Finance Vocabulary: Main Words and Expressions You Need

Written by

Ernest Bio Bogore

Reviewed by

Ibrahim Litinine

Financial literacy isn't just about understanding numbers—it's about mastering the language that drives global commerce. Whether you're navigating corporate boardrooms, analyzing investment opportunities, or managing personal wealth, your command of finance vocabulary directly impacts your credibility and decision-making capacity.

The stakes are higher than ever. McKinsey research indicates that professionals with strong financial communication skills earn 23% more than their peers within five years of career entry. This isn't coincidental—financial vocabulary serves as the foundation for strategic thinking, risk assessment, and value creation discussions that define modern business success.

Professional advancement demands more than technical competence; it requires the ability to articulate complex financial concepts with precision. When you can seamlessly transition between discussing liquidity ratios and capital allocation strategies, you signal executive-level thinking that opens doors to leadership opportunities.

Why Financial Vocabulary Mastery Matters Now

The financial landscape has evolved dramatically. Cryptocurrency, ESG investing, and algorithmic trading have introduced entirely new vocabularies that traditional finance education never addressed. Professionals who fail to adapt their linguistic toolkit risk becoming obsolete in conversations that shape organizational strategy.

Consider the recent surge in fintech disruption. Companies like Stripe, Square, and Robinhood didn't just innovate products—they redefined how we discuss financial services. Terms like "embedded finance," "API-first banking," and "fractional investing" have become essential for anyone involved in financial decision-making.

Furthermore, regulatory changes following the 2008 financial crisis introduced compliance vocabulary that every financial professional must understand. Terms like "stress testing," "Volcker Rule," and "Basel III requirements" aren't academic concepts—they're operational realities that affect daily business decisions.

Core Financial Terms: Building Your Foundation

Understanding fundamental finance vocabulary requires recognizing how these terms interconnect within broader financial systems. Assets represent more than just items on a balance sheet—they're economic resources that generate future value. When discussing assets, precision matters: current assets convert to cash within one year, while fixed assets support long-term operations.

Liabilities demand equal attention because they represent future cash outflows that constrain strategic flexibility. Short-term liabilities require immediate attention in cash flow planning, while long-term liabilities influence capital structure decisions and borrowing capacity.

Equity represents the residual interest in assets after deducting liabilities, but its implications extend beyond this accounting definition. Equity positions determine control rights, dividend expectations, and risk exposure. When venture capitalists discuss "equity dilution" or "liquidation preferences," they're negotiating fundamental power dynamics that affect company direction.

Cash flow terminology requires particular attention because cash flow management determines business survival. Operating cash flow measures the cash generated from core business activities, while free cash flow indicates the cash available for expansion, dividends, or debt reduction. The distinction between profit and cash flow has ended more businesses than most entrepreneurs realize.

Revenue recognition principles affect how companies report financial performance, making terms like "deferred revenue" and "accrued revenue" critical for understanding actual business health. When SaaS companies discuss "annual recurring revenue" (ARR) versus "monthly recurring revenue" (MRR), they're highlighting predictable cash flow patterns that investors value highly.

Essential Finance Terms for Professional Success

Access refers to your ability to obtain financial resources or information. In banking contexts, access determines your borrowing capacity and investment opportunities. Credit access affects everything from mortgage rates to business expansion possibilities.

Accounts Payable represents money owed to suppliers and vendors. Managing accounts payable effectively improves cash flow timing and strengthens supplier relationships. Extended payment terms can provide working capital advantages, but excessive delays damage business relationships.

Accounts Receivable represents money owed by customers for goods or services delivered. Effective receivables management involves credit assessment, collection procedures, and aging analysis. High-growth companies often struggle with receivables management as they prioritize sales over collection efficiency.

Accrue describes the accumulation of interest, expenses, or income over time. Compound interest accrual demonstrates how time amplifies investment returns. Understanding accrual accounting versus cash accounting affects tax planning and financial reporting strategies.

Balance Sheet provides a snapshot of financial position at a specific moment. The balance sheet equation (Assets = Liabilities + Equity) must always balance, making it a powerful tool for detecting accounting errors and understanding financial leverage.

Budget serves as a financial roadmap that guides resource allocation decisions. Effective budgeting requires understanding variance analysis, flexible budgeting techniques, and zero-based budgeting principles. Budgets become strategic tools when they align financial resources with organizational priorities.

Business Plan translates strategic vision into financial projections and operational requirements. Sophisticated business plans include sensitivity analysis, scenario planning, and milestone-based funding requirements. Investors evaluate business plans based on market sizing, competitive positioning, and financial modeling accuracy.

Commission structures align sales incentives with revenue generation goals. Understanding commission calculations, draw arrangements, and clawback provisions affects compensation planning and sales performance evaluation.

Currency Market dynamics affect international business operations and investment returns. Exchange rate fluctuations create both opportunities and risks that require hedging strategies and exposure management.

