. Portuguese banks implement strict compliance procedures, and incomplete documentation results in application rejection.

Document authenticity verification may require original documents for initial review, followed by certified copies for bank records. Some banks accept high-quality scans, while others mandate physical document presentation.

Translation requirements vary by bank and document type. Official translations cost €15-30 per page but ensure acceptance. Banks may reject unofficial translations, even if content accuracy is perfect.

Address verification challenges affect many new arrivals. Temporary accommodation doesn't satisfy most banks' address requirements. Consider establishing utility accounts immediately upon arrival, even for short-term rentals.

Income documentation complexity increases for non-traditional employment situations. Remote workers, consultants, and retirees face additional scrutiny. Prepare comprehensive income documentation including tax returns, bank statements, and employment contracts spanning 12-24 months.

Step 5: Branch Visit Optimization

Portuguese banking culture emphasizes personal relationships and thorough documentation review. Strategic branch visit planning significantly improves success probability.

Timing considerations matter substantially. Monday mornings and early afternoon periods typically offer optimal staff availability and reduced time pressure. Avoid end-of-day visits, as complex account opening procedures may face rush-related delays.

Initial deposit preparation ranges from €100-500 depending on account type and bank policies. Bring cash or certified funds, as foreign checks require extended clearing periods.

Language preparation enhances communication effectiveness. Learn basic Portuguese banking terminology: "conta bancária" (bank account), "documentos" (documents), "residência" (residence), and "NIF." Even basic Portuguese demonstrates integration commitment.

Backup bank identification prevents wasted trips. If your preferred bank rejects your application, having secondary and tertiary options enables immediate alternatives without returning home empty-handed.

Comprehensive Portuguese Banking Institution Analysis

Domestic Banking Leaders

Caixa Geral de Depósitos operates as Portugal's largest bank by assets, managing over €90 billion. Their state backing provides stability but sometimes creates bureaucratic inefficiencies. CGD offers comprehensive expatriate services including English-language support in major branches.

Their "Conta Caixa" provides basic banking services with €4.95 monthly fees, including unlimited domestic transfers and debit card access. International transfer fees remain competitive at €15-25 per transaction, though SEPA transfers cost only €1.

Millennium BCP targets professional expatriates with specialized international banking services. Their London office enables pre-arrival account setup for UK residents, streamlining Portuguese banking integration.

BCP's "Conta Ordenado" waives monthly fees for salary deposits exceeding €600, making it attractive for employed expatriates. Their mobile banking application receives high user ratings for functionality and English-language support.

Novo Banco emerged from restructuring processes, creating modern banking approaches with competitive fee structures. Their "Conta Digital" offers fully online account management with €3 monthly fees.

International Banking Options

Santander Portugal leverages global banking expertise while maintaining local compliance. Their expatriate-focused services include multi-currency accounts and international transfer advantages.

Santander's "Conta Mundo 123" provides cash-back rewards on purchases, returning 1-3% on various spending categories. This account requires €1,000 minimum monthly balance but can generate meaningful returns for active users.

BBVA Portugal targets younger demographics with their "Maisblue" account for 18-29 year-olds, featuring reduced fees and digital-first banking approaches.

Digital Banking Revolution

ActivoBank represents Portugal's digital banking evolution, combining online efficiency with physical branch availability. Their "Conta Simples" offers fee-free banking for residents but requires Portuguese residency cards.

N26 and Revolut provide European banking access but don't satisfy Portuguese visa requirements for local banking relationships. These platforms serve as supplementary accounts rather than primary Portuguese banking solutions.

Advanced Banking Considerations for Long-term Success

Tax Optimization Through Banking Structure

Portuguese tax residency rules interact complexly with banking relationships. Non-habitual resident (NHR) status provides tax advantages but requires specific banking documentation for compliance verification.

Investment accounts through Portuguese banks may trigger different tax treatment compared to maintaining foreign investment accounts. Consult qualified tax advisors before transferring significant investment portfolios to Portuguese institutions.

Property Purchase Banking Requirements

Portuguese real estate transactions require specific banking relationships beyond basic current accounts. Property purchase financing, escrow services, and legal compliance create additional banking considerations.

