34 Main Startup Terms Every Entrepreneur Must Know

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

The startup ecosystem operates on its own linguistic currency. Every conversation, pitch deck, and board meeting is peppered with specialized terminology that can make or break your credibility in this space. Understanding startup jargon isn't about impressing people with buzzwords—it's about participating meaningfully in an ecosystem where precision matters and where misunderstanding a single term can cost millions.

Consider this: when a venture capitalist mentions your "runway" during a funding meeting, they're not talking about fashion week. When they discuss your "burn rate," they're not commenting on your workout routine. These terms carry specific meanings that directly impact business decisions, and fluency in this language signals whether you belong at the table or you're still learning the rules of the game.

The stakes are higher than ever. With global venture capital investment reaching unprecedented levels and startup valuations soaring, the barrier to entry for meaningful participation in this ecosystem continues to rise. Entrepreneurs who can't navigate startup terminology find themselves excluded from critical conversations, while those who master it gain access to networks, funding, and opportunities that can transform their ventures.

Why Startup Terminology Matters More Than Ever

The startup landscape has evolved dramatically over the past decade. What began as Silicon Valley insider language has become the global standard for entrepreneurial communication. From London to Lagos, from Singapore to São Paulo, entrepreneurs and investors speak the same foundational language of startup terminology.

This linguistic standardization serves a critical purpose. When a founder in Berlin discusses their "MVP" with investors in Tokyo, both parties immediately understand the scope, timeline, and resource implications of what's being proposed. This shared vocabulary accelerates decision-making, reduces miscommunication, and enables the rapid flow of capital and ideas across geographical boundaries.

The urgency of mastering this language has intensified as startup ecosystems mature worldwide. Emerging markets are producing unicorns at record rates, and traditional corporations are increasingly adopting startup methodologies through digital transformation initiatives. The result? Startup jargon has transcended its origins and become essential business vocabulary for anyone operating in innovation-driven industries.

The Foundation: Understanding What Defines a Startup

Before diving into specific terminology, it's crucial to establish what constitutes a startup. A startup represents a temporary organization designed to search for a repeatable and scalable business model. This definition, popularized by entrepreneur Steve Blank, distinguishes startups from traditional small businesses through their focus on scale and innovation rather than replication of existing models.

Startups typically exhibit several key characteristics: they operate under extreme uncertainty, pursue exponential rather than linear growth, leverage technology to solve problems at scale, and seek external funding to accelerate development. These characteristics inform much of the terminology that has emerged around startup operations, funding, and growth strategies.

The temporal nature of startups also matters for understanding their vocabulary. Most startup terms reflect the urgency and resource constraints inherent in early-stage ventures. Terms like "runway," "burn rate," and "pivot" all acknowledge the time-sensitive nature of startup operations, where decisions must be made quickly with limited information and resources.

34 Essential Startup Terms Every Entrepreneur Should Master

1. Accelerator

An accelerator provides intensive, short-term programs designed to rapidly advance early-stage startups through mentorship, resources, and networking opportunities. Unlike other support mechanisms, accelerators operate on fixed timelines—typically three to six months—and culminate in demo days where startups present to potential investors.

The accelerator model has proven particularly effective for first-time entrepreneurs who lack industry networks and experienced guidance. Programs like Techstars and Y Combinator have achieved remarkable success rates, with their portfolio companies achieving significantly higher survival rates and funding success compared to non-accelerated peers. However, entrepreneurs should carefully evaluate whether the equity exchange—typically 6-8% of their company—justifies the program benefits.

Modern accelerators increasingly specialize by industry vertical or demographic focus, creating more targeted value propositions for specific entrepreneur populations.

2. Acqui-hiring

Acqui-hiring occurs when larger companies acquire startups primarily to obtain their talent rather than their products or intellectual property. This practice has become increasingly common in competitive talent markets, particularly in technology sectors where skilled engineers and data scientists command premium compensation packages.

The phenomenon reflects a fundamental shift in how companies view talent acquisition. Rather than competing in traditional hiring markets, established companies identify promising teams working on adjacent technologies and acquire the entire operation. The acquired startup's product typically gets discontinued or absorbed into existing offerings.

For startup founders, acqui-hiring represents a viable exit strategy when product-market fit remains elusive but the team has demonstrated exceptional capabilities. While acqui-hire valuations typically fall below traditional acquisition multiples, they provide immediate liquidity and often come with retention packages for key team members.

3. Angel Investor

Angel investors are high-net-worth individuals who provide capital to early-stage startups in exchange for equity ownership. Unlike institutional investors, angels typically invest their personal wealth and often contribute industry expertise, networks, and mentorship alongside financial resources.

The angel investment landscape has professionalized significantly over the past decade. Many successful entrepreneurs have become active angels, creating robust ecosystems where startup experience circulates through investment activities. Angel groups and syndicates have emerged to enable smaller investors to participate in larger rounds while providing more due diligence resources for deal evaluation.

Successful angel relationships extend far beyond financial transactions. The most effective angels provide strategic guidance during critical inflection points, facilitate introductions to potential customers and partners, and help startups navigate the fundraising process for subsequent rounds.

4. Bootstrapping

Bootstrapping describes the practice of funding startup operations through personal savings, revenue generation, and minimal external capital. Bootstrapped companies maintain maximum control over their operations and equity but typically grow more slowly than venture-funded counterparts due to resource constraints.