Expenditure encompasses all outflows of economic resources. Capital expenditures differ from operating expenditures in their treatment for tax and accounting purposes. Understanding expenditure classification affects cash flow forecasting and investment analysis.

Financial Advisor roles have evolved beyond traditional investment management to include comprehensive wealth planning, tax optimization, and estate planning services. Fee structures vary significantly between commission-based and fee-only advisors, affecting alignment of interests.

Fixed Assets represent long-term investments in productive capacity. Depreciation methods for fixed assets affect reported earnings and tax obligations. Asset turnover ratios measure how efficiently companies utilize fixed asset investments.

Insurance Policy terms determine coverage limits, deductibles, and claim procedures. Business insurance policies require understanding of liability coverage, property coverage, and business interruption protection.

Interest Rate movements affect borrowing costs, investment returns, and economic activity levels. Understanding the yield curve, credit spreads, and interest rate risk helps in making informed financial decisions.

Advanced Financial Vocabulary for Strategic Thinking

Inventory management involves balancing carrying costs against stockout risks. Just-in-time inventory systems reduce working capital requirements but increase supply chain vulnerability. Inventory turnover ratios indicate operational efficiency and demand forecasting accuracy.

Investment strategies require understanding risk-return relationships, correlation effects, and time horizon considerations. Diversification principles help optimize portfolio performance while managing downside risk.

Legal Tender defines acceptable forms of payment for debts and obligations. Understanding legal tender laws becomes important in international transactions and cryptocurrency adoption discussions.

Limited Liability Company (LLC) structures provide operational flexibility while limiting personal liability exposure. LLC tax elections affect income distribution and tax planning strategies.

Mortgage financing involves understanding amortization schedules, prepayment penalties, and refinancing options. Mortgage terms significantly affect long-term wealth accumulation through real estate ownership.

Partnership structures require clear agreements regarding profit distribution, decision-making authority, and exit provisions. General partnerships create unlimited liability exposure, while limited partnerships protect passive investors.

Personal Loan terms vary significantly based on credit quality, loan purpose, and lender type. Understanding annual percentage rates (APR) versus simple interest rates affects borrowing decisions.

Profit measurement requires distinguishing between gross profit, operating profit, and net profit. Profit margins indicate pricing power and operational efficiency within competitive markets.

Real Estate investments involve understanding capitalization rates, cash-on-cash returns, and market cycle timing. Real estate investment trusts (REITs) provide portfolio diversification without direct property management responsibilities.

Shareholder rights include voting privileges, dividend expectations, and liquidation preferences. Understanding shareholder agreements becomes critical in closely held corporations and partnership structures.

Mastering Income-Related Financial Expressions

Professional communication about income requires precision because compensation structures have become increasingly complex. When discussing earning potential, distinguish between base salary, variable compensation, equity participation, and benefit values. This granular understanding demonstrates sophisticated thinking about total compensation packages.

Building wealth through systematic savings requires understanding compound growth principles and tax-advantaged account utilization. Traditional financial advice suggesting 10% savings rates fails to account for current economic realities where housing costs, healthcare expenses, and education costs have dramatically outpaced wage growth.

Legacy planning involves more than simple inheritance transfers. Modern legacy strategies incorporate tax optimization, charitable giving, generation-skipping techniques, and family governance structures. When high-net-worth individuals discuss legacy planning, they're implementing multi-generational wealth transfer strategies that minimize tax exposure while maintaining family cohesion.

Fixed income strategies become critical as individuals approach retirement and require predictable cash flows. However, ultra-low interest rates have forced investors to reconsider traditional fixed income approaches, leading to increased allocation toward dividend-paying stocks, real estate investment trusts, and alternative income investments.

Pension systems face structural challenges that affect retirement planning assumptions. Traditional defined benefit pensions have largely disappeared, shifting retirement security responsibility to individuals through defined contribution plans. Understanding pension maximization strategies, Social Security optimization, and required minimum distribution rules affects retirement lifestyle sustainability.

Strategic Spending and Investment Vocabulary

Investment terminology has expanded beyond traditional stocks and bonds to include alternative investments, cryptocurrency, and private equity opportunities. When financial advisors discuss portfolio optimization, they're balancing correlation effects, risk parity approaches, and factor-based investing strategies that require sophisticated vocabulary understanding.

Payment methods continue evolving as digital transformation accelerates. Understanding the cost structures, security implications, and processing times for different payment methods affects both personal financial management and business operations. Credit card reward optimization has become a legitimate wealth-building strategy for disciplined consumers.

Short-term versus long-term investment distinctions affect tax treatment, liquidity planning, and risk management approaches. Tax-loss harvesting strategies require understanding wash sale rules, cost basis calculations, and holding period requirements that maximize after-tax returns.