Mortgage pre-approval processes through Portuguese banks often provide competitive rates compared to foreign financing, particularly for EU residents. Current Portuguese mortgage rates range from 2.5-4.5% depending on loan-to-value ratios and applicant profiles.

Business Banking Integration

Entrepreneurs establishing Portuguese businesses face additional banking complexity. Business account requirements include company registration documentation, shareholder agreements, and regulatory compliance verification.

Portuguese business banking fees significantly exceed personal account costs, with monthly fees ranging from €15-50 plus transaction charges. However, business accounts provide essential services like merchant payment processing and invoice management integration.

Common Pitfalls and Strategic Solutions

Many expatriates encounter predictable obstacles during Portuguese banking integration. Understanding these challenges enables proactive solutions rather than reactive problem-solving.

Documentation rejection often stems from minor formatting issues rather than fundamental problems. Portuguese banks may reject documents with minor name variations, expired dates, or informal presentation styles.

Branch-specific policies create inconsistent experiences even within the same banking institution. Staff discretion and interpretation vary significantly, making multiple branch visits sometimes necessary.

Language barriers affect complex banking discussions even when basic Portuguese sufficiency exists. Consider bringing Portuguese-speaking friends or hiring professional translators for critical banking meetings.

Seasonal timing impacts banking efficiency, with summer periods creating staffing limitations and extended processing times. Plan banking integration during spring or fall months when possible.