The bootstrapping approach has gained renewed respect as entrepreneurs recognize the trade-offs inherent in external funding. Bootstrapped companies retain full ownership and decision-making authority, avoid dilution pressure, and develop sustainable unit economics from inception. Companies like Mailchimp and Basecamp have demonstrated that bootstrapping can lead to highly successful outcomes without traditional venture capital.

However, bootstrapping requires exceptional discipline around resource allocation and may limit a company's ability to respond quickly to market opportunities or competitive threats that require significant capital investment.

5. Bridge Loan

Bridge loans provide short-term financing designed to sustain startup operations until more permanent funding sources become available. These loans typically carry higher interest rates than long-term financing but offer critical flexibility during transitional periods.

Bridge financing often emerges when startups face timing mismatches between their capital needs and fundraising cycles. For example, a company might secure commitments for a larger funding round but need immediate capital to meet payroll or inventory requirements before the round closes.

Successful bridge loan strategies require clear visibility into upcoming financing events and realistic assessment of the time required to complete those transactions. Entrepreneurs should carefully evaluate the cost of bridge financing against the risk of operational disruption from inadequate working capital.

6. Burn Rate

Burn rate measures the speed at which a startup consumes its available capital, typically expressed as monthly cash outflow. This metric serves as a fundamental indicator of operational efficiency and financial sustainability, directly informing strategic decisions about resource allocation and fundraising timing.

Understanding burn rate requires distinguishing between gross burn (total monthly expenses) and net burn (monthly expenses minus revenue). Net burn provides a more accurate picture of capital consumption for revenue-generating companies, while gross burn matters more for pre-revenue ventures evaluating operational efficiency.

Effective burn rate management involves continuous optimization of the relationship between spending and value creation. Startups that achieve meaningful milestones while maintaining efficient burn rates position themselves favorably for subsequent funding rounds and demonstrate operational discipline to potential investors.

7. Churn Rate

Churn rate quantifies the percentage of customers who discontinue using a company's products or services during a specific time period. This metric serves as a critical indicator of product-market fit, customer satisfaction, and long-term business viability.

High churn rates signal fundamental problems with product value proposition, customer experience, or market positioning. Low churn rates indicate strong customer loyalty and suggest sustainable growth potential. However, churn analysis requires careful segmentation to understand which customer types are most likely to leave and why.

Successful churn reduction strategies focus on improving customer onboarding, enhancing product value delivery, and identifying early warning indicators that predict customer departure. Companies with strong retention metrics often achieve higher valuations due to their predictable revenue streams and expansion opportunities within existing customer bases.

8. Cliff

A cliff represents a time period that must elapse before employees become eligible to exercise their equity compensation. This mechanism prevents individuals from joining companies solely to obtain equity benefits and then departing immediately after vesting begins.

Standard cliff periods typically last one year, after which employees become eligible for a portion of their equity grants with continued vesting occurring monthly or quarterly thereafter. This structure aligns employee incentives with company long-term success while providing protection against opportunistic behavior.

Cliff structures require careful design to balance retention objectives with competitive talent acquisition needs. Companies in highly competitive talent markets may offer shorter cliff periods or other incentives to attract key personnel while maintaining appropriate alignment mechanisms.

9. Cottage Business

Cottage businesses operate effectively at small scale with limited growth potential or capital requirements. These ventures typically focus on niche markets, artisanal products, or specialized services that don't benefit from scale economies.

While cottage businesses can provide sustainable income and lifestyle benefits for their operators, they rarely attract venture capital investment due to their limited scalability. However, some cottage businesses evolve into larger enterprises through product innovation, market expansion, or business model refinement.

The cottage business model has experienced renewed interest as digital platforms enable small-scale operators to reach global markets efficiently. E-commerce marketplaces, social media marketing, and digital payment systems have reduced many traditional barriers to cottage business success.

10. Disruptive Technology

Disruptive technology fundamentally alters existing market dynamics by introducing new approaches that initially serve overlooked customer segments before eventually transforming entire industries. This concept, developed by Clayton Christensen, explains how seemingly inferior technologies can ultimately displace established market leaders.

True disruption follows predictable patterns: new technologies initially offer limited functionality at lower prices, gradually improve to serve mainstream customers, and eventually offer superior value propositions that render existing solutions obsolete. The smartphone's disruption of multiple industries—cameras, music players, navigation systems—exemplifies this process.

Identifying disruptive potential requires understanding both technological capabilities and market dynamics. Technologies that seem inferior today might become dominant tomorrow if they address unmet needs or remove significant barriers to adoption.

11. Exit Strategy

Exit strategies define how startup founders and investors will eventually realize returns on their investments through ownership transfer mechanisms. Common exit routes include initial public offerings, acquisitions by strategic buyers, management buyouts, and merger transactions.

Successful exit planning begins early in a company's development and influences many strategic decisions throughout its evolution. Different exit strategies require different preparation approaches: IPO candidates must develop robust financial reporting and governance systems, while acquisition targets should focus on strategic value creation for potential buyers.

Market conditions significantly influence exit strategy viability and timing. Economic cycles, industry consolidation trends, and capital market availability all affect the attractiveness and feasibility of different exit approaches.

12. Freemium

The freemium business model offers basic product functionality at no cost while charging for advanced features, increased usage limits, or premium services. This approach enables companies to acquire large user bases with minimal customer acquisition costs while monetizing a subset of users who require enhanced capabilities.

