Opening a Bank Account in Germany: Complete Guide

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

Banking infrastructure forms the backbone of financial integration for expatriates relocating to Germany. Without a German bank account, accessing essential services—from salary deposits to utility payments—becomes unnecessarily complex and expensive. The process demands strategic preparation and understanding of Germany's unique banking landscape.

The German banking system operates on strict documentation requirements and appointment-based protocols. This systematic approach, while initially appearing bureaucratic, actually streamlines the process once you understand the framework. Two critical factors determine success: comprehensive documentation preparation and strategic bank selection based on individual financial needs.

Understanding German Bank Account Categories

German financial institutions structure their offerings around four primary account types, each serving distinct financial objectives:

Girokonto represents the standard current account equivalent, designed for daily transactions including salary deposits, bill payments, and cash withdrawals. Most Girokontos include digital banking access and debit card functionality, with monthly fees ranging from €0-15 depending on the institution and account package.

Tagesgeldkonto functions as an accessible savings vehicle with instant liquidity. Interest rates typically hover between 0.01%-3.5% annually, depending on market conditions and promotional offers. The flexibility comes at the cost of lower returns compared to fixed-term alternatives.

Festgeldkonto locks funds for predetermined periods—typically 6 months to 10 years—in exchange for higher interest rates. Current rates range from 1.5%-4.2% annually, with longer terms generally offering better returns. Early withdrawal penalties apply, making this unsuitable for emergency funds.

Depot accounts facilitate securities trading and investment portfolio management. These accounts often carry separate fee structures for transactions, custody, and advisory services, with costs varying significantly between institutions.

Specialized accounts target demographic segments including students (reduced fees), seniors (simplified interfaces), and business owners (commercial banking features). Student accounts frequently waive monthly fees and offer reduced transaction costs, representing significant savings during university years.

Essential Documentation Requirements

German banks maintain stringent identity verification standards, reflecting both regulatory compliance and anti-money laundering protocols. The documentation process requires multiple layers of proof, each serving specific verification purposes.

Identity verification demands government-issued photo identification, typically a passport for non-EU residents. German banks cannot accept driver's licenses or other secondary identification forms as primary documents. Ensure passport validity extends at least six months beyond your intended account opening date.

Address confirmation requires the Anmeldebescheinigung (registration certificate), obtained after registering your German address at the local Bürgeramt (citizen's office). This document proves legal residency and cannot be substituted with utility bills or rental agreements. The registration process itself takes 1-2 weeks, so plan accordingly.

Tax identification involves presenting your Steueridentifikationsnummer (tax ID), an 11-digit number automatically assigned after address registration. This number links your banking activity to German tax obligations and enables proper tax reporting.

Legal status documentation includes visa or residence permits for non-EU nationals. Banks verify your legal right to maintain German financial accounts and assess account duration based on permit validity periods.

Income verification may include employment contracts, salary statements, or business registration documents. While not universally required, many banks request income proof for account approval and credit limit determination.

Documentation requirements vary between institutions, with some banks requesting additional materials like academic enrollment certificates for students or business plans for entrepreneurs. Contact prospective banks directly to confirm specific requirements, avoiding multiple branch visits due to incomplete paperwork.

Strategic Bank Selection Process

Germany's banking landscape encompasses approximately 1,400 institutions across four distinct categories, each offering unique advantages and limitations. Strategic selection requires analyzing your specific financial needs against institutional capabilities.

Traditional Private Banks (Cash Group)

The Cash Group coalition—Deutsche Bank, Commerzbank, HypoVereinsbank, and Postbank—provides extensive ATM networks and comprehensive services. Members access over 9,000 ATMs without fees, representing significant savings for frequent cash users.

Deutsche Bank operates as Germany's largest private bank, offering sophisticated international banking services. Their English-language support and global presence benefit expatriates maintaining financial ties across multiple countries. Monthly fees range from €6.90-€34.90, with premium accounts including investment advisory services.

Commerzbank focuses on digital banking innovation while maintaining traditional branch networks. Their online account opening process streamlines initial setup, though branch visits may still be required for final verification. International transfer fees remain competitive compared to traditional wire services.