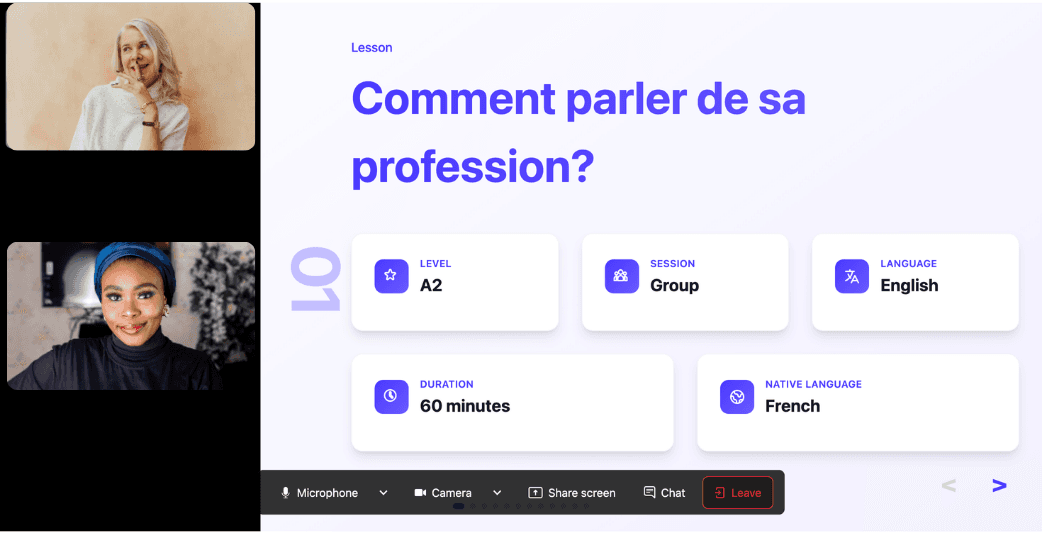

Learn Any Language with Kylian AI

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

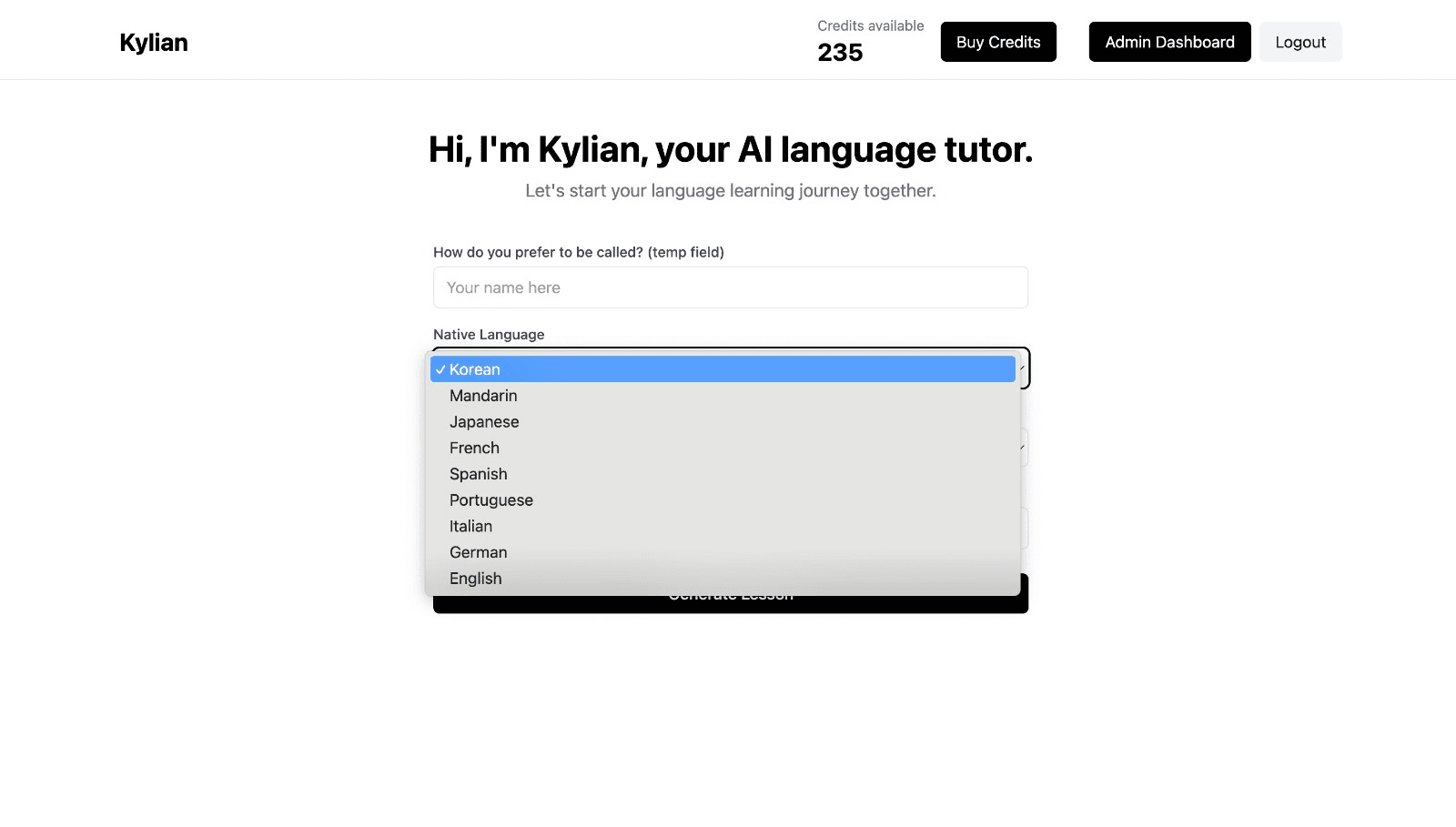