Successful freemium implementation requires careful balance between free value provision and premium feature differentiation. Free tiers must provide sufficient value to attract and retain users while creating clear upgrade pathways for customers who need additional functionality.

Freemium metrics focus on conversion rates from free to paid tiers, user engagement levels, and customer lifetime value across different subscription segments. Companies with effective freemium models often achieve lower customer acquisition costs and higher retention rates than pure subscription businesses.

13. Growth Hacking

Growth hacking employs creative, low-cost marketing tactics designed to achieve rapid user acquisition and engagement growth. This approach emphasizes experimentation, data analysis, and iterative optimization over traditional marketing methods.

Effective growth hacking requires deep understanding of customer behavior, product usage patterns, and viral mechanics. Successful campaigns often leverage existing platforms, user-generated content, or network effects to achieve exponential growth without proportional cost increases.

The growth hacking mindset has evolved beyond marketing tactics to encompass product development, user experience design, and business model innovation. Companies that integrate growth considerations into their core product development processes often achieve more sustainable and cost-effective scaling.

14. Hockey Stick Growth

Hockey stick growth describes the pattern where business metrics show initial flat performance followed by dramatic exponential increases. This growth trajectory often indicates successful product-market fit achievement and scalable business model validation.

The hockey stick pattern typically emerges when companies overcome initial market education requirements, refine their value propositions, and achieve operational leverage through scale effects. However, not all hockey stick growth is sustainable—some patterns reflect temporary market conditions or unsustainable competitive advantages.

Investors particularly value hockey stick growth patterns because they suggest businesses have identified scalable growth mechanisms that can continue generating returns as additional capital gets deployed.

15. Incubator

Incubators provide longer-term support programs for early-stage startups, typically offering workspace, mentorship, and resources over extended periods without fixed graduation timelines. Unlike accelerators, incubators focus on nurturing business concepts through their earliest development stages.

University-affiliated incubators often emphasize technology transfer and research commercialization, while corporate incubators focus on innovations relevant to their parent companies' strategic interests. These programs typically require less equity than accelerators but provide more sustained support relationships.

The incubator model works particularly well for hardware startups, research-intensive ventures, and entrepreneurs who need extended development periods before their concepts become investor-ready.

16. IPO (Initial Public Offering)

An initial public offering represents a company's transition from private to public ownership through the sale of shares on public stock exchanges. This process provides access to significant capital while creating liquidity opportunities for existing shareholders.

IPO preparation requires extensive financial reporting systems, governance structures, and regulatory compliance capabilities. Companies must demonstrate consistent financial performance, scalable business models, and management teams capable of operating under public company scrutiny.

Market conditions significantly influence IPO timing and success. Favorable market sentiment, industry trends, and economic stability all contribute to IPO viability and pricing outcomes.

17. Iteration

Iteration describes the cyclical process of developing, testing, learning from, and refining products or business models based on market feedback. This approach enables startups to improve their offerings systematically while minimizing resource waste on unvalidated assumptions.

Effective iteration requires establishing clear hypotheses, designing appropriate tests, collecting meaningful data, and making objective decisions based on results. The speed and quality of iteration cycles often determine competitive advantage in rapidly evolving markets.

Successful iteration balances the need for rapid learning with the importance of sustained execution. Companies that iterate too frequently may confuse customers or fail to give strategies sufficient time to prove effectiveness.

18. Launch

Launch refers to the formal introduction of products, services, or companies to their target markets. Effective launches coordinate product readiness, market preparation, customer education, and operational scaling to maximize initial market impact.

Modern launch strategies often emphasize soft launches or beta releases that enable companies to gather feedback and refine offerings before broader market introduction. This approach reduces launch risks while providing opportunities for early customer validation and testimonial development.

Launch timing should align with market readiness, competitive dynamics, and internal preparation levels. Premature launches can damage brand perception and market positioning, while delayed launches may cede competitive advantages to faster-moving rivals.

19. Lean Startup

The lean startup methodology emphasizes rapid experimentation, customer feedback integration, and iterative product development to minimize resource waste while maximizing learning speed. This approach helps entrepreneurs avoid building products nobody wants while conserving capital for validated opportunities.

Lean startup principles include building minimum viable products, measuring customer responses, and learning from market feedback to inform subsequent development cycles. This methodology has become standard practice across many startup ecosystems due to its practical effectiveness and resource efficiency.

Successful lean startup implementation requires discipline to avoid feature creep, commitment to objective data analysis, and willingness to pivot when evidence contradicts initial assumptions.

20. Merger

Mergers combine two separate companies into a single entity, typically to achieve scale economies, market expansion, or capability complementarity. Unlike acquisitions, mergers theoretically represent partnerships between equals, though practical power dynamics often create de facto acquisition scenarios.

Merger success depends on cultural compatibility, strategic alignment, and effective integration planning. Many mergers fail to achieve their projected benefits due to cultural clashes, duplicated systems, or inadequate change management processes.

The merger process requires extensive due diligence, regulatory approval, and stakeholder alignment across both organizations. Legal, financial, and operational complexities make mergers time-intensive and expensive undertakings.

21. MVP (Minimum Viable Product)

A minimum viable product represents the most basic version of a product that provides enough functionality to attract early customers and validate core business assumptions. MVPs enable companies to test market demand while minimizing development costs and time investment.

