Top 11 Crowdfunding Platforms for Startups

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

The crowdfunding industry reached $1.41 billion in the United States alone during 2023, representing a fundamental shift in how entrepreneurs access capital. This isn't just another financing trend—it's a democratization of investment that has rendered traditional gatekeepers less relevant. For startups facing the perpetual challenge of securing funding without surrendering excessive equity or navigating complex loan structures, crowdfunding platforms offer a viable alternative that deserves serious consideration.

Why does this matter now? Traditional venture capital funding has become increasingly concentrated among a small number of firms, with geographic and demographic biases that exclude countless viable ventures. Crowdfunding platforms have emerged as the great equalizer, enabling entrepreneurs to access capital directly from consumers, early adopters, and smaller investors who believe in their vision.

The data supporting this shift is compelling: Kickstarter alone has facilitated nearly $8 billion in funding across more than 250,000 projects since its inception. Indiegogo has supported over 800,000 campaigns, while platforms like GoFundMe have processed billions in donations. These numbers represent real businesses, real jobs, and real solutions to market problems that might never have seen daylight under traditional funding models.

Understanding Crowdfunding Platforms: The Foundation

Crowdfunding operates on a deceptively simple premise: instead of seeking large investments from a few institutional sources, entrepreneurs collect smaller contributions from many individual backers. This approach fundamentally alters the relationship between business owners and their funding sources, creating a community of stakeholders who are emotionally and financially invested in the venture's success.

The mechanics are straightforward yet powerful. Entrepreneurs create campaigns on specialized platforms, presenting their business concept, funding goals, and proposed rewards or returns. Potential backers browse these campaigns, evaluate the propositions, and contribute funds electronically. The platform facilitates the entire transaction process, from payment processing to fund distribution, while taking a percentage of successfully raised capital.

What makes this model particularly compelling for startups is the validation it provides. A successful crowdfunding campaign doesn't just generate capital—it proves market demand. When hundreds or thousands of people voluntarily contribute their money to support a product or service, they're providing the most authentic form of market research possible. This validation becomes invaluable when approaching additional investors, negotiating with suppliers, or making strategic business decisions.

The Strategic Advantage of Different Platform Types

The crowdfunding ecosystem has evolved into distinct categories, each serving specific needs and risk profiles. Understanding these differences is crucial for selecting the right platform for your venture.

Reward-based platforms represent the most accessible entry point for most startups. Contributors receive products, services, or experiences in exchange for their support, creating a pre-sales environment that generates both funding and early customers. This model works exceptionally well for consumer products, creative projects, and innovative services where backers can easily understand and desire the proposed rewards.

Donation-based platforms cater to causes and ventures with strong social impact components. While contributors don't receive tangible returns, they gain the satisfaction of supporting meaningful initiatives. This model proves most effective for social enterprises, community projects, and businesses addressing pressing societal challenges.

Equity-based platforms offer the most sophisticated funding mechanism, allowing contributors to purchase actual ownership stakes in ventures. This approach attracts more serious investors and enables larger funding rounds, but comes with increased regulatory requirements and complexity. Startups using equity crowdfunding must be prepared for ongoing relationships with numerous small shareholders.

Top 11 Crowdfunding Platforms: Detailed Analysis

Kickstarter: The Creative Powerhouse

Kickstarter has established itself as the premier destination for creative projects and innovative consumer products. With $8 billion raised across 250,000+ projects over 15 years, the platform has proven its ability to connect creators with supporters at scale.

The platform's reward-based structure creates a unique dynamic where backers become early customers and brand advocates. This pre-sales approach allows entrepreneurs to validate demand, refine products based on feedback, and generate buzz before official launch. Kickstarter's tiered reward system enables campaigns to capture different levels of supporter enthusiasm, from small-dollar backers seeking basic rewards to major contributors willing to pay premium prices for exclusive access.

However, Kickstarter's strength in creative projects can be a limitation for traditional business ventures. The platform's community expects innovation, creativity, and compelling storytelling—qualities that don't always align with conventional business models. Additionally, the all-or-nothing funding structure means campaigns that fall short of their goals receive nothing, adding pressure and risk to the fundraising process.