HypoVereinsbank (UniCredit subsidiary) provides strong European banking connections, particularly beneficial for expatriates from EU countries. Their wealth management services cater to higher-income individuals seeking comprehensive financial planning.

Postbank emphasizes consumer banking with competitive loan rates and simplified account structures. As a Deutsche Bank subsidiary, customers access expanded ATM networks while benefiting from streamlined retail banking approaches.

Regional Savings Banks (Sparkassen)

Germany's 376 Sparkassen operate as public institutions serving local communities. Their deep regional knowledge and community focus provide personalized service often lacking in larger institutions.

Local Sparkassen understand regional employment patterns, housing markets, and economic conditions, enabling more nuanced account approval decisions. Many expatriates find Sparkassen representatives more willing to explain German banking conventions and provide guidance during the integration process.

Fee structures typically favor local customers, with many Sparkassen offering reduced fees for regional employment or educational enrollment. However, limited English-language support may challenge non-German speakers.

Cooperative Banks (Volksbanken)

Germany's 812 cooperative banks operate under member ownership models, where account holders become partial owners with voting rights in institutional decisions. This structure often translates to more customer-focused policies and competitive fee structures.

Membership requires purchasing nominal shares (typically €15-52) upon account opening, but members receive annual dividend payments based on bank performance. The ownership model creates alignment between customer interests and institutional success.

Volksbanken typically serve specific geographic regions or professional groups, fostering community connections valuable for expatriates seeking local integration.

Online Banking Platforms

Digital-first banks eliminate branch networks, passing savings to customers through reduced fees and enhanced digital experiences. These platforms particularly appeal to tech-savvy expatriates comfortable with mobile-first banking.

N26 pioneered German neobanking with sophisticated mobile applications and English-language support. Their fee structure remains transparent, with free basic accounts and premium tiers offering travel insurance and other benefits.

Comdirect (Commerzbank subsidiary) combines online efficiency with traditional banking stability. Their investment platform particularly appeals to expatriates managing diversified portfolios across multiple currencies.

Wise (formerly TransferWise) specializes in multi-currency accounts and international transfers. Their real exchange rates and transparent fee structure significantly reduce costs for expatriates maintaining international financial connections.

International Bank Branches

Foreign banks operating German branches provide familiar services for expatriates from specific countries, often with native-language support and specialized products.

Santander offers Spanish-language services and products designed for expatriates maintaining financial ties with Spain and Latin America. Their European network facilitates cross-border banking relationships.

Ziraat Bank serves Turkish communities with specialized remittance services and Islamic banking products. Their German presence spans major cities with significant Turkish populations.

Step-by-Step Account Opening Process

Phase 1: Pre-Application Research and Preparation

Begin bank selection 4-6 weeks before needing active banking services. This timeline accommodates documentation gathering, appointment scheduling, and potential delays in the approval process.

Analyze your specific banking needs against institutional offerings. Consider factors including monthly fee tolerance, international transfer frequency, investment interests, and preferred communication languages. Create a comparison matrix ranking potential banks across relevant criteria.

Research customer experiences through expatriate forums and regional Facebook groups, focusing on English-language support quality and account opening experiences for your specific nationality or visa type.

Phase 2: Documentation Assembly

Gather required documents systematically, ensuring each meets specific bank requirements. Obtain certified translations for non-German documents if required by your chosen institution.

Create digital copies of all documents as backup, but prepare original physical documents for in-person verification. Some banks accept notarized copies, while others require original document inspection.

Verify document validity periods, ensuring passports and permits remain valid throughout the account opening process and initial account period.

Phase 3: Appointment Scheduling and Branch Visit

German banks operate on appointment-based systems, particularly for account opening services. Schedule appointments 2-3 weeks in advance, as popular branches may have limited availability.

Prepare basic German phrases for initial interactions, demonstrating cultural respect and facilitating communication. Even banks with English-speaking staff appreciate clients who attempt German greetings and basic banking terminology.

Arrive 10 minutes early with all documentation organized in a folder. Dress professionally, as German business culture values formal presentation during official proceedings.