Effective MVP development requires identifying the smallest feature set that delivers meaningful value to target customers. This often means resisting the temptation to include desirable but non-essential features in favor of faster market validation.

MVP success should be measured by learning generation rather than traditional business metrics. Early revenue and user adoption provide valuable signals, but the primary value comes from validated learning about customer needs and market dynamics.

22. Pitch Deck

Pitch decks provide structured presentations designed to communicate business opportunities to potential investors, partners, or customers. Effective pitch decks tell compelling stories while providing necessary information for decision-making.

Standard pitch deck formats typically include problem identification, solution description, market analysis, business model explanation, competitive positioning, team introduction, financial projections, and funding requirements. However, the most effective pitch decks adapt their structure to their specific audiences and objectives.

Successful pitch decks balance comprehensive information provision with engaging storytelling. Investors see hundreds of pitch decks, so differentiation through clear value proposition communication and compelling narrative becomes critical for capturing attention.

23. Pivot

A pivot represents a significant change in business strategy, target market, or product focus based on market learning and feedback. Pivots enable companies to adapt their approaches while leveraging existing assets and capabilities.

Successful pivots require honest assessment of current strategy effectiveness, clear identification of new opportunities, and systematic planning for transition execution. The best pivots build on validated learning from previous approaches rather than representing complete strategic abandonment.

Pivot timing becomes critical for startup success. Pivoting too early may abandon strategies before they have adequate time to prove effectiveness, while pivoting too late may consume resources needed for successful transition execution.

24. Pre-Money Valuation

Pre-money valuation estimates a company's worth before receiving new investment capital. This valuation serves as the baseline for determining how much equity new investors receive in exchange for their capital contributions.

Pre-money valuations depend on multiple factors including revenue growth, market opportunity, competitive position, team capabilities, and investor demand. Valuation methodologies vary by industry and development stage, with early-stage companies often valued based on potential rather than current performance.

Negotiating appropriate pre-money valuations requires balancing founder equity preservation with investor return expectations. Overvaluing companies can create challenges for subsequent funding rounds, while undervaluing can result in excessive dilution.

25. Post-Money Valuation

Post-money valuation represents a company's estimated worth after incorporating new investment capital. This figure equals pre-money valuation plus the amount of new investment received.

Post-money valuations provide benchmarks for measuring company growth between funding rounds and inform decisions about future financing needs. Consistent post-money valuation growth demonstrates business development progress and market validation.

Investors use post-money valuations to calculate their ownership percentages and projected returns based on various exit scenarios. These calculations inform investment decisions and structure negotiations.

26. ROI (Return on Investment)

Return on investment measures the efficiency of investments by comparing gains received to costs incurred. For startups, ROI analysis applies to multiple areas including marketing spend, product development, and equipment purchases.

Calculating meaningful ROI requires accurate cost accounting and objective benefit measurement. Many startup investments generate returns over extended periods, making ROI calculation complex and sometimes misleading if analyzed over insufficient timeframes.

Investors evaluate startup opportunities partly based on projected ROI across different exit scenarios and timeframes. Higher ROI potential typically justifies higher risk tolerance and longer investment horizons.

27. Runway

Runway measures how long a company can continue operating at its current burn rate before exhausting available capital. This metric provides critical insight into fundraising urgency and operational sustainability.

Runway calculations should account for potential revenue growth, seasonal variations, and planned expenditure changes. Conservative runway estimates help ensure companies have adequate time to complete fundraising processes or implement cost reduction measures.

Effective runway management involves maintaining sufficient time buffers for unexpected challenges while avoiding excessive cash hoarding that might slow growth unnecessarily.

28. Scalable

Scalability describes a business's ability to increase revenue and serve additional customers without proportional increases in costs or complexity. Scalable businesses can grow efficiently by leveraging technology, systems, or network effects.

True scalability requires business models that generate increasing returns as they grow rather than simply maintaining consistent margins. Software businesses often exhibit strong scalability characteristics due to their low marginal costs for serving additional users.

Assessing scalability requires analyzing unit economics, operational processes, and market dynamics to understand how growth affects profitability and resource requirements.

29. Seed Funding

Seed funding represents the earliest formal investment stage, typically supporting product development, market validation, and initial team building. Seed rounds often involve angel investors, seed funds, or startup accelerators.

Seed funding amounts have increased significantly over the past decade as startup costs have risen and investor appetites for early-stage opportunities have grown. Modern seed rounds often provide sufficient capital for companies to achieve significant milestones before requiring additional funding.

Successful seed fundraising requires demonstrating initial market validation, strong founding teams, and clear paths to subsequent value creation milestones.

30. Sweat Equity

Sweat equity provides company ownership to employees, founders, or advisors in exchange for their labor and expertise rather than financial investment. This arrangement enables startups to attract talent while conserving cash resources.

Sweat equity arrangements require careful legal structuring to ensure appropriate vesting schedules, tax compliance, and future liquidity provisions. Poorly structured sweat equity can create conflicts or tax liabilities that damage company prospects.

The value of sweat equity depends on company success, making these arrangements inherently risky for recipients but potentially very rewarding for successful ventures.

31. Term Sheet

Term sheets outline the key terms and conditions for investment transactions before formal legal documentation gets prepared. These non-binding agreements establish frameworks for detailed contract negotiations.

Standard term sheet provisions include investment amounts, valuation terms, board composition, liquidation preferences, anti-dilution protections, and investor rights. Understanding these terms enables entrepreneurs to evaluate different investment offers effectively.