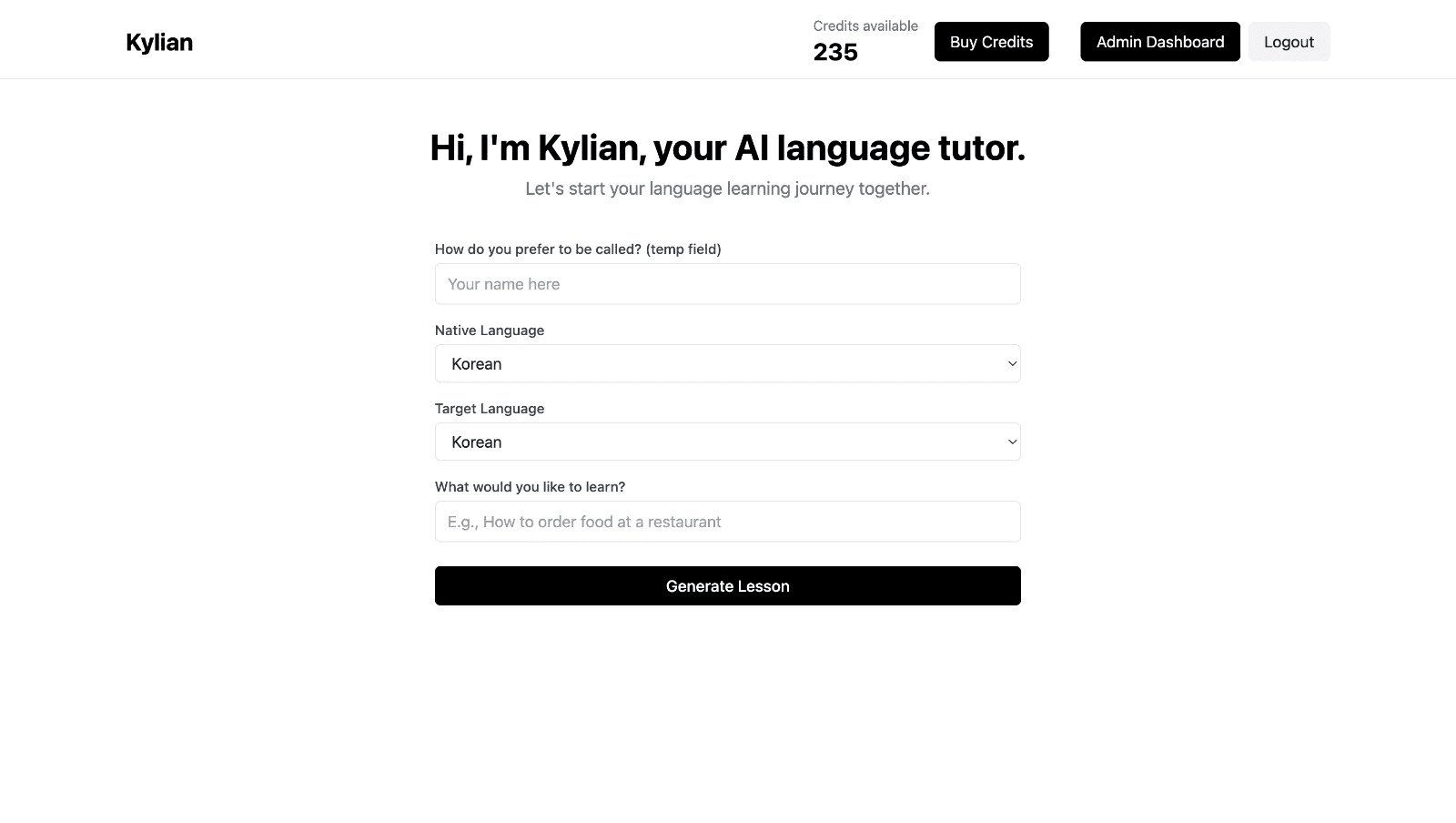

To get started, just tell Kylian which language you want to learn and what your native language is