Key Metrics:

- Platform fee: 5% of successfully funded campaigns

- Payment processing: 3-5% of transactions

- Success rate: Approximately 38% of campaigns reach their funding goals

- Average successful campaign: $28,656

Indiegogo: The Tech Innovation Hub

Indiegogo has carved out a distinct position as the platform of choice for tech entrepreneurs and early adopters. Since 2008, the platform has facilitated over 800,000 campaign launches, with a particular strength in hardware, gadgets, and technological solutions.

The platform's flexible funding option sets it apart from competitors—campaigns can keep whatever funds they raise, even if they don't reach their initial goals. This approach reduces risk for entrepreneurs while providing more opportunities for partial funding of viable projects. Indiegogo's focus on innovation and emerging technology attracts backers who are specifically seeking cutting-edge products and solutions.

The platform's demographics skew toward tech-savvy consumers and early adopters, creating an ideal environment for hardware startups, app developers, and companies creating novel technological solutions. However, this focus can limit appeal for projects outside the technology sphere.

Key Metrics:

- Platform fee: 5% for campaigns that reach goals, 9% for flexible funding

- Payment processing: 3-4% plus nominal flat rate

- Notable stat: 47% of campaigns exceeding goals are led by women

- Geographic reach: Available in over 235 countries

GoFundMe: The Social Impact Leader

GoFundMe has revolutionized donation-based crowdfunding with over $15 billion raised since its founding. While primarily known for personal causes and emergencies, the platform has increasingly supported social enterprises and community-focused businesses.

The platform's strength lies in its ability to mobilize communities around causes and needs. For startups with strong social impact components or community ties, GoFundMe can provide both funding and grassroots support. The platform's sharing features and social media integration enable campaigns to spread organically through personal networks.

However, GoFundMe explicitly prohibits offering goods or services in exchange for donations, limiting its applicability for traditional business ventures. The platform works best for ventures that can frame their funding needs as community benefits rather than investment opportunities.

Key Metrics:

- Platform fee: 0% (as of 2017)

- Payment processing: 2.9% + $0.30 per transaction

- Total raised: Over $15 billion globally

- Active users: Millions of donors across 19 countries

Patreon: The Subscription-Based Creator Economy

Patreon has pioneered the subscription-based crowdfunding model, enabling creators to build sustainable income streams through recurring contributions. With over 250,000 active creators and millions of patrons, the platform has demonstrated the viability of ongoing funding relationships.

For startups in content creation, education, or entertainment, Patreon offers a way to build revenue while developing products or services. The platform's subscription model creates predictable income streams that can fund ongoing operations and development. The direct relationship between creators and patrons also provides valuable feedback and community building opportunities.

The platform's focus on creative content limits its applicability for traditional product or service businesses. Additionally, building a sustainable patron base requires consistent content creation and community engagement, which may distract from core business development activities.

Key Metrics:

- Creator earnings: Over $3.5 billion paid out to creators

- Platform fees: 5-12% depending on plan

- Payment processing: 2.9-3.9% per transaction

- Average monthly pledge: $12 per patron

Crowdfundr: The Flexible Alternative

Crowdfundr positions itself as a more flexible and cost-effective alternative to established platforms. Since 2012, the platform has supported over 200,000 campaigns and facilitated $250 million in funding with innovative fee structures that give organizers more control over costs.

The platform's unique value proposition lies in its flexible fee structure. Organizers can choose to absorb platform costs, pass them to supporters, or rely on voluntary tips. This flexibility can significantly impact campaign economics, especially for smaller ventures operating on tight margins.

However, Crowdfundr's smaller market presence means less organic traffic and discovery compared to major platforms. Campaigns may need to invest more heavily in external marketing to achieve visibility and reach funding goals.

Key Metrics:

- Platform fees: 0-5% depending on chosen structure

- Payment processing: Standard credit card rates

- Campaigns supported: 200,000+

- Total funding facilitated: $250+ million

Mightycause: The Nonprofit Specialist

Mightycause focuses specifically on nonprofit organizations and social causes, offering specialized tools and features designed for mission-driven fundraising. The platform's emphasis on donor management and community building makes it particularly valuable for social enterprises and ventures with strong charitable components.

The platform's strength lies in its comprehensive approach to nonprofit fundraising, including donor management tools, automated receipting, and integration with existing nonprofit systems. For startups operating as social enterprises or benefit corporations, these features can provide significant operational advantages.