Term sheet negotiations require balancing current funding needs with future flexibility requirements. Terms that seem acceptable for early rounds may create challenges for subsequent fundraising or exit transactions.

32. Unicorn

Unicorn status applies to private companies valued at over $1 billion. This designation indicates exceptional growth achievement and market validation, though it also creates pressure for sustained performance and eventual exit execution.

The proliferation of unicorn companies reflects increased global venture capital availability, longer times to IPO, and higher private market valuations. However, unicorn status doesn't guarantee eventual success, as many highly valued private companies struggle with public market transitions.

Achieving unicorn status requires exceptional execution across multiple dimensions including product development, market expansion, team building, and capital efficiency.

33. Value Proposition

Value propositions articulate the specific benefits customers receive from products or services and explain why those benefits matter more than competitive alternatives. Strong value propositions differentiate companies in crowded markets while guiding product development priorities.

Effective value propositions address real customer pain points with quantifiable benefits and clear competitive differentiation. The best value propositions evolve based on market feedback and customer behavior analysis.

Value proposition development requires deep customer understanding, competitive analysis, and continuous refinement based on market response and business model evolution.

34. Venture Capital

Venture capital provides funding to high-growth startups in exchange for equity ownership. Venture capitalists typically invest institutional money rather than personal wealth and focus on companies with significant scale potential.

Venture capital operates through fund structures that raise money from institutional investors and deploy it across portfolio companies over specific timeframes. This model creates incentives for venture capitalists to pursue high-return investments that can generate substantial exits.

Successful venture capital relationships extend beyond financial investment to include strategic guidance, network access, and operational support. The best venture capitalists become trusted advisors who help companies navigate growth challenges and market opportunities.

Two Critical Areas Every Entrepreneur Must Master

Product-Market Fit: The Ultimate Validation

Product-market fit represents the point where a company has developed a product that satisfies strong market demand. This concept, while not traditionally included in basic startup terminology lists, has become essential for understanding startup success patterns.

Achieving product-market fit requires iterative development cycles that balance customer feedback integration with product vision maintenance. Companies with strong product-market fit typically exhibit high customer retention rates, organic growth patterns, and increasing customer lifetime values.

Measuring product-market fit involves analyzing multiple metrics including customer acquisition costs, retention rates, usage patterns, and satisfaction scores. Quantitative data should be supplemented with qualitative feedback to understand the depth and sustainability of market demand.

Unit Economics: The Foundation of Sustainable Growth

Unit economics measure the direct revenues and costs associated with individual business units, typically customers or transactions. Understanding unit economics enables companies to evaluate business model sustainability and optimize resource allocation decisions.

Positive unit economics at the customer level indicate that businesses can profitably acquire and serve customers, providing foundation for sustainable scaling. Companies with negative unit economics must achieve scale economies or pricing improvements to become viable long-term.

Unit economics analysis should account for all direct costs including acquisition, fulfillment, support, and retention expenses. This comprehensive approach provides realistic assessments of business model viability and informs strategic decisions about growth investment.