During the appointment, ask specific questions about fee structures, international services, and digital banking capabilities. Request written confirmation of verbal commitments regarding fees or services.

Phase 4: Post-Opening Setup and Integration

Account activation typically requires 5-10 business days, during which you'll receive debit cards, PIN codes, and online banking credentials via separate mailings for security purposes.

Download and configure mobile banking applications immediately upon receiving credentials. Test basic functions including balance checks, transaction history, and transfer capabilities.

Set up essential automated payments including rent, utilities, and insurance premiums. German service providers often offer discounts for automated payment arrangements.

Banking Fee Analysis and Optimization

German banking fees vary significantly between institutions and account types, with careful selection potentially saving hundreds of euros annually. Understanding fee structures enables informed decisions and ongoing cost optimization.

Monthly Account Maintenance Fees

Basic Girokonto fees range from €0-€15 monthly, with premium accounts reaching €35+ monthly. Fee waivers often apply based on minimum balance requirements, salary deposits, or age demographics.

Many banks waive fees for students, apprentices, or young adults under 26-30 years old. Salary deposit requirements typically range from €600-€1,200 monthly for fee waivers.

Transaction and Service Fees

ATM withdrawals within bank networks remain free, but external ATM usage costs €2-€5 per transaction. Cash Group membership provides access to over 9,000 ATMs without fees, representing significant savings for cash-dependent users.

International transfer fees vary dramatically, from €10-€50 for traditional wire transfers versus €0.50-€5 for modern digital services. Expatriates maintaining international financial obligations should prioritize banks with competitive international transfer rates.

Overdraft interest rates range from 6.5%-14% annually, making careful account balance management essential. Some banks offer interest-free overdraft buffers up to €100-€500.

Hidden Costs and Optimization Strategies

Paper statement fees typically cost €1-€3 monthly, easily avoided through digital banking adoption. Currency conversion fees of 1.5%-3% apply to foreign transactions, making multi-currency accounts valuable for frequent travelers.

Account closure fees of €10-€50 discourage frequent bank switching, emphasizing the importance of initial selection accuracy.

Digital Banking Integration and Security

German banks maintain sophisticated digital platforms combining convenience with robust security protocols. Understanding these systems maximizes banking efficiency while maintaining financial security.

Mobile Application Capabilities

Modern German banking apps support comprehensive account management including real-time balance monitoring, transaction categorization, and spending analytics. Push notifications provide instant transaction alerts, enhancing security monitoring.

Photo-based document uploads facilitate service requests without branch visits. Many banks now accept check deposits, loan applications, and address changes through mobile platforms.

Security Protocols and Best Practices

German banks employ multi-factor authentication combining passwords, SMS verification, and biometric confirmation. The TAN (Transaction Authentication Number) system requires secondary confirmation for sensitive transactions.

Never conduct banking activities on public Wi-Fi networks, as German consumer protection laws provide limited recourse for security breaches resulting from negligent user behavior.

Regular password updates and immediate reporting of suspicious activities maintain account security. German banks typically provide 24/7 fraud hotlines with English-language support.

Navigating Common Challenges and Solutions

Language Barriers and Communication

While major German banks offer English-language support, technical banking terminology and legal documents often remain in German. Invest in basic German banking vocabulary or identify bilingual friends who can assist with complex documentation.

Many banks provide English-language website versions, but German versions typically contain more comprehensive information and current promotional offers.

Bureaucratic Processes and Timeline Management

German banking emphasizes systematic processes over speed, with account opening taking 2-4 weeks from application to full activation. Plan banking needs accordingly, avoiding last-minute applications before salary payment deadlines.

Maintain detailed records of all banking interactions, including appointment confirmations, document submissions, and service requests. German institutions value thorough documentation and organized communication.

Credit History Establishment

Germany's SCHUFA credit reporting system influences banking relationships and loan eligibility. Building positive SCHUFA history requires consistent account management, timely bill payments, and avoiding overdrafts.

Request annual SCHUFA reports to monitor credit status and address any inaccuracies promptly. Positive banking relationships established early benefit long-term financial planning in Germany.