Deposit insurance protections vary by institution type and account structure. Understanding FDIC coverage limits, SIPC protections for investment accounts, and credit union insurance helps optimize safety while maximizing returns on cash positions.

Navigating Financial Difficulties: Crisis Vocabulary

Debt management requires understanding the hierarchy of obligations, negotiation strategies, and legal protections available to borrowers. When businesses face financial distress, terms like "workout agreements," "debt restructuring," and "assignment for benefit of creditors" become operationally critical.

Cash flow crises develop gradually, then accelerate rapidly. Understanding early warning indicators like declining working capital ratios, increasing days sales outstanding, and deteriorating vendor payment terms helps prevent liquidity emergencies. Businesses that monitor these metrics proactively maintain strategic flexibility during economic downturns.

Overdraft protection mechanisms vary significantly in cost and accessibility. Understanding the true cost of overdraft fees, line of credit alternatives, and automatic transfer arrangements helps optimize liquidity management while minimizing unnecessary fees.

Debt settlement negotiations require understanding creditor rights, collection procedures, and credit reporting implications. Professional debt negotiation often achieves better outcomes than individual efforts, but the costs and tax implications of forgiven debt must be carefully evaluated.

Modern Finance: Emerging Vocabulary Trends

Technology has introduced financial terminology that traditional education never addressed. Robo-advisors use algorithmic portfolio management to reduce investment costs while maintaining diversification principles. Understanding how these platforms work helps evaluate their appropriateness for different investor profiles.

Cryptocurrency vocabulary extends beyond Bitcoin to include decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain infrastructure investments. While speculative aspects attract attention, the underlying technology creates legitimate investment opportunities that require new analytical frameworks.

Environmental, social, and governance (ESG) investing has moved from niche specialty to mainstream strategy. Understanding ESG scoring methodologies, impact measurement techniques, and sustainable investing principles helps evaluate investment opportunities that align values with returns.

Artificial intelligence applications in finance include fraud detection, credit scoring, algorithmic trading, and customer service automation. Financial professionals who understand AI capabilities maintain competitive advantages in efficiency and risk management.

Practical Application: Using Finance Vocabulary Strategically

Mastering financial vocabulary requires consistent application in professional contexts. When presenting investment recommendations, use precise terminology that demonstrates analytical rigor. Replace vague phrases like "good investment" with specific metrics like "expected risk-adjusted returns of 8-12% annually with 15% standard deviation."

Networking effectiveness improves when you can contribute meaningfully to financial discussions. Understanding current market conditions, regulatory changes, and industry trends positions you as a valuable connection rather than someone seeking help.

Negotiation outcomes improve when you understand the financial implications for all parties involved. Whether negotiating salary, investment terms, or business partnerships, financial vocabulary precision helps identify mutual value creation opportunities.

Professional development requires staying current with evolving financial terminology. Subscribe to authoritative financial publications, attend industry conferences, and participate in continuing education programs that expand your vocabulary systematically.