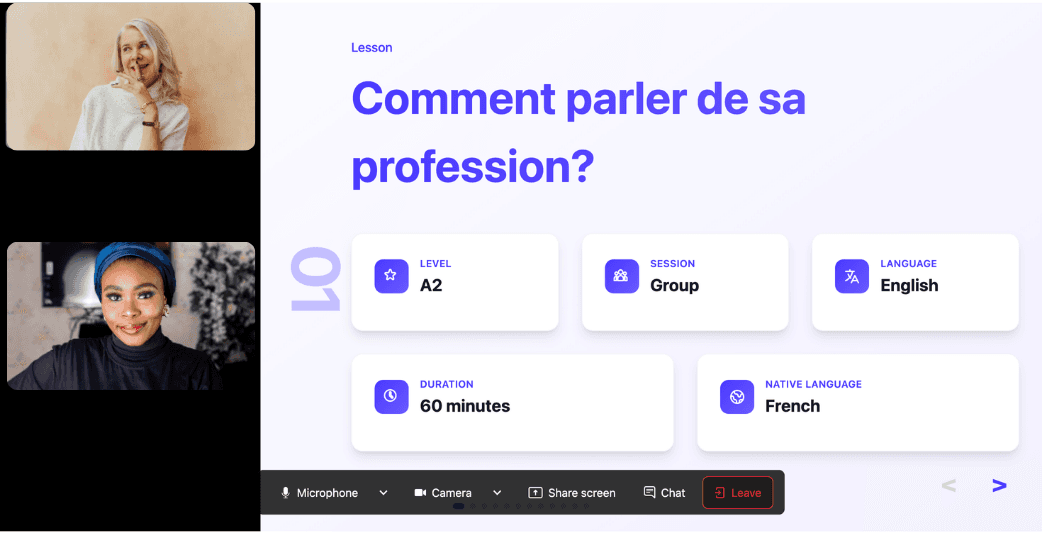

Learn Any Language with Kylian AI

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

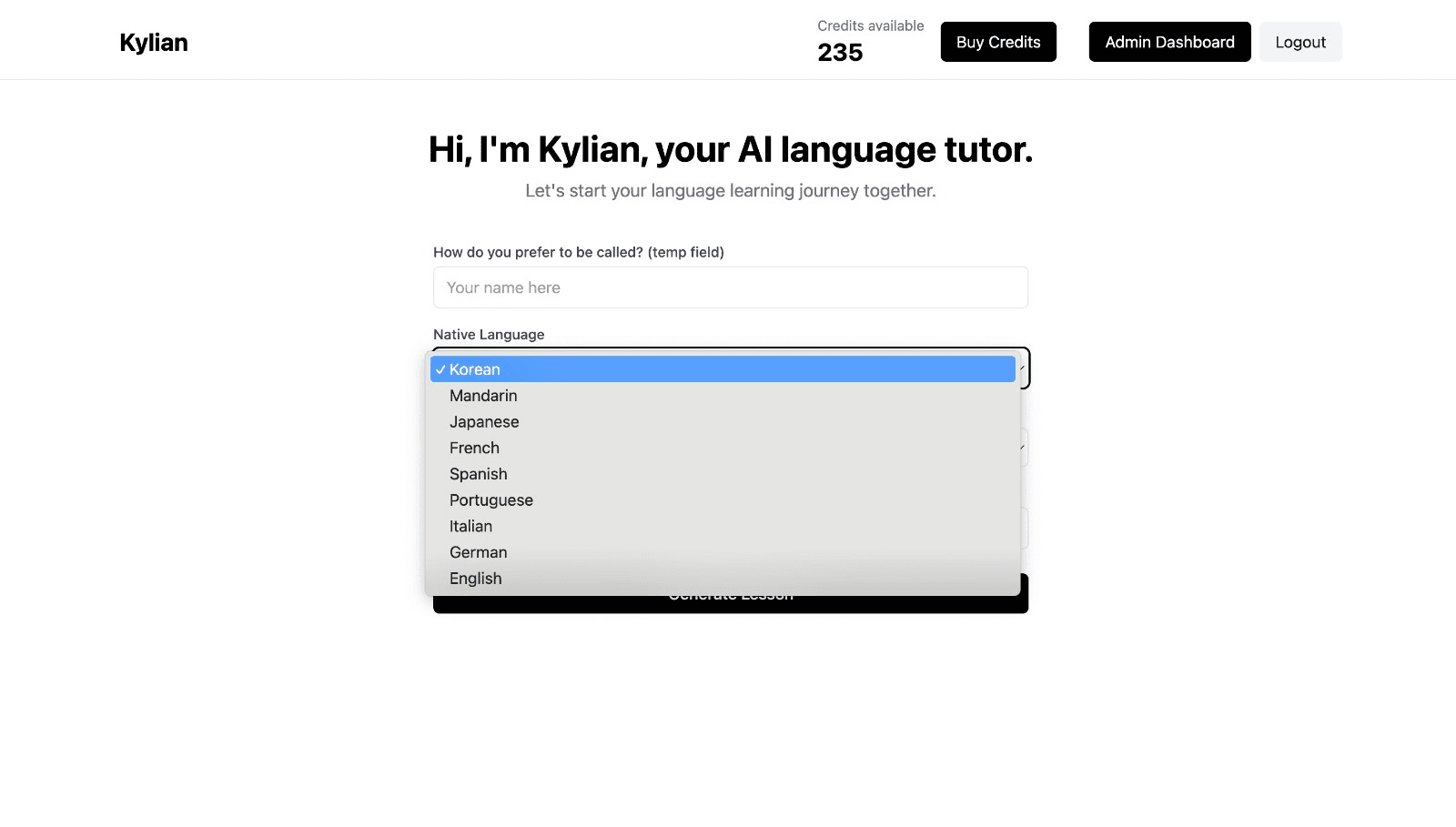

To get started, just tell Kylian which language you want to learn and what your native language is