Specialized Considerations for Different Expatriate Categories

International Students

Student bank accounts offer significant fee reductions and simplified requirements, but may include transaction limitations or balance restrictions. Enrollment certificates and student visa documentation facilitate account approval.

Many banks partner with universities to offer on-campus banking services and specialized financial products including study loans and graduation account transitions.

Working Professionals

Employment contracts strengthen account applications and enable higher credit limits or premium account eligibility. Salary direct deposit arrangements often trigger fee waivers and enhanced services.

Corporate banking relationships through employers may provide preferential rates or expedited account opening processes.

Entrepreneurs and Business Owners

Business banking requires separate accounts and additional documentation including business registration certificates and tax identification numbers. Mixing personal and business transactions creates legal and tax complications.

Consider banks with strong business banking divisions and English-language commercial support for ongoing business financial needs.

Long-term Banking Strategy and Relationship Management

Successful German banking extends beyond initial account opening to ongoing relationship optimization and strategic financial planning.

Account Portfolio Optimization

As financial needs evolve, consider expanding account types within your primary bank to access relationship pricing and consolidated services. Multi-product relationships often unlock fee waivers and enhanced customer service.

Future Financial Planning Integration

German banks offer comprehensive financial planning services including retirement savings, investment management, and insurance coordination. Establishing early banking relationships facilitates access to these services as income and assets grow.