The platform's focus on nonprofits limits its applicability for traditional for-profit ventures. Additionally, the monthly subscription model may not be cost-effective for smaller or occasional fundraising efforts.

Key Metrics:

- Pricing: $79-119 monthly subscription

- Payment processing: 2.9% + $0.30 per transaction

- Specialized features: Donor management, event fundraising tools

- Target market: Established nonprofits and social enterprises

Crowdcube: The European Equity Pioneer

Crowdcube has established itself as Europe's leading equity crowdfunding platform, facilitating over £1.5 billion in investments across thousands of campaigns. The platform connects retail investors with growth-stage businesses seeking equity investment.

For startups ready to offer equity stakes, Crowdcube provides access to a large pool of potential investors and the credibility that comes with platform vetting. The due diligence process and investor protection measures create a more professional environment than many crowdfunding platforms.

However, equity crowdfunding involves significant regulatory compliance and ongoing obligations to shareholders. Startups must be prepared for the administrative burden and potential complications of having numerous small shareholders.

Key Metrics:

- Total invested: £1.5+ billion

- Average investment per person: £3,000

- Platform fees: 7% of funds raised plus VAT

- Success rate: Approximately 77% of campaigns that go live

Fundable: The Accredited Investor Network

Fundable caters specifically to accredited investors, creating a more sophisticated funding environment for serious business ventures. The platform offers both rewards-based and equity-based funding options, providing flexibility for different types of campaigns.

The focus on accredited investors means access to individuals with significant financial resources and business experience. This can translate to larger individual contributions and valuable mentorship opportunities. The platform's professional approach and investor vetting also enhance credibility.

The limitation to accredited investors significantly reduces the potential backer pool. Additionally, the monthly fee structure during active campaigns can add substantial costs to fundraising efforts.

Key Metrics:

- Monthly fee: $179 during active campaigns

- Target investors: Accredited investors only

- Funding options: Both rewards and equity-based

- Geographic focus: United States

StartEngine: The Comprehensive Equity Platform

StartEngine has emerged as one of the largest equity crowdfunding platforms in the United States, facilitating over $500 million in investments. The platform offers both Regulation Crowdfunding and Regulation A+ options, enabling campaigns ranging from $5 million to $75 million.

The platform's comprehensive approach includes secondary market trading for certain investments, creating liquidity opportunities for investors. This feature can make investments more attractive and potentially increase funding success rates.

The complexity of equity crowdfunding and regulatory requirements can be overwhelming for inexperienced entrepreneurs. The platform's fee structure is also more complex, including both platform fees and required financial audits.

Key Metrics:

- Total funding facilitated: $500+ million

- Maximum raise: $75 million (Regulation A+)

- Platform focus: Growth-stage startups

- Secondary market: Available for select investments

CrowdStreet: The Real Estate Specialist

CrowdStreet has created a niche in real estate crowdfunding, facilitating over $4.3 billion in commercial real estate investments. The platform connects accredited investors with vetted real estate opportunities.

For real estate entrepreneurs and developers, CrowdStreet provides access to a targeted investor base specifically interested in property investments. The platform's due diligence process and track record can enhance credibility with potential investors.

The platform's exclusive focus on real estate limits its applicability for other business types. The accredited investor requirement also restricts the potential investor pool.

Key Metrics:

- Total investments: $4.3+ billion

- Investment minimums: Typically $25,000+

- Investor focus: Accredited investors only

- Property types: Commercial real estate focus

Crowdfunder: The UK Community Platform

Crowdfunder has established itself as the UK's leading community-focused crowdfunding platform, supporting over 175,000 projects and facilitating £100+ million in funding. The platform emphasizes local community support and social impact.

The platform's community focus creates strong local support networks for campaigns, particularly valuable for businesses with geographic ties or community impact. The flexible fee structure accommodates different types of projects and funding needs.

The geographic limitation to UK-based projects restricts international accessibility. The community focus, while beneficial for local projects, may limit scalability for businesses seeking broader market reach.

Key Metrics:

- Projects supported: 175,000+

- Total funding: £100+ million

- Fee structure: 0-5% depending on project type

- Geographic focus: United Kingdom

Strategic Platform Selection Framework

Choosing the right crowdfunding platform requires careful analysis of multiple factors that extend beyond simple fee comparisons. The decision fundamentally impacts campaign success, ongoing relationships, and long-term business development.