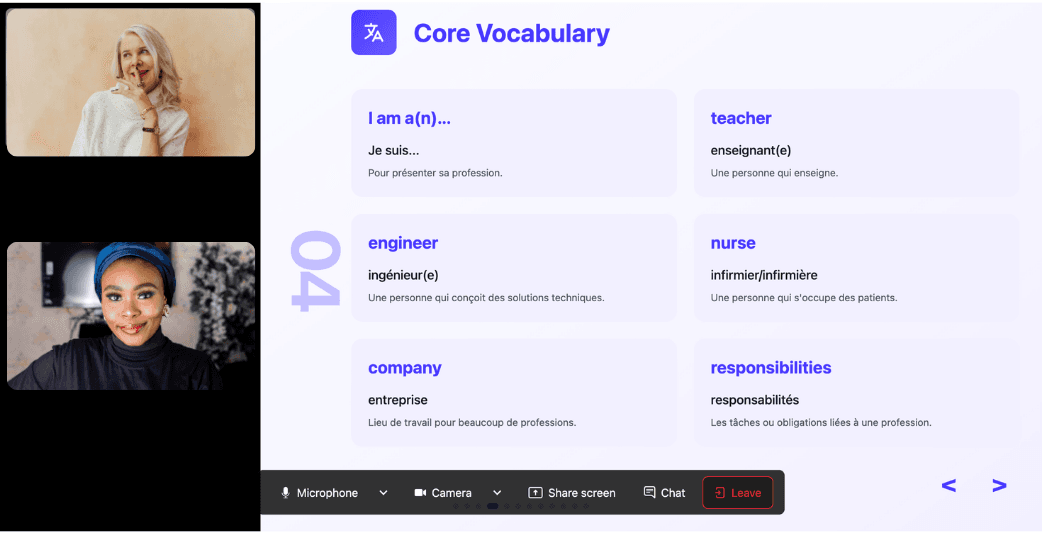

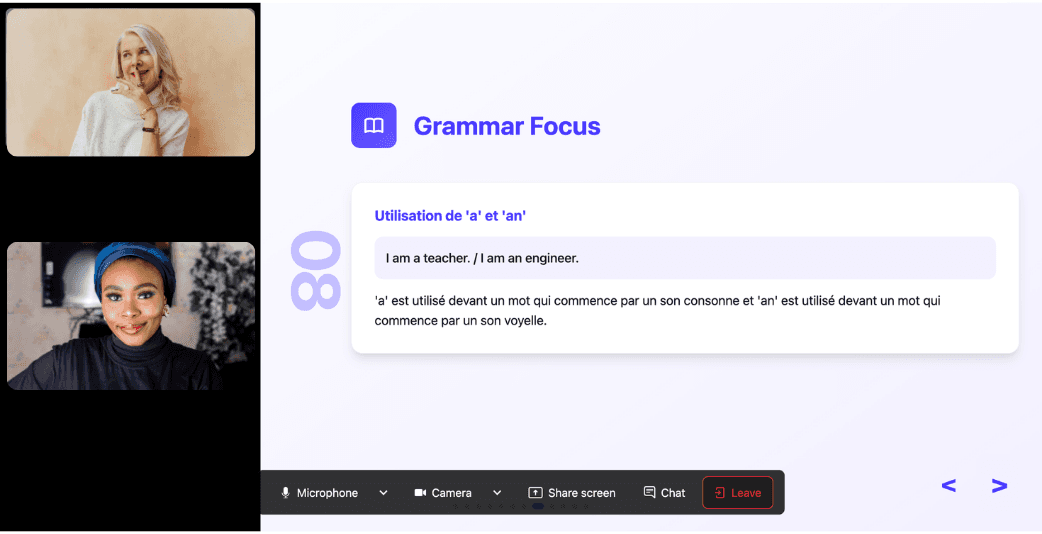

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

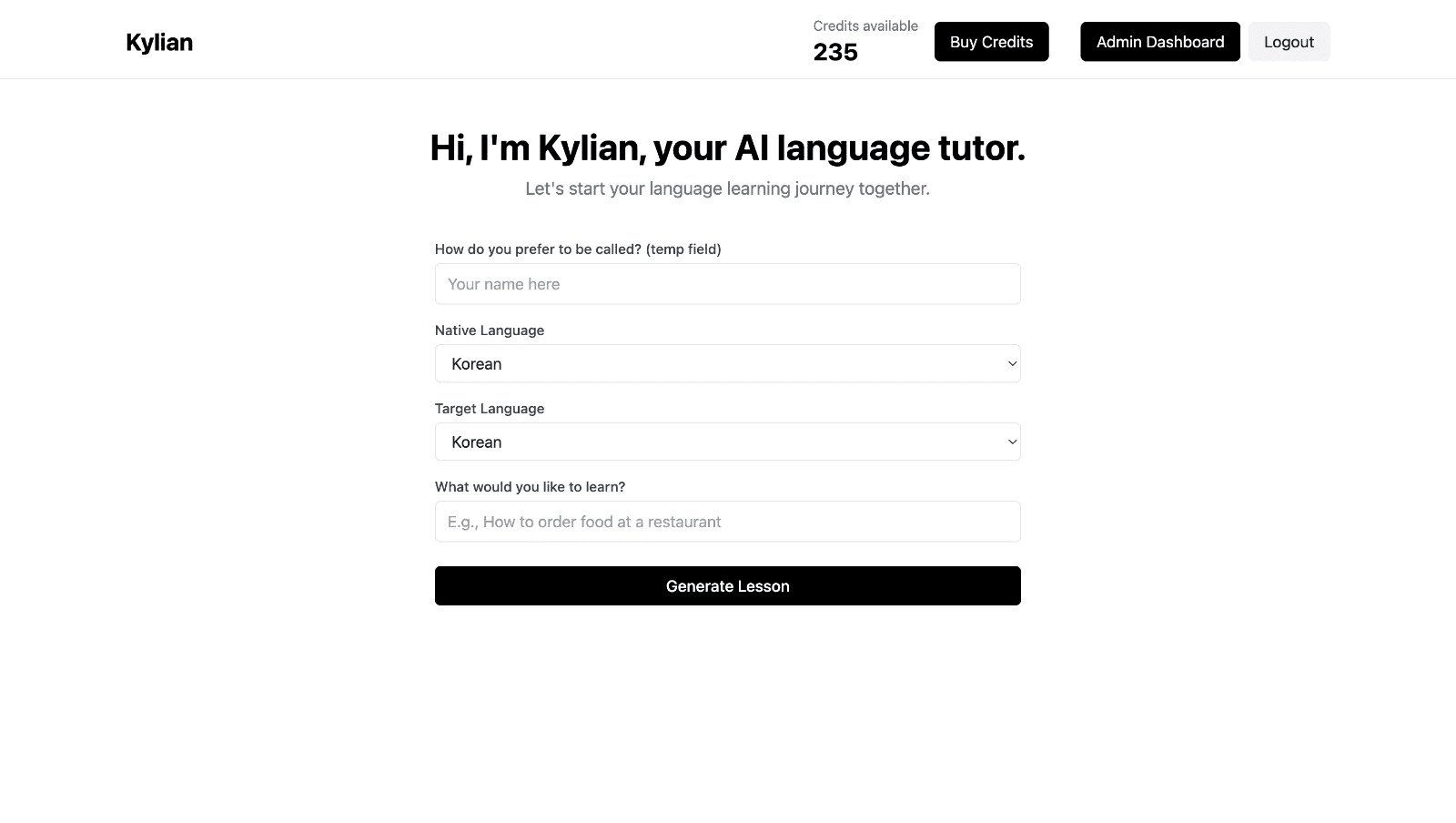

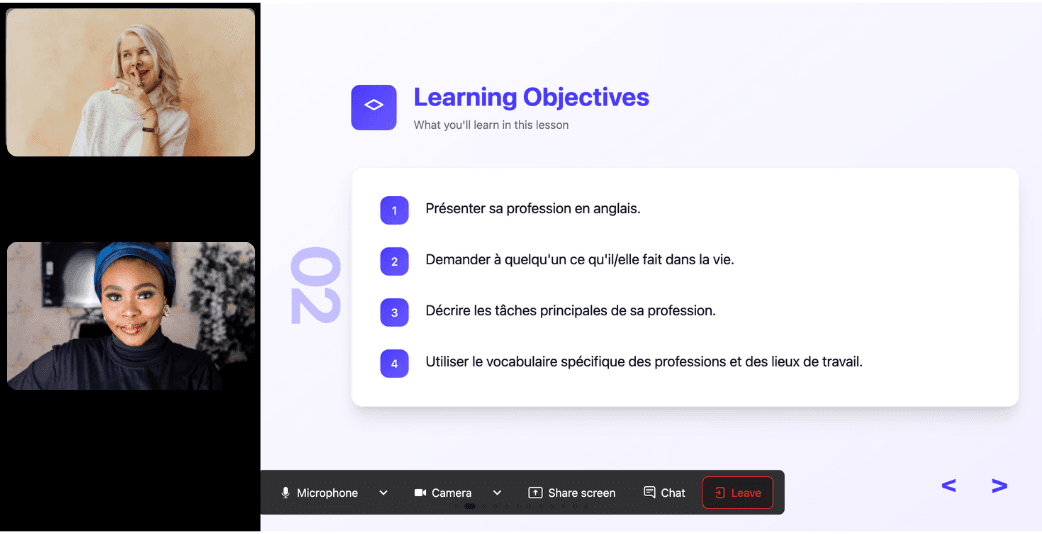

Choose a specific topic you want to learn

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

Join the room to begin your lesson

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

Learning Professional English: Phone Communication Skills

Phone conversations remain a critical professional skill, despite our increasing reliance on text-based communication. For non-native English speakers, these calls can be particularly challenging without the visual cues of face-to-face interaction. This comprehensive guide provides practical strategies to enhance your professional phone communication in English.

Punctuation Rules in English: Master Every Mark

Punctuation errors account for nearly 50% of score variability in professional writing assessments, making proper punctuation mastery not just a stylistic choice but a career-defining necessity. With roughly 50% of score variability explainable by error occurrences, the stated hypothesis is considered confirmed. Research consistently demonstrates that punctuation errors (n = 989) ranking first among grammatical mistakes in published academic writing, yet most professionals remain unaware of how these seemingly minor marks fundamentally alter meaning, credibility, and reader comprehension. The reality of modern communication demands precision. Every misplaced comma, incorrect apostrophe, or missing semicolon sends a signal about your attention to detail, professionalism, and communication competence. This comprehensive guide examines why punctuation rules matter now more than ever and provides the systematic framework needed to eliminate errors that undermine your written authority.

Better Ways to Say "I Like" and "I Don't Like" in English