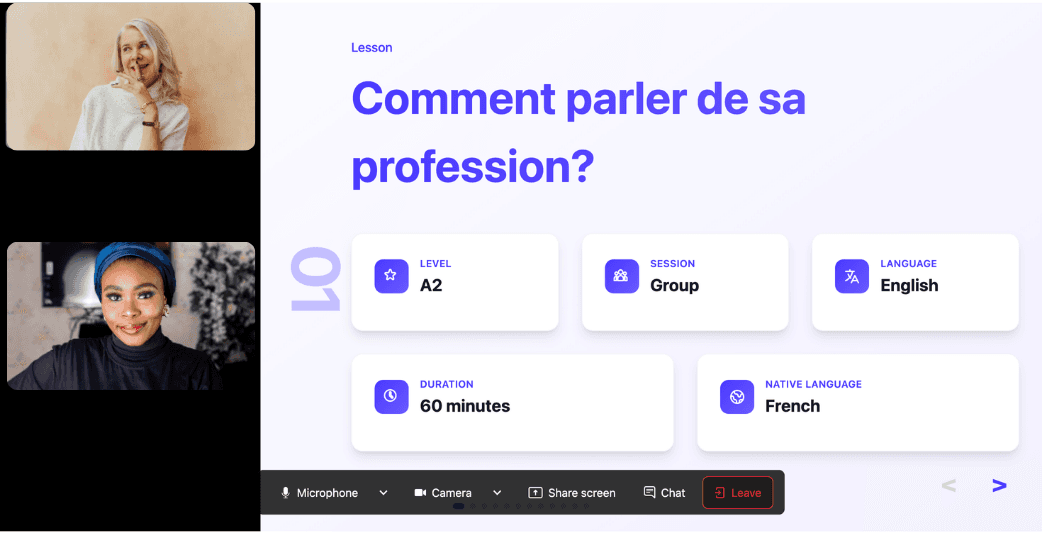

Learn Any Language with Kylian AI

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

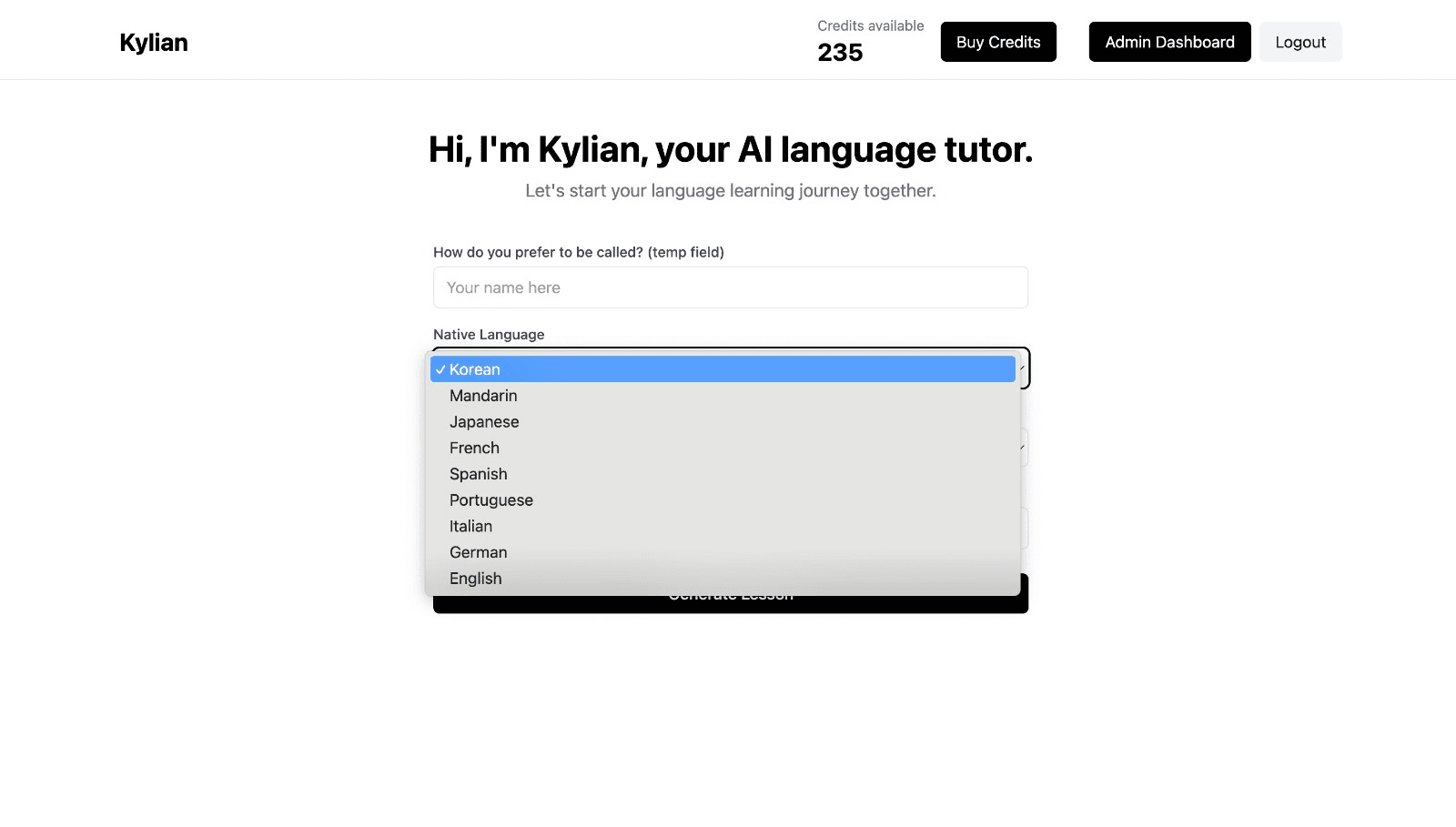

To get started, just tell Kylian which language you want to learn and what your native language is