Learn Any Language with Kylian AI

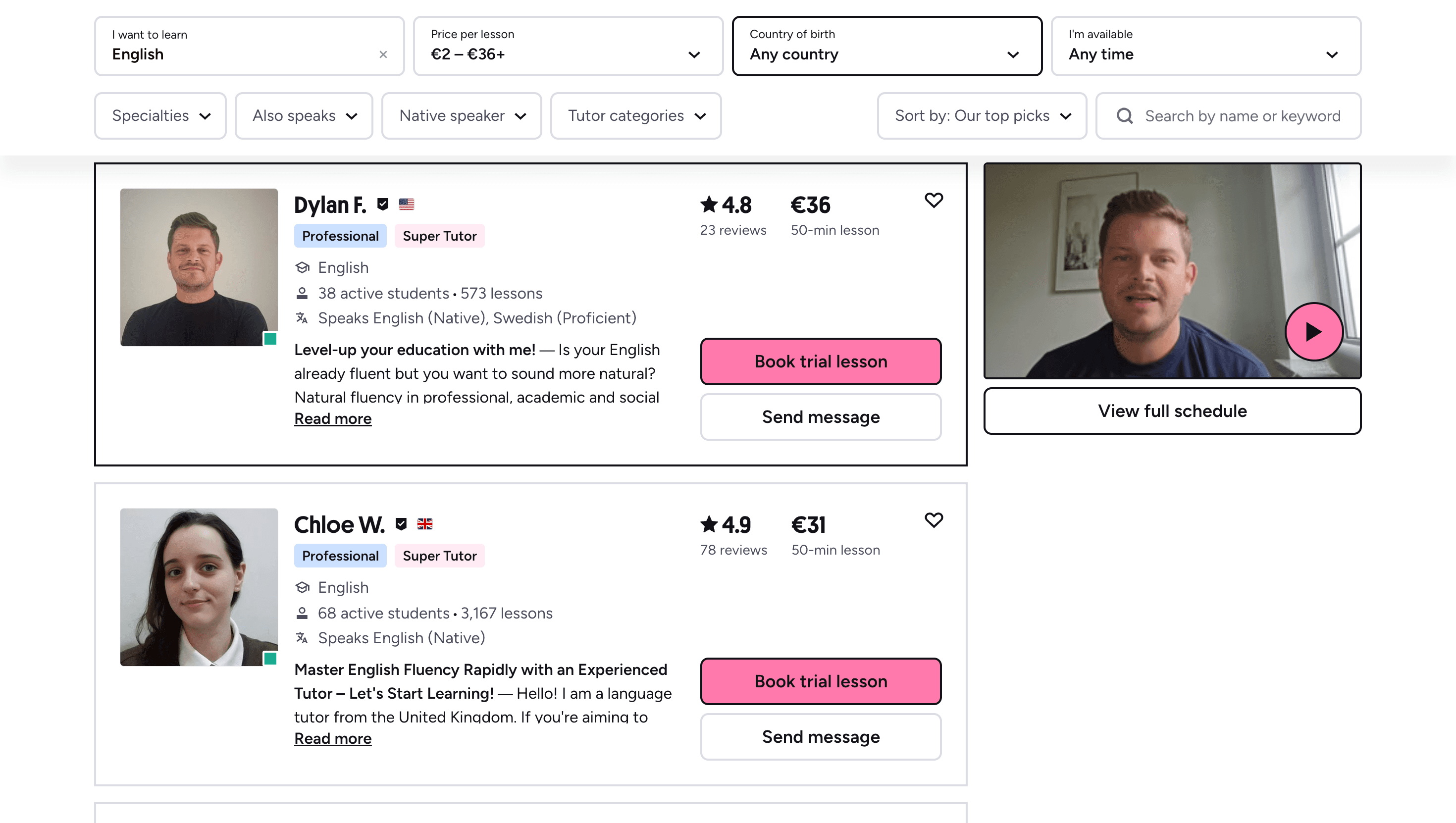

Private language lessons are expensive. Paying between 15 and 50 euros per lesson isn’t realistic for most people—especially when dozens of sessions are needed to see real progress.

Many learners give up on language learning due to these high costs, missing out on valuable professional and personal opportunities.

That’s why we created Kylian: to make language learning accessible to everyone and help people master a foreign language without breaking the bank.