Do you find yourself repeatedly using the same phrases to express your preferences? The ability to articulate what you enjoy or dislike with precision and variety not only enriches your conversations but also demonstrates language proficiency. This article explores alternative expressions to the common "I like" and "I don't like" statements, providing you with a diverse vocabulary arsenal to communicate your preferences more effectively.

Italian Object Pronouns Explained

Object pronouns represent a critical junction in Italian language acquisition. They function as the difference between elementary phrases and fluid, natural-sounding Italian conversation. Understanding the nuances of both direct and indirect pronouns equips learners with essential tools to elevate their language proficiency beyond basic communication.

Speak with a British Accent: Key Words, Slang & Tips

British English carries a certain charm and sophistication that continues to captivate language learners worldwide. Despite American English dominating global media, many learners specifically aim to master the distinctive sounds, vocabulary, and expressions found across the United Kingdom. Whether you're preparing for a Cambridge examination, planning to study in London, or simply fascinated by British culture, understanding what makes British English unique requires more than casual exposure to BBC content. This guide explores the fundamental elements that distinguish British English from other varieties, offering practical strategies to develop an authentic British accent and integrate regional vocabulary into your speech. From pronunciation nuances to cultural context, we'll examine what it takes to sound genuinely British.

How to Master Language Exchanges: 10 Steps to Become Fluent

Speaking practice stands as the cornerstone of language acquisition. While countless apps and resources can introduce you to vocabulary and grammar rules, language remains merely an intellectual exercise until you actively engage in conversation. Language exchanges offer a powerful solution, providing authentic speaking opportunities with native speakers—but maximizing their effectiveness requires strategy and intentionality.