Audience alignment represents the most critical factor. Each platform has developed distinct communities with specific interests, demographics, and funding behaviors. Kickstarter's community gravitates toward creative and innovative consumer products, while Indiegogo attracts tech enthusiasts and early adopters. GoFundMe supporters focus on social causes and community needs, while equity platforms draw investors seeking financial returns.

Fee structures require comprehensive analysis beyond headline percentages. Platform fees, payment processing costs, marketing expenses, and fulfillment considerations all impact campaign economics. Some platforms offset higher fees with better marketing support or larger audiences, potentially delivering superior net results.

Funding models create different risk profiles and success requirements. All-or-nothing funding models create urgency and social proof but risk complete failure. Flexible funding provides safety nets but may reduce backer urgency. Equity models offer larger funding potential but create ongoing obligations and complications.

Platform services and support vary dramatically and can impact campaign success. Some platforms provide extensive marketing support, campaign guidance, and community building tools. Others offer minimal support but charge lower fees. The value of these services depends on your team's existing capabilities and experience.

Advanced Crowdfunding Strategies

Successful crowdfunding extends far beyond platform selection and campaign creation. The most effective campaigns employ sophisticated strategies that begin months before launch and continue long after funding goals are met.

Pre-launch community building has become essential for crowdfunding success. The most successful campaigns arrive on platforms with existing audiences ready to contribute immediately. This early momentum creates social proof and algorithm advantages that can make the difference between success and failure.

Content strategy and storytelling separate successful campaigns from failures. Compelling narratives that connect emotionally with potential backers while clearly communicating value propositions are non-negotiable. This content must work across multiple channels, from platform pages to social media and email marketing.

Backer communication and fulfillment extend far beyond the funding period. Successful campaigns maintain ongoing relationships with backers, providing updates, addressing concerns, and delivering promised rewards on schedule. These relationships often translate into long-term customers, brand advocates, and repeat supporters for future ventures.

Risk Management and Legal Considerations

Crowdfunding involves significant risks that entrepreneurs must understand and manage proactively. Platform failure, regulatory changes, intellectual property concerns, and fulfillment challenges can all impact campaign success and business viability.

Intellectual property protection becomes critical when publicly sharing detailed product information and business plans. Filing provisional patents, trademark applications, and establishing trade secret protections should precede public campaign launches.

Regulatory compliance varies significantly between platform types and funding models. Equity crowdfunding involves securities regulations, while rewards-based campaigns must comply with consumer protection laws. International campaigns add additional complexity with varying jurisdictions and requirements.

Financial planning and tax implications require professional guidance. Crowdfunding proceeds may have different tax treatments depending on structure and jurisdiction. Additionally, managing funds during development and fulfillment periods requires careful cash flow planning and accounting systems.

Measuring Success Beyond Funding Goals

The most sophisticated crowdfunding campaigns establish success metrics that extend far beyond simple funding targets. These broader measures provide more accurate assessments of campaign value and long-term business impact.

Customer acquisition costs through crowdfunding often prove significantly lower than traditional marketing channels. Calculating the lifetime value of backers who become ongoing customers can justify crowdfunding efforts even when funding goals aren't met.

Market validation and product development insights from crowdfunding campaigns provide invaluable data for business development. Backer feedback, feature requests, and usage patterns inform product development, marketing strategies, and future business decisions.

Brand building and media attention generated by successful campaigns can provide marketing value that exceeds direct funding benefits. Media coverage, influencer attention, and community building often create long-term brand assets worth more than immediate funding.

Future Trends and Platform Evolution

The crowdfunding landscape continues evolving rapidly, driven by technological advances, regulatory changes, and shifting consumer behaviors. Understanding these trends helps entrepreneurs make strategic platform decisions and timing considerations.

Blockchain and cryptocurrency integration is creating new funding models and investor relationships. Some platforms now accept cryptocurrency contributions, while others are exploring tokenization of campaigns and rewards.

Artificial intelligence and machine learning are improving campaign optimization, backer matching, and success prediction. These technologies help platforms provide better guidance to campaign creators while improving experience for contributors.