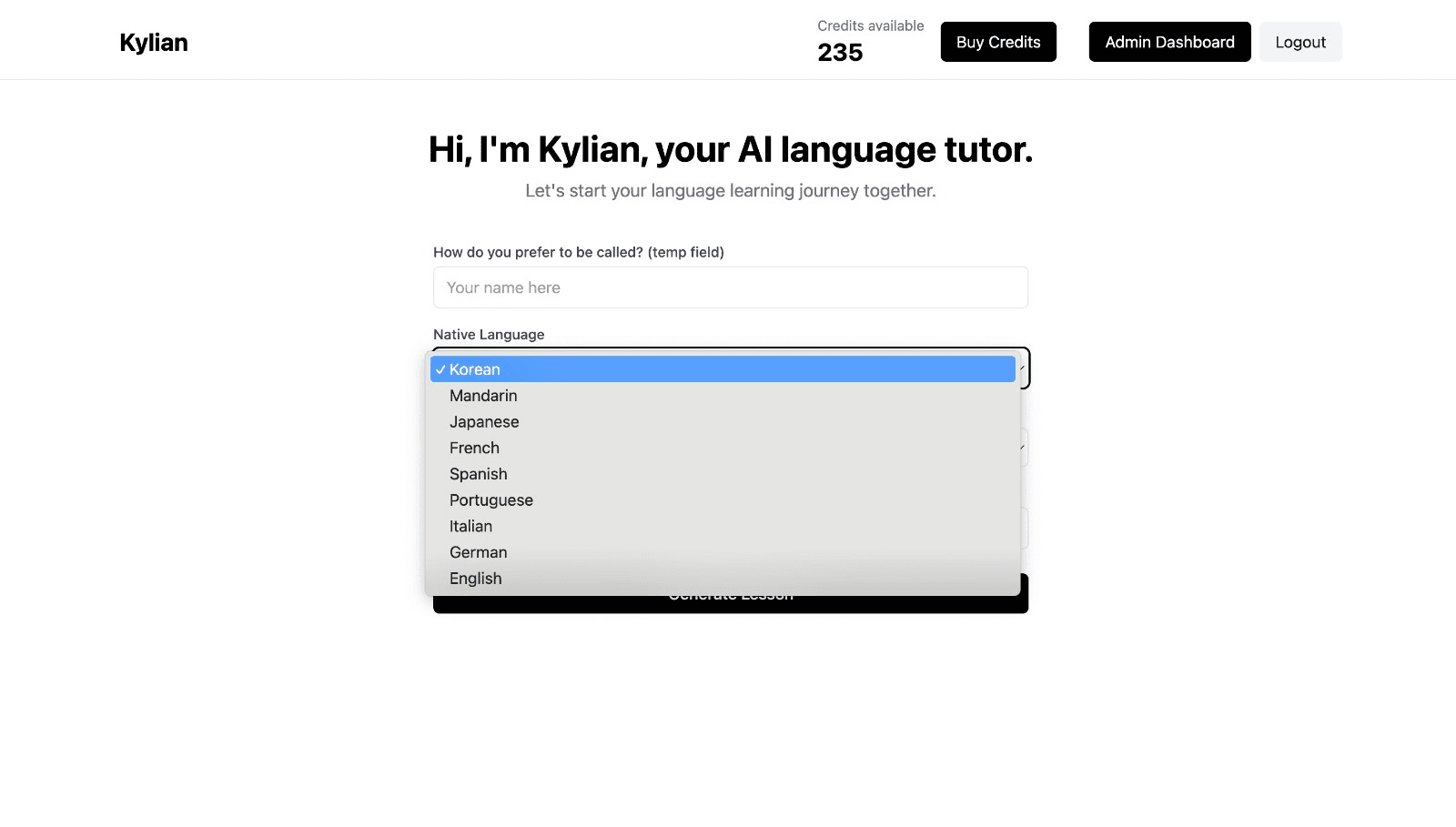

To get started, just tell Kylian which language you want to learn and what your native language is

Tired of teachers who don’t understand your specific struggles as a French speaker? Kylian’s advantage lies in its ability to teach any language using your native tongue as the foundation.

Unlike generic apps that offer the same content to everyone, Kylian explains concepts in your native language (French) and switches to the target language when necessary—perfectly adapting to your level and needs.

This personalization removes the frustration and confusion that are so common in traditional language learning.