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

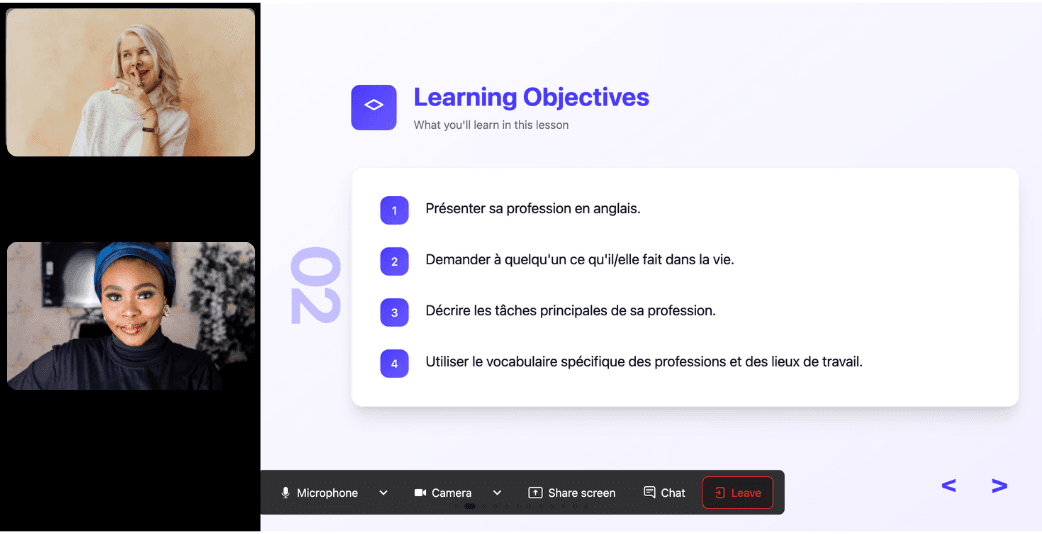

Choose a specific topic you want to learn

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

Join the room to begin your lesson

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

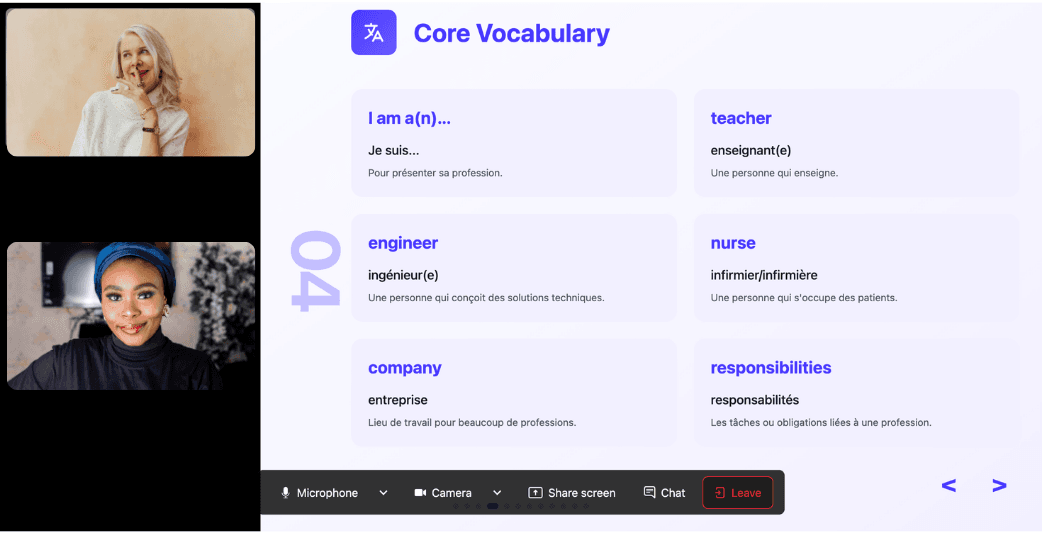

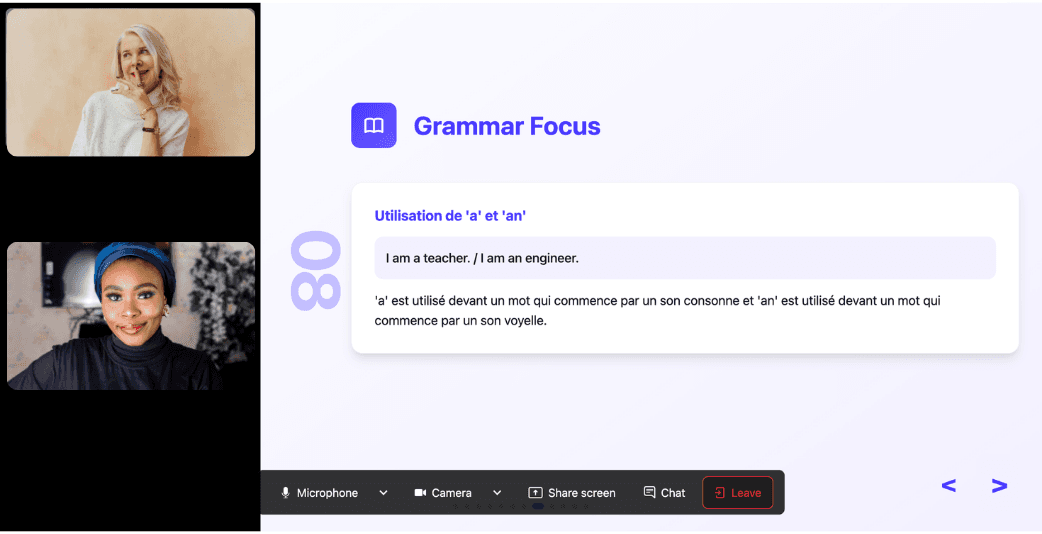

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

How to Become an Expat: 14 Key Steps

The statistics tell a compelling story: over 280 million people currently live outside their country of birth, representing nearly 4% of the global population according to the International Organization for Migration's 2022 data. What drives this massive migration? A 2023 survey revealed that securing employment independently ranks as the primary motivator, while 35% of expatriates through InterNations indicate they plan permanent relocation. These numbers reflect more than demographic trends—they represent millions of individual decisions to pursue better opportunities, higher quality of life, or simply the adventure of experiencing different cultures. Yet behind every successful expatriate story lies careful planning, strategic preparation, and a systematic approach to one of life's most significant transitions. The difference between expatriates who thrive and those who struggle often comes down to preparation quality and execution timing. This guide distills insights from experienced expatriates who have successfully navigated the complex process of international relocation, providing actionable steps that address both practical necessities and long-term integration strategies.

10 Main Idioms to Express Sadness in English

Emotional expression separates fluent speakers from basic learners. While anyone can say "I am sad," sophisticated communicators understand that English idioms transform simple statements into vivid, culturally resonant expressions that connect deeply with native speakers. Research from Cambridge University's Applied Linguistics department demonstrates that ESL students who master emotional idioms achieve 47% higher conversational fluency scores compared to those relying solely on basic adjectives. This data matters because emotional intelligence through language directly correlates with professional advancement and social integration in English-speaking environments. The neurological reality strengthens this argument further. When native speakers encounter familiar idioms, their brains process meaning 23% faster than literal expressions, according to MIT's cognitive linguistics studies. This processing advantage creates immediate rapport and understanding – essential elements for anyone serious about English mastery.

Master French Weather Terms: Practical Guide for Beginners