Regulatory evolution continues shaping equity crowdfunding opportunities and requirements. Recent changes have increased funding limits and simplified compliance requirements, making equity crowdfunding more accessible to smaller businesses.

Learn Any Language with Kylian AI

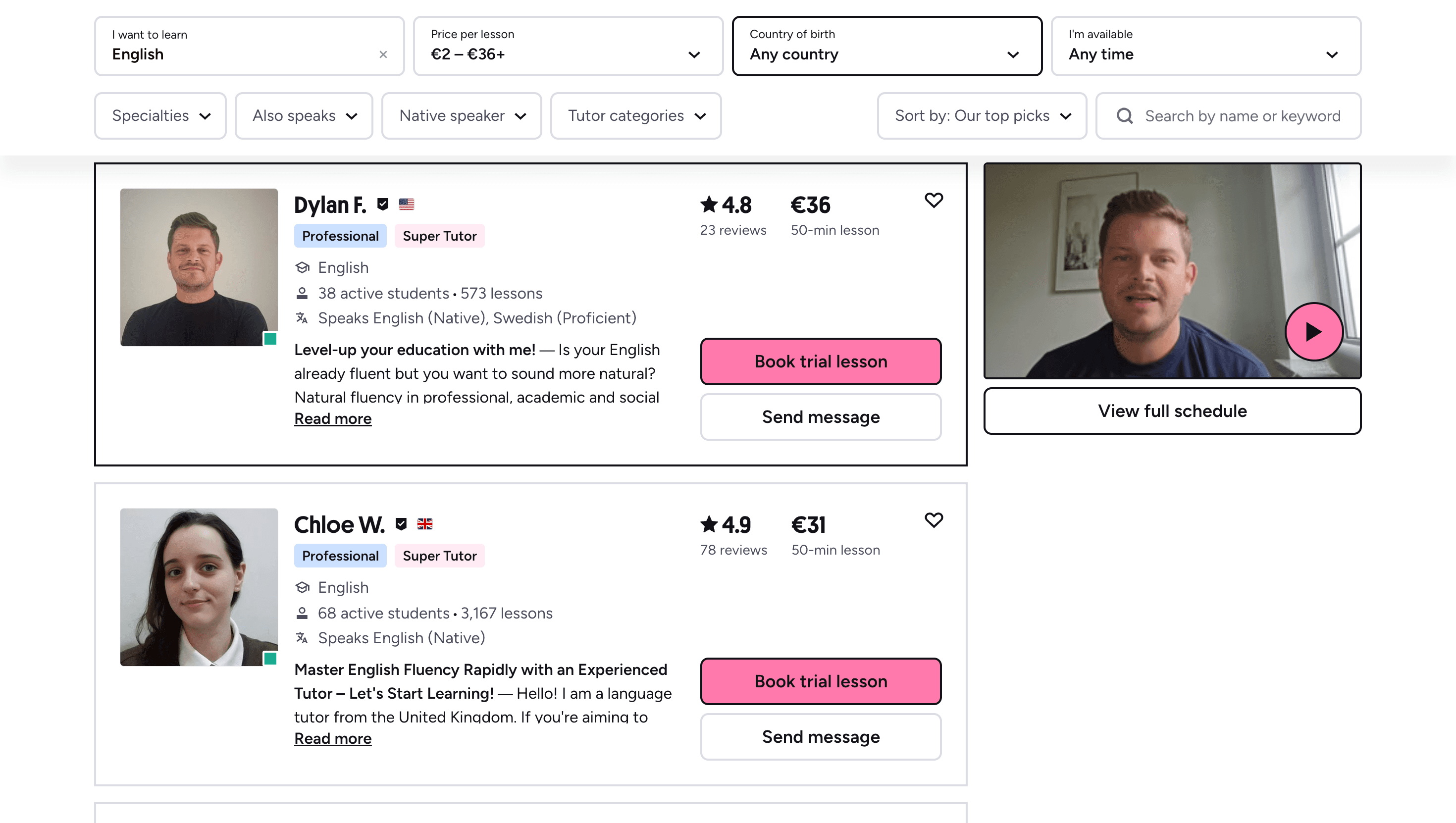

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

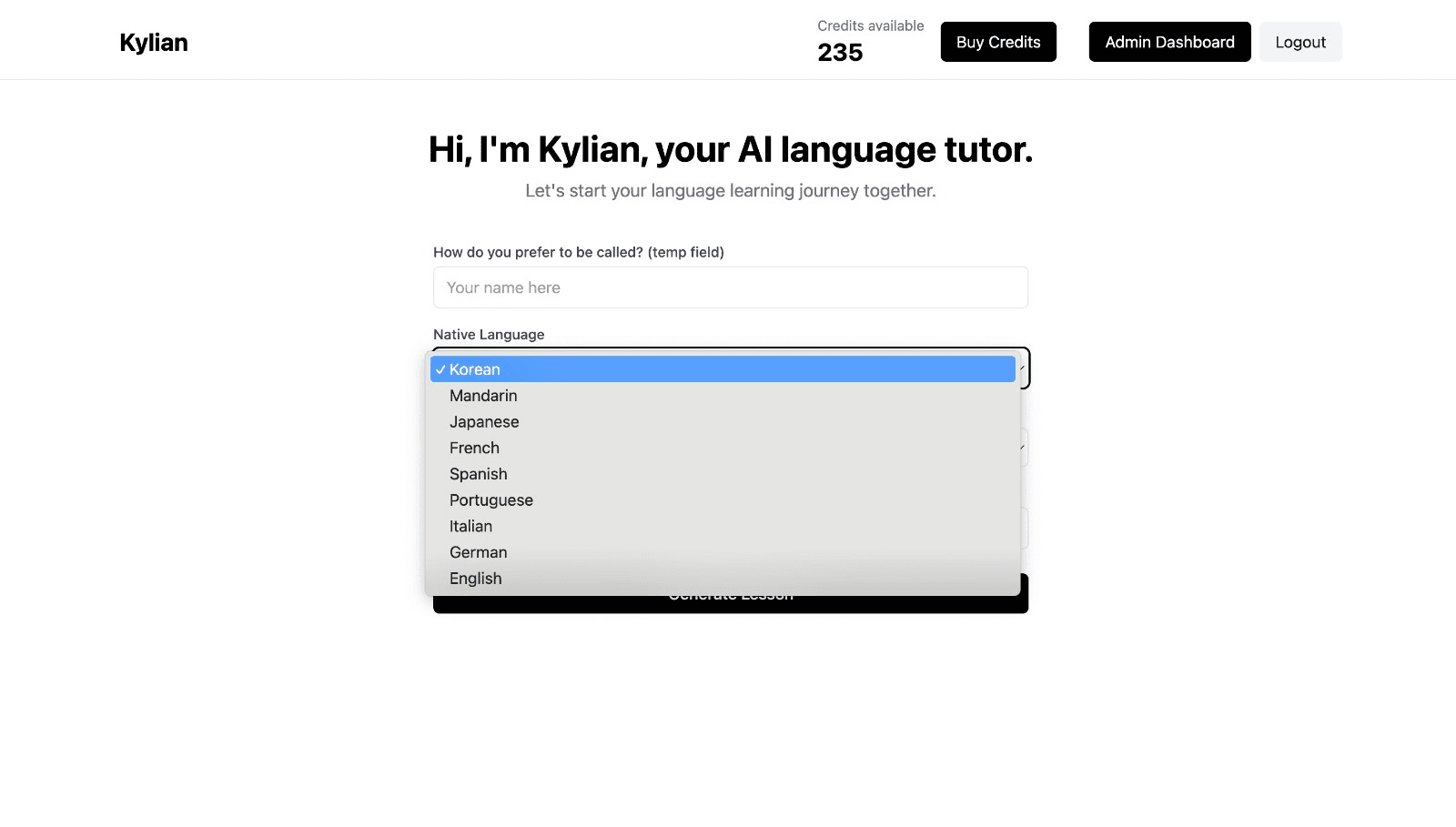

To get started, just tell Kylian which language you want to learn and what your native language is