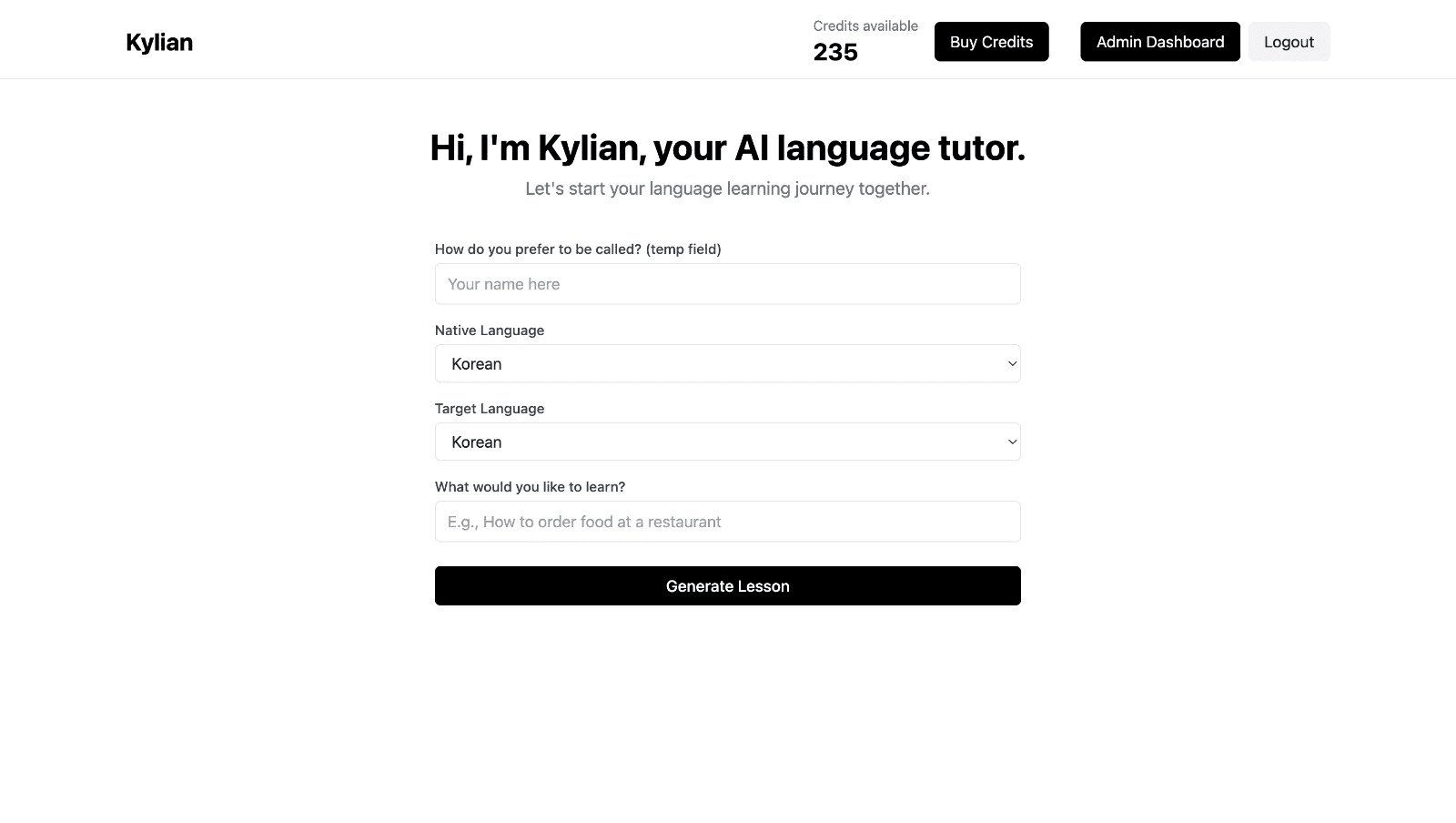

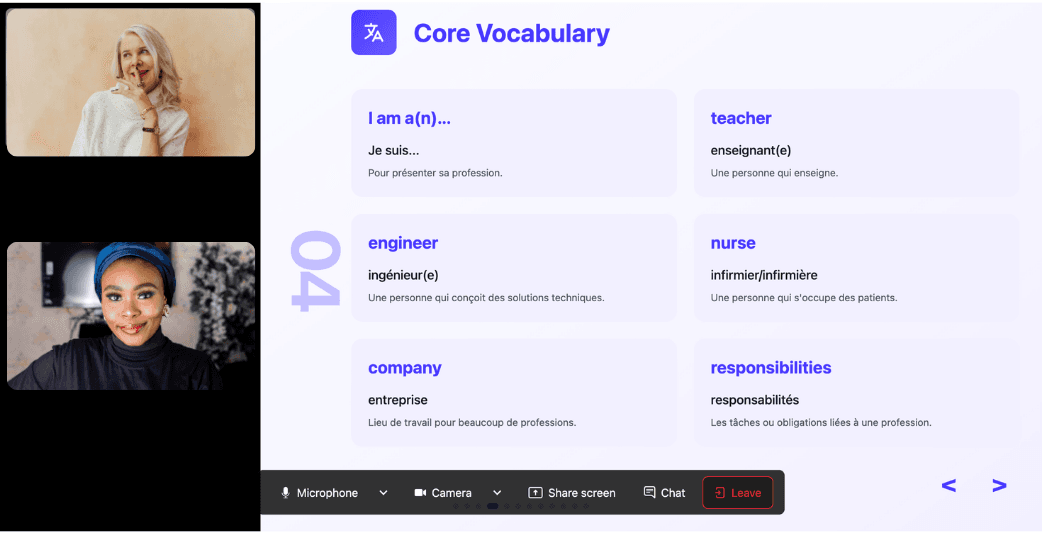

Choose a specific topic you want to learn

Frustrated by language lessons that never cover exactly what you need? Kylian can teach you any aspect of a language—from pronunciation to advanced grammar—by focusing on your specific goals.

Avoid vague requests like “How can I improve my accent?” and be precise: “How do I pronounce the R like a native English speaker?” or “How do I conjugate the verb ‘to be’ in the present tense?”

With Kylian, you’ll never again pay for irrelevant content or feel embarrassed asking “too basic” questions to a teacher. Your learning plan is entirely personalized.

Once you’ve chosen your topic, just hit the “Generate a Lesson” button, and within seconds, you’ll get a lesson designed exclusively for you.

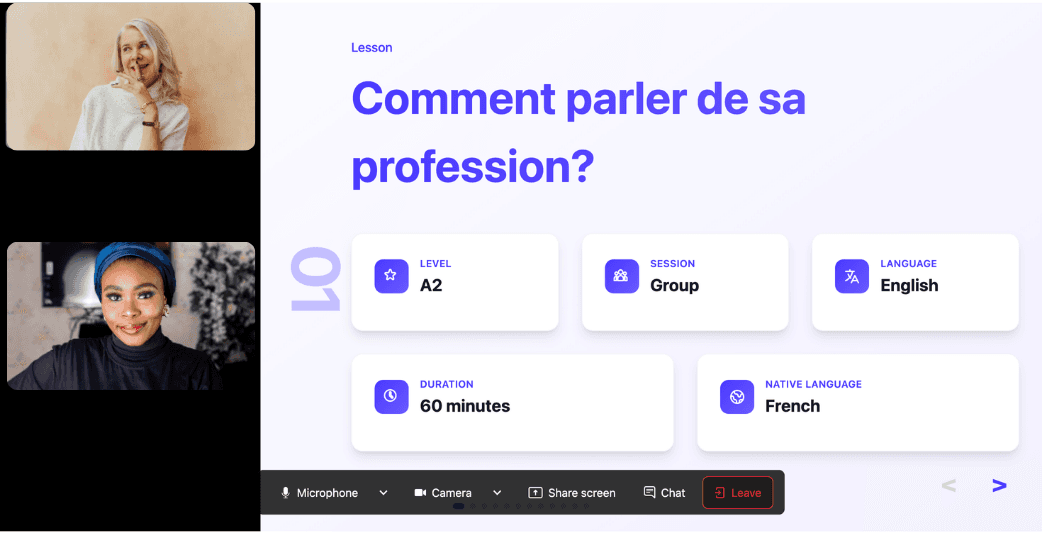

Join the room to begin your lesson

The session feels like a one-on-one language class with a human tutor—but without the high price or time constraints.