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

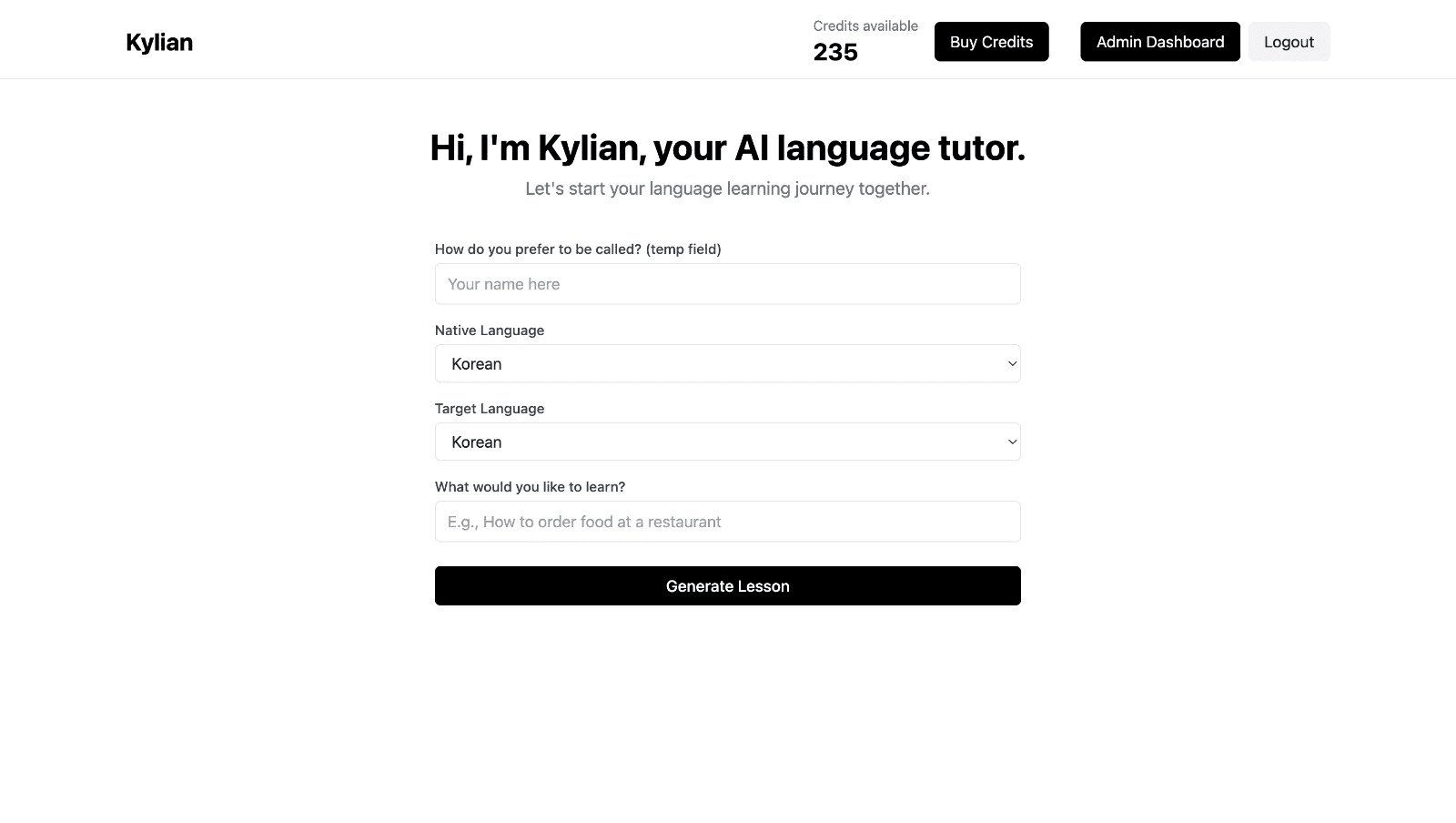

Choose a specific topic you want to learn

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

Join the room to begin your lesson

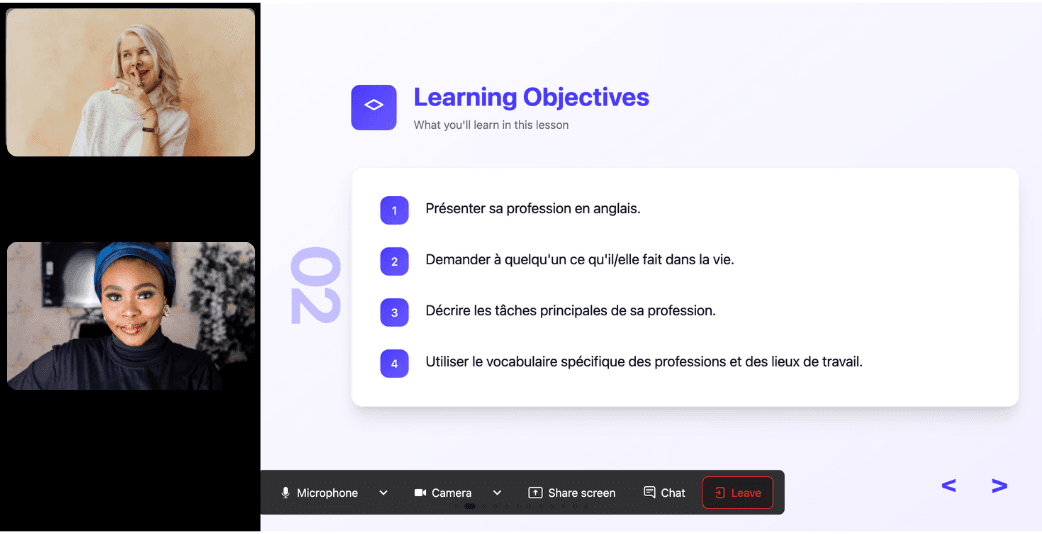

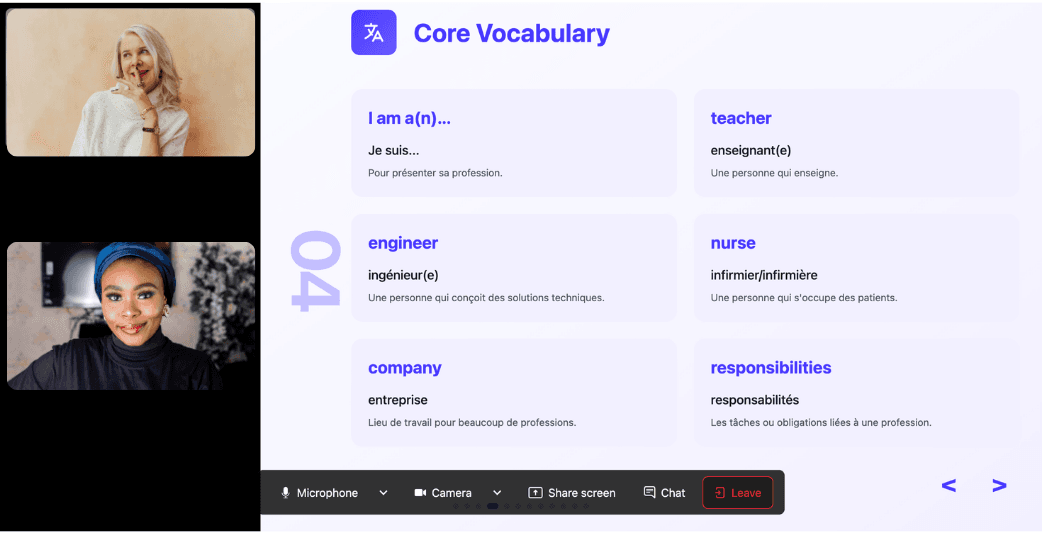

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

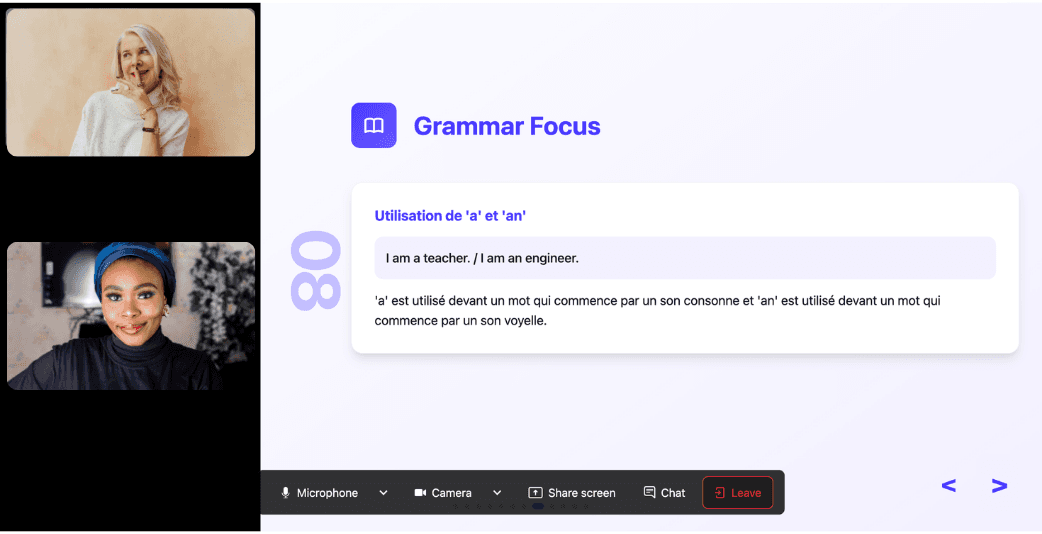

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

How to Become an Expat: 14 Key Steps

The statistics tell a compelling story: over 280 million people currently live outside their country of birth, representing nearly 4% of the global population according to the International Organization for Migration's 2022 data. What drives this massive migration? A 2023 survey revealed that securing employment independently ranks as the primary motivator, while 35% of expatriates through InterNations indicate they plan permanent relocation. These numbers reflect more than demographic trends—they represent millions of individual decisions to pursue better opportunities, higher quality of life, or simply the adventure of experiencing different cultures. Yet behind every successful expatriate story lies careful planning, strategic preparation, and a systematic approach to one of life's most significant transitions. The difference between expatriates who thrive and those who struggle often comes down to preparation quality and execution timing. This guide distills insights from experienced expatriates who have successfully navigated the complex process of international relocation, providing actionable steps that address both practical necessities and long-term integration strategies.