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

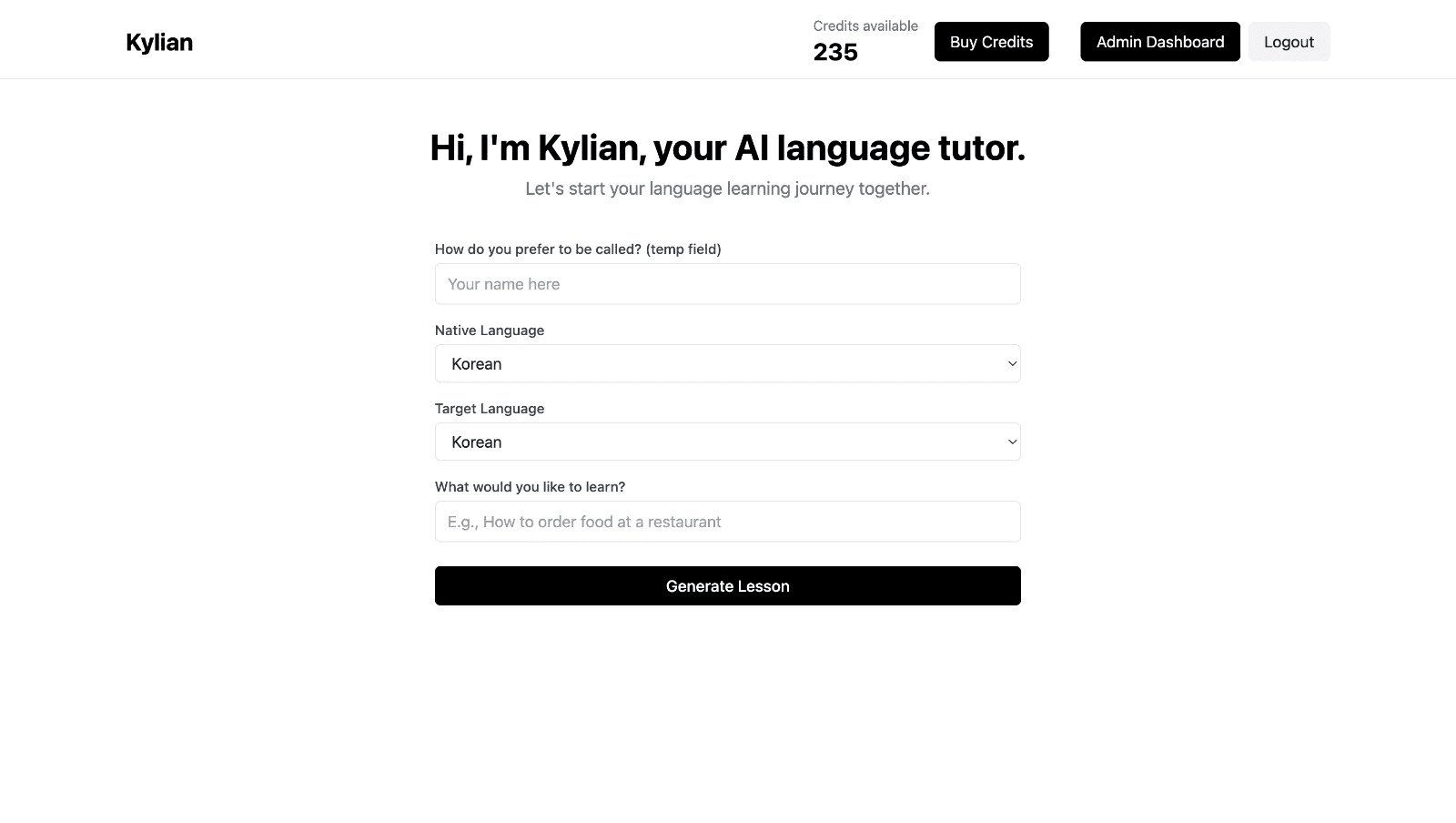

Choose a specific topic you want to learn

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

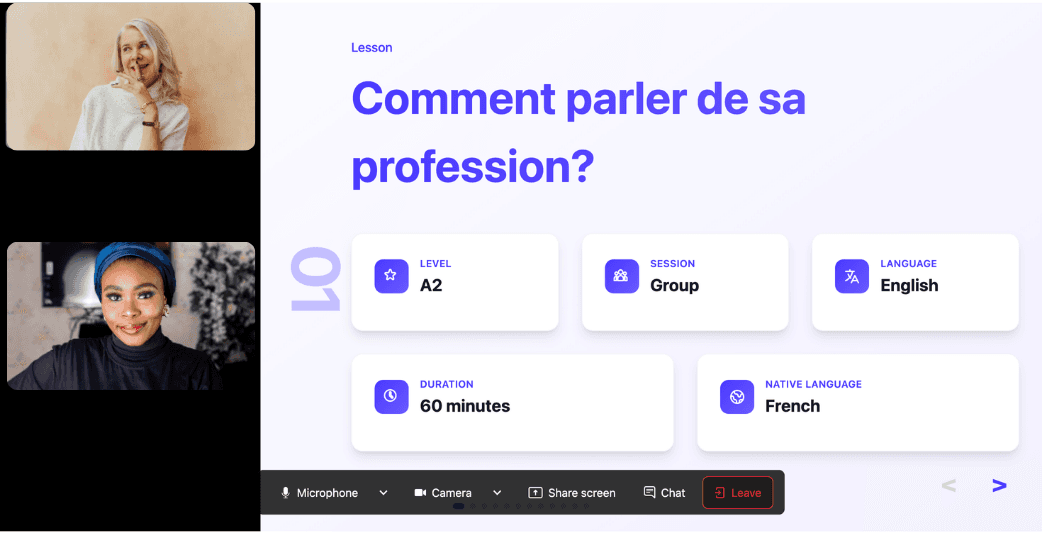

Join the room to begin your lesson

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

12 Cultural Differences in Nonverbal Communication

Communication transcends spoken language. Research by psychologist Albert Mehrabian reveals that nonverbal cues carry 55% of communicative weight, vocal tone contributes 38%, while words account for merely 7%. This data fundamentally challenges how we perceive effective communication, especially across cultural boundaries. The implications extend beyond academic curiosity. Misinterpreting nonverbal signals can derail business negotiations, strain diplomatic relations, or create uncomfortable social situations. Understanding these cultural variations isn't optional in our globalized economy—it's essential for anyone operating across cultural contexts. Anthropologist Michael Argyle documented over 700,000 distinct forms of body language and gestures across human cultures. This staggering diversity means identical gestures can convey opposite meanings depending on cultural context. The stakes are real: a well-intentioned gesture in one culture might be perceived as offensive in another.

Punctuation Rules in English: Master Every Mark

Punctuation errors account for nearly 50% of score variability in professional writing assessments, making proper punctuation mastery not just a stylistic choice but a career-defining necessity. With roughly 50% of score variability explainable by error occurrences, the stated hypothesis is considered confirmed. Research consistently demonstrates that punctuation errors (n = 989) ranking first among grammatical mistakes in published academic writing, yet most professionals remain unaware of how these seemingly minor marks fundamentally alter meaning, credibility, and reader comprehension. The reality of modern communication demands precision. Every misplaced comma, incorrect