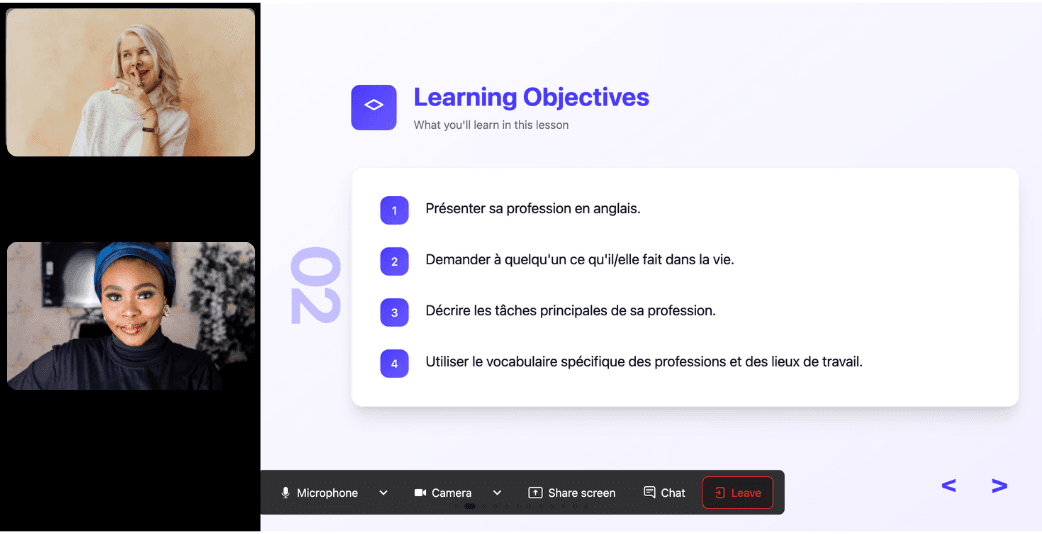

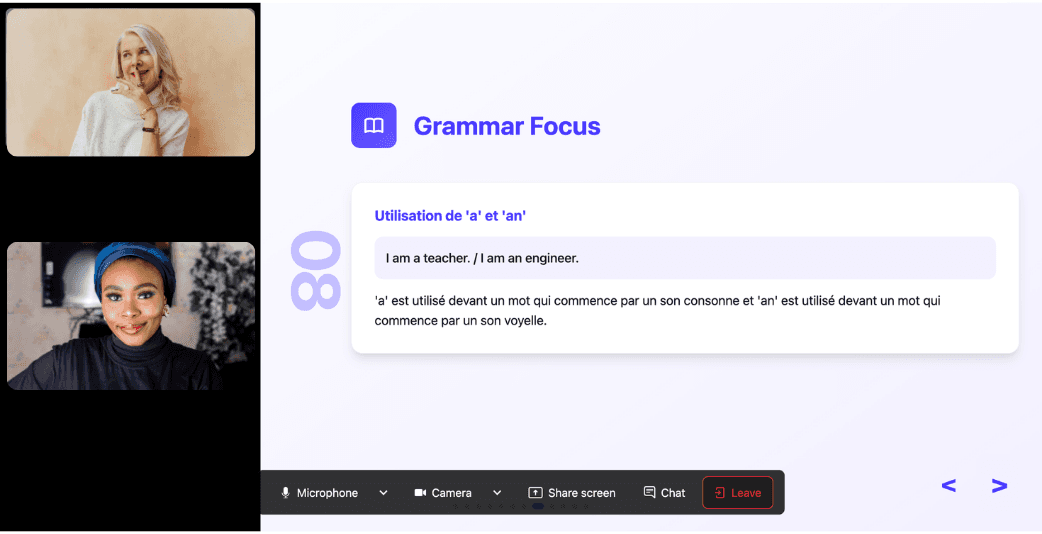

In a 25-minute lesson, Kylian teaches exactly what you need to know about your chosen topic: the nuances that textbooks never explain, key cultural differences between French and your target language, grammar rules, and much more.

Ever felt frustrated trying to keep up with a native-speaking teacher, or embarrassed to ask for something to be repeated? With Kylian, that problem disappears. It switches intelligently between French and the target language depending on your level, helping you understand every concept at your own pace.