16 Expert Steps + Bonus Tips for Moving to Spain

Spain consistently ranks among the most desirable destinations for relocation. Its Mediterranean climate, relaxed lifestyle, and rich cultural heritage attract millions of foreign nationals annually. According to 2022 data from the INE (Instituto Nacional de Estadística), over five million foreign-born residents call Spain home—representing more than 11% of the total population. This significant expatriate presence isn't surprising. Spain offers busy professionals a welcome work-life balance shift, provides families with excellent educational options, and presents retirees with an enviable quality of life. The country also consistently ranks among the world's most family-friendly nations, making it particularly attractive for those raising children. Successful relocation requires careful planning and preparation. This comprehensive guide provides a step-by-step approach to moving to Spain, featuring insights from expatriates who have successfully navigated the process.

Mastering the Past Tense of Sit: English Grammar Essentials

The English language presents unique challenges with its irregular verbs, which don't follow the standard "-ed" pattern for past tense formation. Among these irregulars, "sit" stands as a common yet frequently misused verb in everyday communication. Understanding its correct past tense forms unlocks more precise expression and elevates language proficiency.

What Does Amped Mean? Complete Guide in English

The evolution of language reflects our society's constant transformation. Few words exemplify this evolution better than "amped" – a term that has transcended its original technical context to become embedded in our everyday vernacular. Understanding what "amped" means provides insight not only into linguistic development but also into how culture shapes communication. This comprehensive analysis explores the meaning of "amped," tracing its etymology, examining its diverse applications across contexts, and analyzing how it has evolved to reflect our contemporary experiences. By dissecting this term, we gain valuable perspective on how language adapts to serve our communicative needs.

Past Tense of Leave in English: Complete Guide

Understanding how verbs transform across tenses constitutes a fundamental aspect of English language mastery. The verb "leave" presents particular challenges due to its irregular conjugation pattern that diverges from standard -ed suffix additions. This comprehensive examination explores the past tense forms of "leave," contextualizes their appropriate usage, and provides essential guidance for English language learners navigating this common yet complex verb.

Past Tense of Stick in English: Complete Guide

Verb tenses form the backbone of effective communication in English. Understanding how to properly conjugate verbs like "stick" empowers language learners to express past actions with precision and confidence. The past tense of "stick" presents unique challenges due to its irregular conjugation patterns that diverge from standard "-ed" endings. This comprehensive guide explores the various forms of "stick" in past tenses, providing clear explanations, practical examples, and essential context for mastering this fundamental aspect of English grammar.