apostrophe, or missing semicolon sends a signal about your attention to detail, professionalism, and communication competence. This comprehensive guide examines why punctuation rules matter now more than ever and provides the systematic framework needed to eliminate errors that undermine your written authority.

60 English Verbs for Beginners: Building Your Foundation

Learning English requires a strategic approach. When faced with thousands of words to memorize, knowing which ones to prioritize makes all the difference in your progress. Verbs—the action words that drive your sentences—form the backbone of effective communication. Master the right ones first, and you'll achieve conversational ability much faster.

Better Ways to Say "I Like" and "I Don't Like" in English

Do you find yourself repeatedly using the same phrases to express your preferences? The ability to articulate what you enjoy or dislike with precision and variety not only enriches your conversations but also demonstrates language proficiency. This article explores alternative expressions to the common "I like" and "I don't like" statements, providing you with a diverse vocabulary arsenal to communicate your preferences more effectively.

How to Master Language Exchanges: 10 Steps to Become Fluent

Speaking practice stands as the cornerstone of language acquisition. While countless apps and resources can introduce you to vocabulary and grammar rules, language remains merely an intellectual exercise until you actively engage in conversation. Language exchanges offer a powerful solution, providing authentic speaking opportunities with native speakers—but maximizing their effectiveness requires strategy and intentionality.

The Meaning of "Nandemonai" in Japanese

The Japanese expression "nandemonai" carries layers of meaning that extend far beyond its literal translation. Understanding this phrase opens a window into Japanese communication patterns, social etiquette, and cultural values. Let's explore what makes this seemingly simple expression so complex and significant in Japanese language and society.