During the lesson, Kylian uses role-plays, real-life examples, and adapts to your learning style. Didn’t understand something? No problem—you can pause Kylian anytime to ask for clarification, without fear of being judged.

Ask all the questions you want, repeat sections if needed, and customize your learning experience in ways traditional teachers and generic apps simply can’t match.

With 24/7 access at a fraction of the cost of private lessons, Kylian removes all the barriers that have kept you from mastering the language you’ve always wanted to learn.

Similar Content You Might Want To Read

60 English Verbs for Beginners: Building Your Foundation

Learning English requires a strategic approach. When faced with thousands of words to memorize, knowing which ones to prioritize makes all the difference in your progress. Verbs—the action words that drive your sentences—form the backbone of effective communication. Master the right ones first, and you'll achieve conversational ability much faster.

Korean vs Japanese: Which Language is Easier to Learn?

The choice between Korean and Japanese represents more than a simple language preference—it's a strategic decision that impacts your learning trajectory, career opportunities, and cultural engagement for years to come. This comparison cuts through the surface-level advice to examine the structural, cognitive, and practical factors that determine which language aligns with your capabilities and objectives. Both languages occupy the same difficulty tier according to the U.S. Foreign Service Institute, requiring approximately 2,200 classroom hours to reach proficiency. This classification places them among the most challenging languages for English speakers, alongside Arabic and Mandarin Chinese. The question isn't whether these languages are difficult—they are. The question is which difficulty curves match your learning profile and long-term goals. The strategic importance of this decision extends beyond personal enrichment. Korean and Japanese serve as gateways to two of Asia's most influential economies, distinct cultural ecosystems, and rapidly evolving technological landscapes. The language you choose determines which professional networks, entertainment industries, and innovation hubs become accessible to you.

Common Business Abbreviations in English: Useful Guide

In today's fast-paced business environment, efficiency isn't just appreciated—it's expected. One subtle yet powerful way professionals streamline communication is through abbreviations. These shorthand expressions save time and space while conveying complex ideas with remarkable precision. However, encountering unfamiliar business abbreviations can create unnecessary confusion and misunderstanding. For non-native English speakers and professionals new to specific industries, this challenge can be particularly daunting. This comprehensive guide unpacks the most essential business abbreviations in English, providing clarity and context for each. Beyond mere definitions, we'll examine when and how to use these abbreviations effectively, ensuring your business communication remains both efficient and unambiguous.

10 Ways to Overcome Language Barriers Effectively

Communication breakdowns cost organizations an average of $62.4 million annually, according to Holmes Report research. Language barriers represent a significant portion of these failures, yet most professionals lack systematic approaches to address them. The stakes have never been higher. Remote work has increased cross-cultural interactions by 300% since 2020, while international business partnerships continue expanding globally. Whether you're navigating a critical client presentation in Tokyo, collaborating with a development team in Eastern Europe, or building relationships with Spanish-speaking colleagues, language barriers can derail your objectives before you realize what happened. This analysis examines ten evidence-based strategies that transform language obstacles into manageable challenges. Each approach addresses specific scenarios where communication failures carry the highest costs.

![Past Participle of Upset: Complete Grammar Guide [English]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F147z5m2d%2Fproduction%2F53c67ecdd120bc85bef71090e949f58449b4b106-2240x1260.png%3Frect%3D175%2C0%2C1890%2C1260%26w%3D600%26h%3D400&w=3840&q=75)

Past Participle of Upset: Complete Grammar Guide [English]

The past participle of "upset" is "upset" – unchanged from its base form. This fundamental grammatical truth matters because "upset" belongs to a specialized category of irregular verbs that challenge conventional English conjugation patterns, affecting how millions of English learners construct perfect tenses, passive voice, and participial phrases. Understanding this verb's behavior isn't merely academic. The verb "upset" appears in approximately 2.3% of all English conversations according to corpus linguistics research, making its correct usage essential for fluent communication. Yet its unchanging form creates persistent confusion among learners who expect morphological variation.

Grammar Differences: American vs British English

English speakers worldwide navigate subtle yet significant grammatical variations that can determine professional credibility and communication effectiveness. Understanding these distinctions matters more than most realize—particularly for professionals working across international markets, students preparing for standardized tests, or writers targeting specific audiences. The stakes are higher than simple preference. Grammar choices signal geographical origin, educational background, and cultural alignment. They influence how your message lands with different audiences and can determine whether your content resonates or feels foreign to your intended readers. Why does this matter now? Global remote work has eliminated geographical barriers, making cross-cultural communication skills essential rather than optional. A misplaced verb tense or incorrect collective noun usage can undermine your credibility in international business settings or academic environments. This analysis examines the core grammatical differences between American and British English, focusing on practical applications that directly impact professional and academic communication. Each difference represents a decision point that affects how your audience perceives your expertise and cultural awareness.