Weather conversations represent one of the most fundamental interaction points in any language. They serve as natural icebreakers, provide contextual relevance to daily activities, and offer beginners a practical entry point into meaningful dialogue. For French language learners, mastering weather vocabulary delivers immediate practical value - enabling authentic conversations from day one. Understanding French weather terminology transcends mere vocabulary memorization - it opens cultural doors and creates genuine connection opportunities. Let's explore the essential elements of discussing la météo in French, from basic expressions to nuanced idioms that will elevate your conversational abilities.

Expressing Sympathy in English: "My Thoughts Are With You"

Communication during difficult times requires both emotional intelligence and linguistic precision. The expression "my thoughts are with you" serves as a powerful vehicle for conveying sympathy and support when others face challenging circumstances. This phrase has become a cornerstone of empathetic communication in English, offering a way to acknowledge someone's pain without overstepping boundaries or making assumptions about their experience. Understanding when and how to employ this expression effectively requires insight into its cultural context, appropriate situations for use, and the subtle nuances that distinguish it from similar phrases. This exploration examines why this expression matters, how it functions in various contexts, and provides practical guidance for both native and non-native English speakers seeking to communicate compassion authentically.

The Useful Guide to Saying "Thank You" in Portuguese

In the realm of language acquisition, mastering expressions of gratitude stands as a fundamental milestone. When venturing into Portuguese-speaking territories—whether the bustling streets of Lisbon or the vibrant beaches of Rio de Janeiro—knowing how to properly express thanks transcends mere politeness; it establishes meaningful connection. The Portuguese language, like many Romance languages, incorporates nuanced ways to express gratitude that vary depending on context, relationship, and even the speaker's gender identity. This comprehensive guide delves into the multifaceted approaches to saying "thank you" in Portuguese, equipping you with practical knowledge for authentic interactions.

When vs. Whenever in English: Learn Some Subtle Differences

Communication precision matters. While seemingly interchangeable, the temporal conjunctions "when" and "whenever" carry distinct implications that, when used strategically, enhance the clarity and impact of your message. This distinction isn't merely academic—it's fundamental to conveying accurate timing relationships in English.